International Asset Prices and Trade in Intermediate Goods

There seems to be a systematic relationship between the amount of research and development (R&D) that is embodied in trade and movements in international asset prices. Country pairs that share more R&D through trade in products display more correlated stock market returns and less volatile exchange rates.

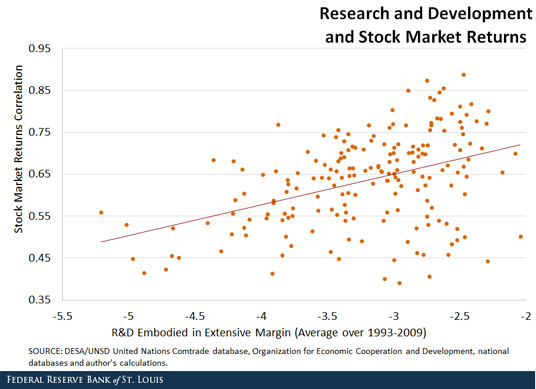

In my paper “International R&D Spillovers and Asset Prices,” co-authored with Federico Gavazzoni, we examined a sample of 20 countries over the period 1993-2009.1 The figure below shows a positive correlation between the R&D that two countries share through trade in intermediate products and the correlation of their stock market returns.

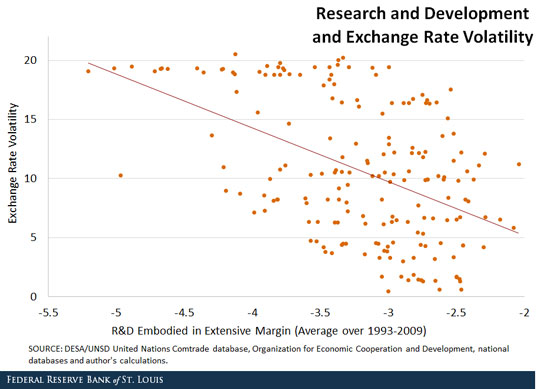

In addition, our research shows a negative correlation between the R&D embodied in traded intermediate goods and the volatility of the exchange rate depreciation between the currencies of each country-pair. This relationship is shown in the next figure.2

These features are important because they link movements of asset prices across countries to macroeconomic fundamentals. For instance, Canada-USA, Finland-Sweden and USA-Japan are examples of pairs of countries that share a lot of R&D through their trade and also exhibit some of the highest correlations of their stock market returns and lowest correlations of exchange rate volatility in the sample of study. On one hand, these are very innovative countries that invest a lot of resources into R&D. On the other hand, these countries trade a large number of products.

Our research shows that R&D spillovers through international trade may be an important channel to understand several features of international asset prices. Innovation in each country makes its growth path risky. The international linkages through trade, then, impose that all countries are exposed to the risks associated with innovation.

Asset prices reflect the prospects of growth of an economy, which are affected by the innovation of the closest trading partners in our open economy setting. Therefore, the more linked the countries are internationally, the more their stock market returns will be connected. Likewise, international relative prices (e.g., the exchange rates) can potentially be less volatile as international trade favors a stronger degree of risk sharing.

Notes and References

1 Gavazzoni, Federico; and Santacreu, Ana Maria. “International R&D Spillovers and Asset Prices.” Working Paper, 2015.

2 It is important to note that these graphs do not imply any causal relationship.

Additional Resources

- On the Economy: Improving Business Climates and Escaping the Middle-Income Trap

- On the Economy: India’s Services Sector Is Booming, While Manufacturing Lags

- On the Economy: Which Regions Have Recovered from the Great Recession?

Citation

Ana Maria Santacreu, ldquoInternational Asset Prices and Trade in Intermediate Goods,rdquo St. Louis Fed On the Economy, Nov. 30, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions