A Foregone Conclusion

How and Why St. Louis Was Chosen for a Federal Reserve Bank

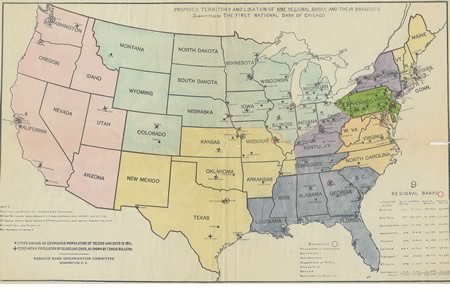

The selection of St. Louis for a Federal Reserve bank seems to have been, in the words of historian James Neal Primm, a "foregone conclusion." 1 In announcing its decisions on April 2, 1914, the Reserve Bank Organization Committee (RBOC) made clear that St. Louis, along with New York City, Chicago, Philadelphia, Boston and Cleveland, were obvious choices: "In population these are the six largest cities in the United States; their geographical situation and all other considerations fully justified their selection." 2

In the competition for Reserve banks, St. Louis had several advantages. It was the nation's fourth-largest city, with a population of 687,029. Only New York City (4,766,883), Chicago (2,185,283) and Philadelphia (1,549,008) were larger. 3 St. Louis was also a regional banking and commercial center, as well as a transportation hub. Its banks provided financial services, and its businesses sold and distributed manufactured goods throughout the Midwest, South and Southwest. St. Louis was a manufacturing powerhouse, one with a diverse base. The city was the largest shoe distributor in the nation, the second-largest millinery market, the foremost producer of tobacco products and home to the nation's largest brewery. 4

Fifth and Olive streets in downtown St. Louis in 1910. When it was awarded a Reserve bank in 1914, St. Louis was the nation's fourth-largest city. One of the numerous options for downtown shoppers was Boyd's.

Good railroad connections were an important consideration for the location of a Reserve bank because they ensured rapid delivery of currency and checks between the Reserve bank and the commercial banks in its district, as well as between the Reserve bank and other Reserve banks. With 26 trunk lines linking over 64,000 miles of rail and a prime location at the confluence of the Mississippi and Missouri rivers, St. Louis' transportation infrastructure made the city a strong choice for the location of a Federal Reserve bank. 5

St. Louis was one of only three cities designated as a "central reserve city" in the national banking system—the structure and rules governing commercial banks with federal charters under the national banking acts of the 1860s. New York City and Chicago were the other two. The designation recognized and contributed to St. Louis' importance as a banking center by enabling national banks throughout the country to satisfy a portion of their legal reserve requirements by holding deposits in national banks in St. Louis. Being at the top of the reserve pyramid, national banks in St. Louis and the other central reserve cities were required to hold their legal reserves solely in the form of gold.

St. Louis was home to 44 banks and trust companies in 1914, including seven national banks. Its national banks ranked fifth behind those in New York City, Chicago, Philadelphia and Boston in terms of correspondent deposits. 6 Although less than 20 percent of the amount held by New York City banks, the correspondent balances held by St. Louis' national banks far exceeded those held by banks in several other cities chosen for Federal Reserve banks. 7

Data on state-chartered banks and trust companies were not available to the RBOC for all states. So, in evaluating proposals for the location of Reserve banks, the committee focused primarily on the size and prominence of a city's national banks. Among all U.S. cities, St. Louis ranked seventh in terms of national bank capital, deposits and loans. The seven national banks in St. Louis had combined capital of $29 million, deposits for individuals and firms of $62 million, and loans of $102 million. 8

Reserve Bank Organization Committee Hearings

At the time that St. Louis was vying for a Reserve bank, the city stood out in many areas of business, including the brewing of beer. The Anheuser-Busch brewery, then and now, was a landmark on the south side of the city. The brewhouse, shown in 1926, was built in 1892.

Six cities may have been obvious choices for Reserve banks, but the RBOC was charged with naming at least eight cities for Reserve banks and setting the boundaries for all Federal Reserve districts. The RBOC evaluated proposals from 37 cities seeking Federal Reserve banks, including St. Louis, Louisville, Ky., and Memphis, Tenn., and held hearings in 18 cities, including St. Louis, where they interviewed local bankers, businessmen and civic leaders. The committee also relied heavily on a survey of national banks in which the banks were asked to name their preferred location for a Reserve bank that would serve their region. 9

The RBOC held its first hearing Jan. 5-7, 1914, in New York City, less than two weeks after President Woodrow Wilson signed the Federal Reserve Act. Subsequently, the committee held hearings in Boston, Washington, D.C., and Chicago before meeting in St. Louis on Jan. 21-22, 1914. 10

The RBOC consisted of Secretary of the Treasury William G. McAdoo, Secretary of Agriculture David Houston and Comptroller of the Currency John Skelton Williams. At the time, Houston was on leave from Washington University in St. Louis, where he was chancellor. In St. Louis, the RBOC heard testimony from several nationally prominent residents, including David R. Francis, a former St. Louis mayor, Missouri governor and U.S. secretary of the interior; Rolla Wells, also a former St. Louis mayor and treasurer of Wilson's 1912 presidential campaign; Robert Brookings, a leading businessman and benefactor of Washington University; Festus Wade, president of Mercantile Trust Co. and head of the St. Louis Clearing House Association; Frank O. Watts, president of Third National Bank and chairman of the St. Louis Clearing House Association's RBOC presentation committee; A.L. Shapleigh, president of a leading national hardware company and president of the St. Louis Businessmen's League; and several other leading bankers and businessmen from St. Louis and nearby states. 11

In their testimony before the RBOC, officials of the St. Louis clearinghouse presented letters they had solicited from bankers and businessmen across the Midwest, South and Southwest to support their bid for a large St. Louis-based Federal Reserve district. Many of the letters were effusive in their support of St. Louis' bid for a Reserve bank, such as one submitted by the officers of the Lumbermen's Exchange of St. Louis:

Whereas: St. Louis is the Gateway to the Great Southwest, having connections, through its railroads, with a region that is fertile in nature's products and in manufacturing industries which are in their infancy, which will from year to year be developed, and will out-rival all regions in fertility and productiveness:

Whereas: St. Louis be the Gateway to this wonderful region, all commerce must and will move through St. Louis and:

Whereas: St. Louis is a Gateway between the North and the South, and lying as it does in the center of the greatest country on earth, St. Louis excels all other cities as a point of center for the establishment of a Great Regional Bank and;

Whereas: St. Louis is situated in the midst of and is without doubt the greatest manufacturing center in the United States, having the largest Shoe, Beer, Vehicle, Implement, Tobacco and Stove manufacturing plants in the world. The Dry Goods display is greater than any City in the United States, and as a Lumber center St. Louis is without doubt the greatest in the Country and;

Whereas: Within ten hours ride of St. Louis is located a population of over thirty million people, who trade through and in St. Louis, therefore:

Be it resolved: By the Board of Directors that the Lumbermen's Exchange of St. Louis respectfully urges the Organization Committee ... to establish a Great Regional Bank in St. Louis. 12

The Implement, Vehicle and Hardware Association of St. Louis was another of the many organizations offering strong support, writing:

St. Louis and Chicago already are the leading financial and mercantile centers west of the Atlantic Seaboard, and the two great centers of the enormous intermountain territory—Chicago in the north and northwest and St. Louis in the south and southwest. ... We, as an Association, put ourselves on record as urging the selection of St. Louis for the location of one of the regional reserve banks. 13

The St. Louis Association of Credit Men was no less clear in its support:

Saint Louis, Missouri is the logical and natural location for the regional bank by its rank in population, its great facilities as a railroad center, its rank as a manufacturing center and distributor of merchandise, ... stability and financial strength, its volume of annual clearings and by reason of its importance in trade movements from contiguous territory, the states of Missouri, Oklahoma, Texas, Mississippi, Arkansas, Louisiana, Tennessee, Kentucky, Kansas, Nebraska, Southern Indiana and Southern Illinois. 14

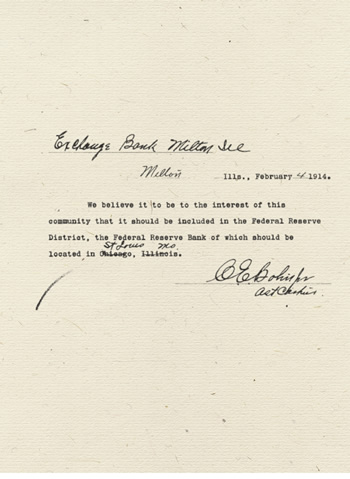

FIGURE 2 - Before it was decided which cities would be named headquarters for Federal Reserve districts, communities in the running solicited letters of support from commercial banks and others. St. Louis backers were happy to see that some bankers who were being courted by Chicago or elsewhere would cross out the suggested city and pencil in St. Louis, as did this employee at the Exchange Bank of Milton, Ill., in early 1914.

St. Louis boosters wanted a large territory for a Federal Reserve district headquartered in St. Louis. The clearinghouse association may have viewed the location of a Reserve bank in St. Louis as a certainty. Perhaps for that reason, the association recommended the creation of just eight Federal Reserve districts—the minimum specified in the Federal Reserve Act—and proposed a large territory encompassing much of the Midwest, South and Southwest United States for a district based in St. Louis.

In his testimony to the RBOC, Frank O. Watts, the clearinghouse association's lead advocate, indicated that the territory his group desired for a St. Louis-based district was similar to the territory represented in a map submitted by E.C. Simmons, chairman of Simmons Hardware Co. (shown in Figure 1). According to Simmons, the shaded region labeled "St. Louis Zone" represented the "legitimate bounds" of the region served predominantly by St. Louis manufacturers and wholesalers. The map also shows areas where other cities, including Chicago, Denver, Kansas City and Memphis, had significant business ties. The map clearly was intended to convince the RBOC that the commercial territories of Chicago and St. Louis were of roughly equal size and largely distinct—Chicago in the Upper Midwest and St. Louis in the Midsouth and Southwest. Simmons' map represented the commercial territories of Denver, Kansas City and Memphis as being much smaller, with those of Kansas City and Memphis—two cities also vying for Federal Reserve banks—appearing as local submarkets within the larger St. Louis zone and, therefore, perhaps less worthy candidates for Reserve banks.

Shapleigh, president of another St. Louis hardware distributor, also pushed for a large St. Louis-based Federal Reserve district. In his testimony before the RBOC, Shapleigh argued:

With the transportation facilities offered from Saint Louis and with the immense stock of goods kept here ... this district has looked upon Saint Louis not only as its financial central reserve city, but its merchandise central reserve city. A by-word in the trade is "Saint Louis has the Goods." The channels of trade follow the channels of transportation. The channels of banking follow the channels of trade. These channels for this district all lead to and from Saint Louis. 15

Proponents of a large Federal Reserve district based in St. Louis stressed the advantages of the proposed territory's economic diversity. A key objective of the authors of the Federal Reserve Act was to facilitate the movement of funds from regions of the country that had surplus funds to those where money and credit were in short supply. Reformers observed that interest rates rose, credit supply tightened and banking crises occurred most often at those times of the year when the demands for money and credit reached seasonal peaks. Some of the seasonal variation in money and credit demand reflected the seasonal nature of agriculture. Proponents of a large, St. Louis-based Federal Reserve district noted that the territory they recommended was economically diverse, with different types of agriculture and a strong manufacturing base. For example, Jackson Johnson, president of International Shoe Co., argued the following:

You would like to balance the borrowers with the lenders as nearly as possible, and to that end we should have to take not only the manufacturing sections but the grain section along with the cotton section. In the last few years, [the region] west of the [Mississippi] River has produced from forty-five to fifty per cent of the cotton crop. If St. Louis covers Texas, Louisiana, Arkansas and Oklahoma they will then have in their territory half of all the cotton crops looking to this center [i.e., St. Louis] to be financed. Now to balance that I think that we should take along with Missouri, say, Kansas and a portion of Nebraska and southern Illinois. 16

A Mississippi banker expressed a similar concern. Although located closer to Memphis, R.I. Peebles, cashier of the Bank of Boyle, Miss., wrote, "St. Louis can better serve us than Memphis because Memphis feels the burden of making a cotton crop just like we do and is so dependent on the cotton growing industry that their funds are low at the time our funds are low." 17 In other words, at the times of the year when banks in Mississippi needed help satisfying their customers' demand for loans, which were closely tied to the planting, harvesting and marketing of the cotton crop, Memphis banks faced similar demands and, thus, were of less help than St. Louis banks.

St. Louis was not the only city where local interests sought support for their cause from bankers and businessmen in nearby states. Many bankers and businessmen were contacted for support by more than one city. For example, the St. Louis clearinghouse sought letters of support from bankers and firms in western Kentucky and Tennessee who were also being courted by Louisville, Memphis and Nashville, Tenn., to support their own bids for Reserve banks. Most bankers in Kentucky and Tennessee expressed a preference for being members of a Reserve bank in their own states, but many wrote or testified that St. Louis was their second choice. For example, Thomas W. Long, the cashier of the First National Bank of Hopkinsville, Ky., testified to the RBOC: "Louisville is our first preference in the establishment of a regional [Reserve] Bank. ... Next to Louisville our choice is St. Louis, beyond any possible question. ... [T]he majority of the national bankers in eastern Kentucky have accounts in St. Louis. It would be very much to the advantage of our community if we could not get in the Louisville district to come to St. Louis." 18

In its St. Louis hearings, the RBOC focused much of its attention on the boundaries between possible St. Louis- and Chicago-based districts and possible St. Louis- and Kansas City-based districts. Chicago bankers proposed a territory that encompassed nearly all of Illinois and the northern tier of counties in Missouri, as well as several states in the Upper Midwest and Great Plains. St. Louis' supporters argued, however, that all of Missouri and the southern half of Illinois, including Springfield, would be served better by a Federal Reserve district headquartered in St. Louis. When asked by the RBOC why Springfield should be located in a St. Louis-based district, Francis, the former governor of Missouri, claimed, "The social relations between Springfield and St. Louis ... are closer than they are between Springfield and Chicago. Southern Illinois is settled very largely by Kentuckians and Virginians, and people from the South generally." 19

Many bankers in southern Illinois did prefer St. Louis and expressed their sentiments in letters and testimony to the RBOC. Several southern Illinois bankers returned a form letter, which had been sent to them by the Chicago clearinghouse requesting support for Chicago's bid, with the name "Chicago, Illinois" scratched out and replaced with "St. Louis, Missouri." (An example is shown in Figure 2 on page 66.) Others expressed their preference for membership in a St. Louis district in testimony before the RBOC. For example, David S. Lansden, a director of the Alexander County National Bank of Cairo, Ill., testified, "We believe Cairo and ... all of Southern Illinois should be in the St. Louis district." 20 J.M. Winters, president of Quincy National Bank in Illinois, testified, "We desire to be attached to the St. Louis district, believing that our interests are materially with that city." 21 Noting that Quincy banks regularly lend to customers in Missouri and have developed business to the south and west, Winters stated: "We have cultivated the West and Southwest for our investments and we believe it is very important to us that we be in the same district. ... We feel that if we were cut off from this West and Southwest district, it would be almost a calamity to us." 22 St. Louis' bid received less support from Springfield-area bankers, however, and ultimately the RBOC placed Springfield in a Chicago-headquartered district while placing Quincy and most of Southern Illinois in the Eighth Federal Reserve District, based in St. Louis.

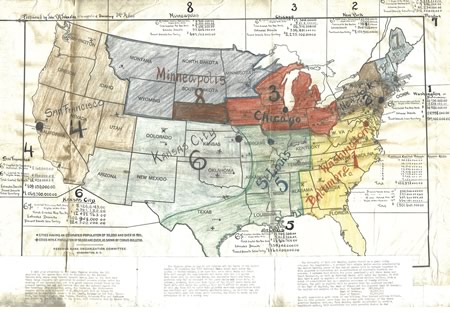

The RBOC was also interested in how far west a St. Louis district should extend. St. Louis firms did extensive business in the Southwest, particularly in Texas and Oklahoma, but Texas bankers sought a Reserve bank headquartered in their state. Kansas City bankers also desired a Reserve bank and proposed a district that included some of the territory sought by St. Louis, including all of Oklahoma and parts of Missouri, Arkansas and Texas. A proposal for eight Federal Reserve districts submitted by Kansas City interests is shown in Figure 3.

FIGURE 3 - This map, one of the documents submitted to the Reserve Bank Organization Committee in support of locating a Reserve bank in Kansas City, shows eight Reserve bank districts, with much of the southern half of the U.S. handled by the three cities of Kansas City, St. Louis, and either Washington, D.C., or Baltimore.

At the RBOC hearings in St. Louis, Treasury Secretary McAdoo noted, "Assuming that a Reserve Bank were established in Kansas City, and another was established in St. Louis, the division of the territory would be, as between Kansas City and St. Louis, very difficult." In his testimony, Francis argued that western Texas and all of Oklahoma should be in a St. Louis district. Further, in response to a question from Secretary of Agriculture David Houston about placing western Missouri and Kansas in a separate district, possibly headquartered in Kansas City, Francis replied, "Well, I should dislike to see Missouri divided in any way." 23

McAdoo asked Frank O. Watts his view of a suggestion "that the regional bank should be established in Kansas City with the branch in St. Louis." Watts replied, "I think they [i.e., Kansas City and St. Louis] serve rather different territories; and in the language of a certain distinguished Admiral, 'there is glory enough for us all.'" 24

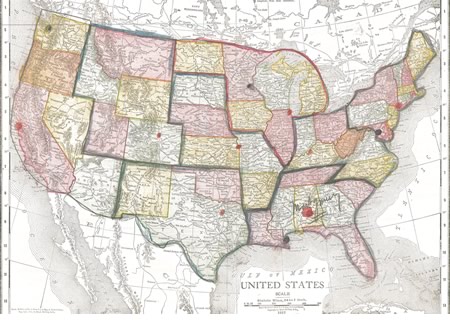

This map, presented in support of a Reserve bank in Montgomery, Ala., shows eight Reserve bank cities, including Denver and Louisville, KY.

Bankers in western Missouri, Oklahoma and Texas were divided in their preferences. A.H. Waite, president of Joplin National Bank in Missouri, testified that he personally favored having his city in a St. Louis-based district, but that at the request of Kansas City bankers, the Joplin clearinghouse signed a statement supporting Kansas City's bid for a Reserve bank:

The Kansas City boys ... are a little quicker on the trigger than the St. Louis boys. ... I personally rather want to join the association in St. Louis ... but the clearinghouse passed a resolution favoring Kansas City. ... [W]hen you go out to Kansas City, you will find the busiest live wires out there you ever saw; they are certainly on their job, and Kansas City is full of that sort. We call it "pep." The nicest lot of fellows you ever met, and if Kansas City was not out there, I think you would have no trouble about determining the location of a Federal Reserve Bank for St. Louis, but, naturally, they are ambitious. 25

This map, presented in support of a Reserve bank location in New York, shows 10 Reserve bank districts. Among other places, banks would have been based in Denver, Cincinnati and Baltimore.

Some bankers in western Missouri and Oklahoma testified that they would be satisfied being placed in either a St. Louis- or a Kansas City-based Federal Reserve district. However, they strongly opposed being tied to a Federal Reserve bank in Texas. For example, O.H. Leonard, a vice president of the Exchange National Bank of Tulsa, Okla., testified:

As my Joplin friend said, the Kansas City people are very quick on the trigger. They are a very nice bunch of fellows; we are very fond of them; they came to Tulsa and we endorsed them. Since that time we have become a little more familiar with the conditions, and it is a question in our minds whether the Committee [RBOC] would locate two banks in Missouri. ... [I]f you expect to locate a bank in Texas, we do not want to be attached to that, because we have no business relations with Texas, neither do we have any business relations with Denver, Colorado. The only business relations we have where we would like to be attached to would be either Kansas City or St. Louis. 26

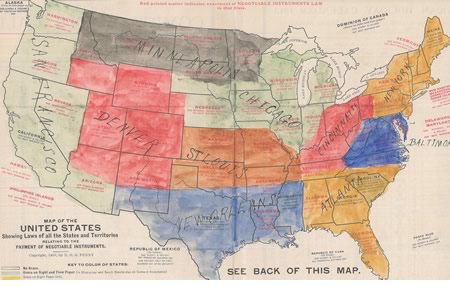

This map, presented in support of a Reserve bank in Chicago, shows eight Reserve bank districts, including a massive Chicago district that would encompass all or part of 14 states.

L.W. Duncan, cashier of the First National Bank of Muskogee, Okla., and representative of bankers in his region, testified similarly: "We want to be in either St. Louis or the Kansas City district. ... The only thing we want to guard against is being put in a southern district. The period of the year that we need money they need money in the south." 27

After visiting St. Louis on Jan. 21-22, 1914, the RBOC traveled to Kansas City, where it held hearings Jan. 23. The RBOC then visited Lincoln, Neb., and Denver. The committee then visited several other cities before concluding hearings in Cleveland, on Feb. 17.

RBOC Survey of Banker Preferences

FIGURE 4 - The Federal Reserve Act of 1913 created a Reserve Bank Organization Committee to draw the boundaries of the districts (between eight and 12 of them) and then to pick a headquarters city for each district. Besides holding hearings around the country, the committee surveyed national banks to gauge their preferences for Reserve bank cities. More than 6,700 national banks responded. The relative total number of first- and second-choice votes is reflected in the dot size above. Cities chosen by the committee for a Reserve bank are shown in green; other cities receiving votes are shown in blue. St. Louis came in third in the voting, after New York City and Chicago.

SOURCE: U.S. Reserve Bank Organization Committee, first-choice vote for Reserve bank cities, July 29, 1914. See http://fraser.stlouisfed.org/publication/?pid=604.

Besides the hearings, the RBOC relied heavily on the results of its survey of national banks to guide the selection of Reserve bank cities and district boundaries. The survey asked bank executives to identify their top three choices for the location of the Reserve bank to which they desired to be connected, as well as to recommend at least eight, but no more than 12, cities nationally for Reserve banks.

Responding to the survey were 6,724 bank leaders, each naming at least one city as his or her bank's preferred location for a Reserve bank. Fifty-nine cities, including St. Louis, Louisville and Memphis, were the first choice of at least one respondent. No respondents listed Little Rock as their first choice, but one listed the city as its second choice.

St. Louis was the first choice of 307 survey respondents and the second choice of 583 respondents. The city's total of 890 first- and second-choice votes was exceeded only by New York City and Chicago. Figure 4 shows the relative number of votes each city received, with the size of a city's dot being proportional to the number of first- and second-place votes it received. The 12 cities chosen for Reserve banks are marked with green dots.

Figure 5 shows the relative number of times each city was named when voters were asked to recommend at least eight, but no more than 12, cities nationally for the location of Reserve banks. Only New York City, Chicago and San Francisco were recommended more often by respondents than St. Louis. 28

The RBOC survey of national banks was clearly important in the committee's selection of Reserve bank cities and their respective districts. The RBOC felt compelled to explain why, for example, it put a Reserve bank in Richmond, Va., but not Baltimore, in Atlanta but not New Orleans, and in Kansas City but not Denver, Lincoln or Omaha, Neb. Regarding the last decision, the committee explained that its survey of bankers had played a major role in the decision:

FIGURE 5 - When those taking the survey were asked to recommend between eight and 12 cities for Reserve banks, St. Louis placed fourth, after New York City, Chicago and San Francisco. Again, the dot size indicates the total number of times a city was recommended. The winning cities are shown in green.

SOURCE: U.S. Reserve Bank Organization Committee, location of Reserve districts in the U.S., May 28, 1914, pp. 356-57. See http://fraser.stlouisfed.org/publication/?pid=606

Careful consideration was given to the claims of Omaha, Lincoln, Denver, and Kansas City, which conflicted in this region. ... [Banks in] the greater part of New Mexico asked for Kansas City. Western Texas, Kansas, and Nebraska [banks] unanimously protested against going to Denver. Kansas [banks] desired Kansas City; Nebraska [banks] preferred Omaha or Lincoln; and Texas [banks] wanted either a Texas city or Kansas City or St. Louis. ... With Montana, Idaho, Arizona, Texas, Kansas, and Nebraska [banks] in opposition, it was clearly impossible to make a district with Denver as the location of a bank. ... It seemed impossible to serve the great section from Kansas City to the mountains in any other way than by creating a district with Kansas City as the headquarters. 29

A few cities protested when they were not selected for a Federal Reserve bank. A committee of bankers and other citizens of Baltimore submitted a formal request to the Federal Reserve Board to designate Baltimore, rather than Richmond, as the location of a Reserve bank for the Fifth Federal Reserve District. 30 The appeal was denied, but a branch of the Richmond Bank was opened in Baltimore.

Although St. Louis was among the 12 cities chosen for a Federal Reserve bank, the RBOC assigned much of the territory sought by St. Louis boosters to other districts, notably the Eleventh District headquartered in Dallas and the Tenth District headquartered in Kansas City. Still, when it was formed, the St. Louis-based Eighth District was the sixth-largest in terms of land area and the third-largest in terms of population, after the Second (New York) and Seventh (Chicago) districts. States in the Midwest and South historically had relatively fewer national banks than other states, however; consequently, the Eighth District ranked only 10th in terms of national bank capital and deposits. 31

From Selection to Opening and Beyond

Once it had designated 12 cities for Federal Reserve banks, the RBOC began a process that led to the incorporation of the Reserve banks and the election of their boards of directors. On May 18, 1914, representatives of five national banks designated by the RBOC met at the offices of the St. Louis clearinghouse to sign the organization certificate of the Federal Reserve Bank of St. Louis. The RBOC then sent ballots to all national banks in the Eighth District to elect a board of directors for the St. Louis Reserve Bank. On Aug. 10, 1914, the RBOC announced the election of Frank O. Watts, Walker Hill and Oscar Fenley as Class A directors; and Murray Carleton, W.B. Plunkett and LeRoy Percy as Class B directors. On Sept. 30, 1914, the Federal Reserve Board announced the appointment of three Class C directors: William McChesney Martin Sr., who was named Federal Reserve agent and chairman of the board of directors; W.W. Smith, who was named deputy Federal Reserve agent and vice chairman; and John W. Boehne.

The board of directors met for the first time Oct. 28 in the boardroom of the Mississippi Valley Trust Co. of St. Louis. One of the board's first acts was to appoint Rolla Wells as governor, William W. Hoxton as deputy governor and C.E. French as cashier of the Federal Reserve Bank of St. Louis.

All 12 Federal Reserve banks opened for business on Nov. 16, 1914. The Federal Reserve Bank of St. Louis occupied temporary quarters on the fourth floor of the newly built Boatmen's Bank building, at the corner of Olive Street and Broadway in downtown St. Louis. On opening day, the Bank's staff consisted of six officers and 17 other employees. On that day, the Bank established a discount window and set its discount rate at 6 percent. The Bank made its first loan, in the sum of $1 million, on Nov. 18. The Bank began to provide clearing services a few days later. By Dec. 4, the Bank was offering to collect checks and drafts drawn on any Federal Reserve bank and on all Eighth District member banks.

Besides lending to member banks through its discount window and providing clearing services, another important function of the Federal Reserve was to supply currency to its member banks. The Federal Reserve Bank of St. Louis made its first delivery of currency to a member bank Dec. 1, 1914.32

The Federal Reserve Bank of St. Louis moved to new, though still temporary, quarters in 1915, and eventually to its present location, at the northeast corner of Broadway and Locust Street, in 1925. Full-service branch offices were also opened in Louisville, Memphis and Little Rock in 1917, 1918 and 1919, respectively.

Figuring prominently among the criteria for choosing the locations of Reserve banks and branches in 1914 were the size of a city's banks and its commercial and transportation networks. In 1914, federal law prohibited interstate branch banking, and many states disallowed any branching within their state borders. Paper checks, bank drafts and cash moved by rail or, locally, by armored truck. In those days, a city's size, business connections and transportation networks were crucial for a Reserve bank to serve its district banks. With nationwide branch banking and rapid electronic communications, such infrastructure is no longer as important for the location of a Reserve bank. Electronic payments sent over the Internet have largely replaced paper checks, for example. Still, many of the benefits of a structurally decentralized Federal Reserve System remain as important today as they were in 1914. The structure remains important, for example, in the gathering of economic information for use in monetary policymaking, as well as in communicating policy actions to the public. A local presence also facilitates and enhances banking supervision, community outreach and economic education, to name just a few of the responsibilities and services a Reserve bank provides within its district. The Fed's decentralized structure also ensures that diverse views are heard in monetary policy deliberations.

Over the years, the Federal Reserve Bank of St. Louis has continued to provide payment services and discount loans for its member banks and other depository institutions, while seeing its responsibilities grow to include important roles in monetary policymaking, banking supervision, the provision of services to the U.S. Treasury and community outreach.

ENDNOTES

1. See Primm. This commemoration of the Bank's 75th anniversary includes a discussion of the problems of the U.S. banking and monetary systems that Congress sought to overcome by establishing the Federal Reserve System. The book also includes background on the selection of St. Louis as the location for a Federal Reserve bank. See www.stlouisfed.org/foregone/index.cfm.

2. See United States. Reserve Bank Organization Committee. Decision of the Reserve Bank Organization Committee, April 2, 1914 (With Statement of the Committee in Relation Thereto, April 10, 1914), p. 24. See http://fraser.stlouisfed.org/publication-series/?id=603.

3. The population data are from the census of 1910. The three cities later chosen for branches of the Federal Reserve Bank of St. Louis—Little Rock, Louisville and Memphis—had populations of 45,941, 223,928 and 131,105, respectively.

4. See Smith.

5. Rail line miles figure stated in A.L. Shapleigh's testimony before the RBOC. See United States. Reserve Bank Organization Committee. Federal Reserve District Divisions and Location of Federal Reserve Banks and Head Offices—Saint Louis, Missouri, p. 1,615. See http://fraser.stlouisfed.org/publication-series/?id=595.

6. Correspondent deposits, sometimes referred to as interbank deposits, are deposits held on account for other banks. Correspondent banks often provide services, especially payment services, for their respondent banks. National banks in St. Louis held a combined $90 million of deposits for other banks. New York City national banks held by far the largest amount of correspondent deposits, with $742 million, and Chicago national banks held $279 million. See United States, Reserve Bank Organization Committee. Decision of the Reserve Bank Organization Committee, April 2, 1914 (With Statement of the Committee in Relation Thereto, April 10, 1914), Table D, p. 15. See http://fraser.stlouisfed.org/publication-series/?id=603.

7. For example, national banks in Kansas City ($55 million), Dallas ($6 million) and Atlanta ($4 million) held substantially less correspondent balances than did St. Louis' national banks. National banks in Louisville and Memphis held $12 million and $2 million of correspondent deposits, respectively.

8. New York City ranked first in national bank capital, deposits and loans. Its 35 national banks had combined capital of $249 million, deposits of $772 million and loans of $1.1 billion. For comparison, Louisville had eight national banks, with combined capital of $8 million, deposits of $20 million and loans of $28 million. Memphis had three national banks, with combined capital of $2 million, deposits of $7.5 million and loans of $7 million. See United States, Reserve Bank Organization Committee. Decision of the Reserve Bank Organization Committee, April 2, 1914 (With Statement of the Committee in Relation Thereto, April 10, 1914), Table E, p. 15. See http://fraser.stlouisfed.org/publication-series/?id=603.

9. The Federal Reserve Act required all national banks, i.e., all commercial banks with a federal charter, to join the Federal Reserve System. Membership was made optional for state- chartered banks that met minimum capital requirements. State-chartered member banks were further required to comply with reserve and capital requirements applied to national banks and to submit to examination and regulations prescribed by the Federal Reserve Board.

10. For the locations of all RBOC hearings and a list of witnesses heard and exhibits presented at each location, see United States. Reserve Bank Organization Committee. Index of Witnesses and Exhibits for the Hearings before the Reserve Bank Organization Committee. See http://fraser.stlouisfed.org/publication-series/?id=599.

11. For a complete list of witnesses and transcripts of the hearings, see United States. Reserve Bank Organization Committee. Hearings Before the Reserve Bank Organization Committee— St. Louis, Missouri. See http://fraser.stlouisfed.org/publication/?pid=595.

12. See United States. Reserve Bank Organization Committee. 1912-1914, Box 2653, Folder 1: #33 Missouri Cities Al to W, from Records of the Federal Reserve System. See http://fraser.stlouisfed.org/docs/historical/nara/nara_rg082_e02_b2653_01.pdf.

13. Ibid.

14. Ibid.

15. See United States. Reserve Bank Organization Committee. Federal Reserve District Divisions and Location of Federal Reserve Banks and Head Offices—Saint Louis, Missouri, p. 1,618. See http://fraser.stlouisfed.org/publication-series/?id=595.

16. Ibid, pp. 1,667-68.

17. R.I. Peebles, cashier, The Bank of Boyle, Miss., to Mr. F.O. Watts, Jan. 17, 1914. United States. Reserve Bank Organization Committee, 1914, Box 2653, Folder 2: #34, Miscellaneous States. See http://fraser.stlouisfed.org/docs/historical/nara/nara_rg082_e02_b2653_02.pdf.

18. See United States. Reserve Bank Organization Committee. Federal Reserve District Divisions and Location of Federal Reserve Banks and Head Offices—Saint Louis, Missouri, pp. 1,730-31. See http://fraser.stlouisfed.org/publication-series/?id=595.

19. Ibid., p. 1,646.

20. Ibid., p. 1,765.

21. Ibid., p. 1,781.

22. Ibid., p. 1,783.

23. Ibid., p. 1,647.

24. Ibid., p. 1,606.

25. Ibid.

26. Ibid., p. 1,715.

Security forces stood guard in 1937 at the vault at the Little Rock Branch of the St. Louis Fed.

27. Ibid., p. 1,736.

28. The number of first-, second- and third-place votes and recommendations for the locations of Federal Reserve banks is summarized in United States. Reserve Bank Organization Committee, First Choice Vote for Reserve Bank Cities, July 29, 1914. See http://fraser.stlouisfed.org/publication/?pid=604. See also United States. Reserve Bank Organization Committee. Location of Reserve Districts in the United States, May 28, 1914, pp. 356-57. See http://fraser.stlouisfed.org/publication/?pid=606.

29. See United States. Reserve Bank Organization Committee. Decision of the Reserve Bank Organization Committee, April 2, 1914 (With Statement of the Committee in Relation Thereto, April 10, 1914), p. 22. See http://fraser.stlouisfed.org/publication-series/?id=603.

30. See United States. Reserve Bank Organization Committee, 1914, Box 2661, Folder 1: #95, Brief on Behalf of the Citizens of Baltimore Before the Federal Reserve Board. See http://fraser.stlouisfed.org/docs/historical/nara/nara_rg082_e02_b2661_01.pdf.

31. As of March 4, 1914, the District's 458 national banks had $83 million of capital and $379 million of deposits. By comparison, the Tenth District had 836 national banks with $93 million of capital and $521 million of deposits. See United States. Reserve Bank Organization Committee. Decision of the Reserve Bank Organization Committee, April 2, 1914 (With Statement of the Committee in Relation Thereto, April 10, 1914), Table A, p. 10. See http://fraser.stlouisfed.org/publication-series/?id=603.

32. The information in the preceding two paragraphs is from the Annual Report of the Federal Reserve Bank of St. Louis for the year ended Dec. 31, 1915. See http://fraser.stlouisfed.org/docs/historical/frbsl_history/annualreports/1915_frbstl_annualreport.pdf.

REFERENCES

Primm, James Neal. A Foregone Conclusion: The Founding of the Federal Reserve Bank of St. Louis. St. Louis: Federal Reserve Bank of St. Louis, 1989.

Smith, Eugene. Annual Statement of the Trade and Commerce of St. Louis, for the Year 1913, Reported to the Merchants' Exchange of St. Louis. St. Louis: R.P. Studley & Co., 1914, p. 30.