Improving Business Climates and Escaping the Middle-Income Trap

The institutional environment of a country is important for attracting investment and generating growth. To obtain a measure of the ease of doing business, the World Bank ranks countries according to the quality of their regulatory environment and protection of property rights, which are key elements for facilitating investment in an economy. The ranking is based on a survey that documents:

- The complexity of regulation

- The time and cost to achieve such regulations

- The extent of protection of property rights

- The tax burden on businesses

In the most recent rankings, for instance, Singapore is No. 1, whereas Venezuela is No. 186.1

An interesting feature of this survey is the ability to track the improvement of a particular country’s institutional environment over time. Indeed, the World Bank’s Doing Business 2016 report finds that entrepreneurs in 122 economies saw improvements in their local regulatory framework last year.2 Many countries undertook several business reforms aimed at reducing the complexity of their regulatory environments.

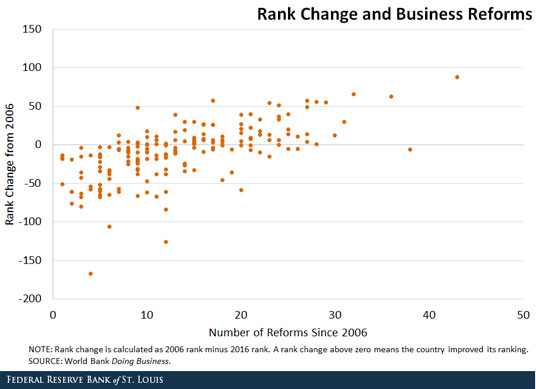

Rwanda, for instance, has introduced the most reforms since 2006 (43 reforms in total). Consequently, it has climbed the most in the rankings (from No. 150 in 2006 to No. 62 in 2016). Interestingly, its economy has been growing 7.6 percent annually.

In general, we observe a positive correlation between the number of reforms done since 2006 and the improvement in the rankings of doing business between 2006 and 2016, as seen in the figure below.

Improving this ranking is especially important for economies that are close to the middle-income trap. Empirical evidence suggests that these economies could become stagnant and stop growing if they do not improve the quality of their institutions. Poland is a clear example of a country that overcame the trap. Since 2006, it has introduced 27 reforms and climbed 49 positions. Its annual growth over this period has been close to 4 percent.

More recently, China has been approaching middle-income status. One of the goals of its government has been to introduce reforms to sustain economic growth. The success of these reforms is still unclear. According to the World Bank, China has introduced 21 reforms since 2006. However, it dropped one position in the ranking (from No. 83 to No. 84). This suggests that:

- Reforms take time to have an impact in the economy (since most of them were introduced in more recent years).

- The particular type of the reform is important when evaluating the business environment of a country.

The decrease in China’s ranking, despite the number of reforms, could be an indication that these reforms have a lower weight in the final index.

Whether China and other countries approaching the middle-income trap can be as successful as Poland will depend on their willingness and credibility to introduce the necessary reforms.

Notes and References

1 “Doing Business Economy Rankings.” World Bank. There are 11 indicators (including the overall ranking) and 189 economies.

2 “Doing Business 2016: Measuring Regulatory Quality and Efficiency.” World Bank.

Additional Resources

- On the Economy: Despite Financial Woes, Greece’s Business Climate Has Improved

- On the Economy: Can Countries Escape the Low- or Middle-Income Trap?

- Regional Economist: Trapped: Few Developing Countries Can Climb the Economic Ladder or Stay There

Citation

Ana Maria Santacreu, ldquoImproving Business Climates and Escaping the Middle-Income Trap,rdquo St. Louis Fed On the Economy, Nov. 16, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions