Lessons from a Maverick: Introduction

How the St. Louis Fed Helped Shape the Nation's Monetary Policy

Today, the Federal Reserve is best known for monetary policy. However, monetary policy was not on the radar when the Fed was established. The idea of managing interest rates, credit conditions or the money supply to smooth the business cycle or control inflation was an idea that came later and developed slowly.

On the heels of the Panic of 1907, financial stability was the main goal. The Fed's founders believed that a geographically decentralized organization, composed of regional Reserve banks and branches, would be more responsive to differences in banking conditions across the nation and, thereby, contribute better to financial stability. Accordingly, the Federal Reserve Act of 1913 established a system of Federal Reserve districts, each with its own Reserve bank, rather than a central bank located solely in the nation's capital or largest financial center.

Although the Federal Reserve System was not set up with monetary policy in mind, the Fed's decentralized structure has distinct benefits for the conduct of monetary policy. Such a structure: 1) contributes to the Fed's political independence; 2) promotes a greater diversity of views in policy deliberations; and 3) ensures that the concerns and conditions of different parts of the country are recognized in making policy. This structure allows greater freedom to develop and promote alternative ideas—and get them heard at the policy table—than does a more "top-down" central bank.

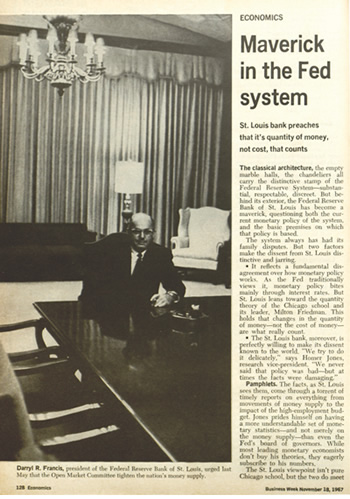

The Federal Reserve Bank of St. Louis bucked the System in the 1960s and '70s, arguing that Fed policies and excessive growth of the money supply were to blame for higher inflation. When the Bank, led then by President Darryl Francis (pictured), couldn't convince the rest of the Federal Open Market Committee, it took its case to the public, leading to the St. Louis Fed's being labeled a maverick. Business Week reported on the "family dispute" in 1967. The St. Louis Fed's reasoning eventually became widely embraced.

The history of the Federal Reserve Bank of St. Louis illustrates how the Fed's structure provides a channel through which different points of view can be expressed in policy deliberations. In the 1960s and 1970s, the St. Louis Fed became known as the maverick Reserve bank for its strong and public advocacy of a policy different from what the System was pursuing at the time. Although the St. Louis Fed lost many battles on this issue, its policy views eventually were widely adopted within the System.

Before getting into details of this episode in Fed history, it's important to understand what came before. Why did the System's founders establish a central bank with a geographically decentralized structure? What were the origins of Federal Reserve monetary policy? Why was the Banking Act of 1935 so significant?

A Central Bank that Isn't: Why the Fed Has Its Structure

The Fed was established mainly to correct defects in the U.S. banking and monetary system that reformers viewed as contributing to financial instability. Those defects included: 1) a national currency whose supply was relatively fixed and did not adjust to changes in demand; 2) the concentration of the nation's bank reserves in a few major financial centers, especially New York City; and 3) the investment of those reserves in short-term loans to stock market speculators.

To address the first defect, the Fed's founders created a new currency—Federal Reserve notes—and a system to ensure that the supply of currency would adjust to changes in demand.

The second and third defects were addressed by establishing a system composed of distinct regional districts, each with its own Reserve bank, and requiring commercial banks that joined the Federal Reserve System to hold reserve balances with their local Federal Reserve bank. Although many banks also kept some deposits in New York City and other major cities, the geographic concentration of the nation's bank reserves and the banking system's exposure to the stock market were reduced.

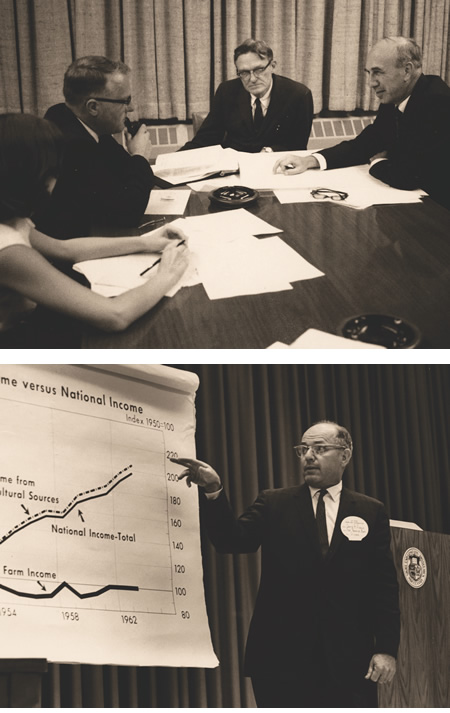

Research Director Homer Jones (top photo, in middle) and President Darryl Francis (bottom photo) were at the helm of the St. Louis Fed when it gained the reputation in the 1960s and 1970s as being a monetary policy maverick.

The Federal Reserve Act required all national banks (i.e., commercial banks with a charter issued by the federal government) to join the System. Membership was made optional for state banks that met certain criteria and agreed to Fed supervision and regulation. A member bank could obtain Federal Reserve notes or additional reserve deposits by borrowing from its Federal Reserve bank. The Fed's lending facility became known as the "discount window," and the interest rate it charged on loans, the "discount rate." 1

The Federal Reserve Act called for the establishment of at least eight and as many as 12 Federal Reserve districts, each with its own Reserve bank. (See the accompanying essay "A Foregone Conclusion.") The Fed's founders believed that a geographically decentralized structure would make the Fed more responsive to banking and economic conditions in the nation's different regions and, thereby, more effective at protecting the banking system and public from banking crises. Each Reserve bank was given its own board of directors, the right to set its own discount rate (subject to Federal Reserve Board approval) and considerable latitude to administer its own discount window and carry out its other operations.

ENDNOTE

1. When the Fed was established, most short-term bank loans were made on a discount basis, the discount being the difference between the amount borrowed and the amount repaid on a loan. Hence, the act of acquiring currency or reserves from the Fed was known as "rediscounting" because the Fed paid out less currency (or reserves) to the member bank than the face value of the loans presented at the discount window. When the rediscounted loans approached maturity, the Reserve bank would return them to the member bank for collection, and upon maturity the bank's reserve account with the Fed would be charged for the full amount of the original loan. An amendment to the Federal Reserve Act in 1916 permitted Reserve banks to make direct loans, known as "advances," to member banks; these loans were secured by the same types of loans that banks could rediscount with the Fed. For more on the distinction between rediscounts and advances and for a history of the Fed's lending functions, see Hackley.