The FOMC Conducts Monetary Policy

The Federal Open Market Committee (FOMC) conducts national monetary policy in the United States. Regularly scheduled FOMC meetings conclude with a vote on the stance of monetary policy—including a decision about whether the FOMC will adjust the target range for the federal funds rate.

The federal funds rate is the Fed’s policy rate, which means it is the rate the Fed chooses to target to achieve its policy goals—the dual mandate. The FOMC sets the target range for the federal funds rate with the upper and lower limits on the range, which have been consistently 0.25 percentage points apart.

The Effective Federal Funds Rate and Target Range

The FRED graph below shows the effective federal funds rate within the target range over time. Each time the FOMC changes its policy position, the target range moves up or down. By adjusting its policy tools, the Fed ensures the effective federal funds rate moves with it.

A Two-Part Process

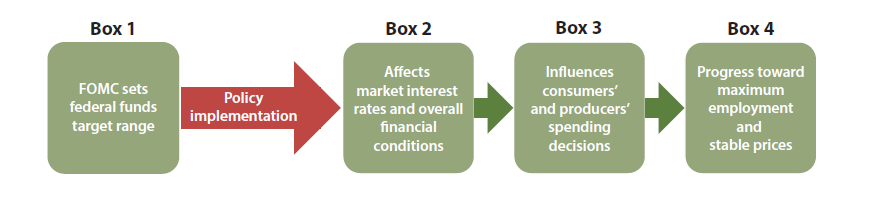

So, monetary policy is really a two-part process.

- The Federal Open Market Committee (FOMC) conducts monetary policy by adjusting the target range for the federal funds rate.

- The Fed implements monetary policy by using its monetary policy tools to ensure that market interest rates are at levels consistent with the FOMC’s target.

The flow diagram below reflects the way the FOMC’s monetary policy stance works its way through the economy to get us closer to the Fed’s dual mandate objectives. The first step, conducting monetary policy, is represented in the first box on the left side.

After each FOMC meeting, the FOMC announces its decision to either:

- leave the federal funds rate target range unchanged;

- decrease the federal funds target range, or

- increase the federal funds target range.

The Committee issues a press release and the Chair of the FOMC holds a press conference directly after each meeting to explain the decision. You can find the most recent FOMC press release and watch the press conference on the Fed Board of Governors website.