The History and Responsibilities of the Federal Reserve

Although the need for banking reform was undisputed, for decades early supporters debated the delicate balance between national and regional interests. Nationally, the central bank had to make it easier to conduct financial transactions between businesses and individuals across regions of the country.

The "central bank" is the generic name given to a country's primary monetary authority. A nation's central bank is usually given a mix of responsibilities including determining the money supply, supervising banks, providing banking services for the government, lending to banks during crises, and promoting consumer protection and community development.

A stable central bank would also strengthen the United States' standing in the world economy because foreign individuals, businesses, and governments have confidence in doing business within a country that has a responsible central bank and economic system. Regionally, the central bank would have to respond to the local needs for currency, which could vary across regions. A lack of available currency had caused the earlier banking panics.

Another important issue was creating a balance between the private interests of banks and the centralized responsibility of government. What emerged—the Federal Reserve System—was a central bank under public control, with many checks and balances.

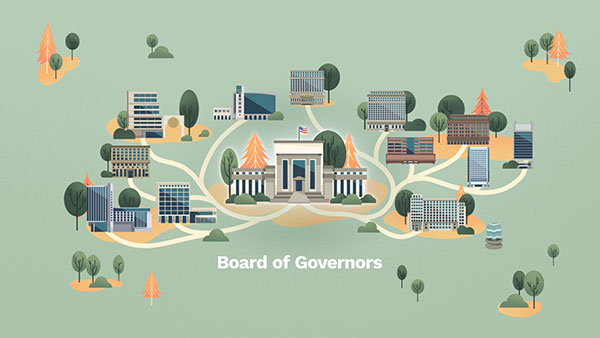

Congress oversees the entire Federal Reserve System. And the Fed must work within the objectives established by Congress. Yet Congress gave the Federal Reserve the autonomy to carry out its responsibilities without political pressure. Each of the Fed's three parts—the Board of Governors, the regional Reserve Banks, and the Federal Open Market Committee (FOMC)—operates independently of the federal government to carry out the Fed's core responsibilities.

The Federal Reserve System was developed and continues to develop as an interesting blend of public and private interests and centralized and decentralized decision-making. As you continue reading, you will learn about the Fed's structure and responsibilities: what the Fed is and what it does.