Getting Caught in the Low- or Middle-Income Trap

Today’s post is the first in a series examining why developing countries have difficulty moving up the economic ladder.

Despite worldwide economic growth following World War II, very few countries have been able to catch up with the high per capita income levels of the developed world and stay there. A recent article in The Regional Economist examined why many developing nations have been “trapped” at a constant low- or middle-income level.

Assistant Vice President and Economist Yi Wen and Senior Research Associate Maria Arias noted that many poor countries today have a per capita income 30 to 50 times smaller than that of the U.S. They wrote: “For such countries to catch up to U.S. living standards, it may take at least 170 to 200 years, assuming that the former could maintain a growth rate that is constantly 2 percentage points over the U.S. rate (which is about 3 percent per year).”

The Low-Income Trap

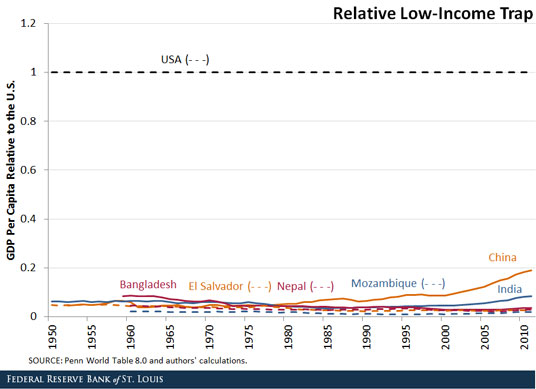

However, many countries haven’t been able to maintain growth rates above the U.S.’s, leading to a lack of convergence with the U.S. in terms of per capita income. The figure below shows a sample of countries caught in the low-income trap.

The authors point out that Bangladesh, El Salvador, Mozambique and Nepal haven’t been able to achieve growth rates above that of the U.S., so their relative income levels have not increased. They wrote: “As a result, the income gap between these nations and the U.S. has permanently been at least 20 times their own income per capita.”

China and India, which have indeed been able to achieve growth rates higher than that of the U.S., have shown signs of getting out of the relative low-income trap. “However, both countries still have a long way to go to catch up and converge to the levels seen in developed economies, and both have yet to encounter the relative middle-income trap.”

The Middle-Income Trap

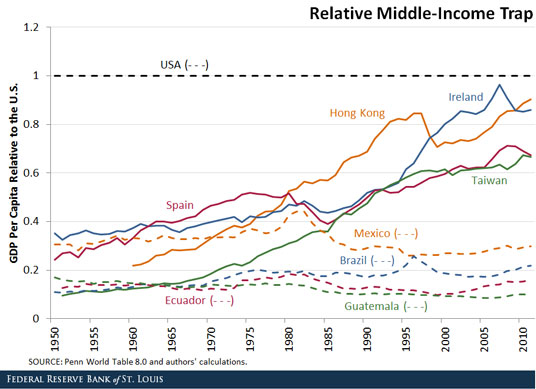

Countries that have been subject to the middle-income trap have had very different experiences, as shown in the figure below.

Some countries—such as the Asian Tigers (Hong Kong, Singapore, South Korea and Taiwan), Spain and Ireland—have experienced rapid and persistent relative income growth. As such, these countries have been catching up or converging to the higher level of per capita income in the U.S.

In sharp contrast, per capita income relative to the U.S. remained constant and stagnant between 10 percent and 40 percent of U.S. income among the Latin American countries listed. The authors noted: “Despite experiencing moderate absolute growth during the same period, they remained stuck in the ‘relative middle-income trap’ and showed no sign of convergence to higher income levels.”

Follow the Series

- Getting Caught in the Low- or Middle-Income Trap

- Why Can’t Developing Countries Catch Up?

- Escaping the Middle-Income Trap: Lessons from Ireland and Mexico

Additional Resources

- Regional Economist: Trapped: Few Developing Countries Can Climb the Economic Ladder or Stay There

- On the Economy: Improving Business Climates and Escaping the Middle-Income Trap

- On the Economy: Which Regions Have Recovered from the Great Recession?

Citation

ldquoGetting Caught in the Low- or Middle-Income Trap,rdquo St. Louis Fed On the Economy, Dec. 14, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions