What the Fed Does and How It Works: 12 Things to Know

Numbers surround the Federal Reserve System. When trying to learn about the structure, purpose and functions of the U.S. central bank, the numbers can seem overwhelming.

The Federal Reserve System includes 12 regional Reserve banks located in districts throughout the United States. Each of the numbers 1-12 can help represent an important facet of the U.S. central banking system.

This blog post walks you through what the Federal Reserve does and how it works, plus some interesting history.

1 Reserve bank president who gets a permanent vote at each FOMC meeting

The Federal Open Market Committee, or FOMC, sets monetary policy for the U.S.

The New York Fed president, who also serves as the FOMC vice chair, is the only one of the 12 regional Reserve bank presidents who serves as a permanent voting member of the FOMC because the New York Fed has unique responsibilities. The New York Fed conducts open market operations and transactions in foreign exchange markets for the System and U.S. Treasury.

2% inflation rate target

The Fed has a dual mandate, which is to achieve price stability and maximum sustainable employment in the U.S. economy. To satisfy the price stability portion of the mandate, the FOMC at present has a long-run inflation target of 2%.

If prices for goods and services are stable, that preserves the purchasing power of money. The FOMC has equated price stability with a low, measured rate of inflation. (Inflation is a general, sustained upward movement of prices for goods and services in an economy.)

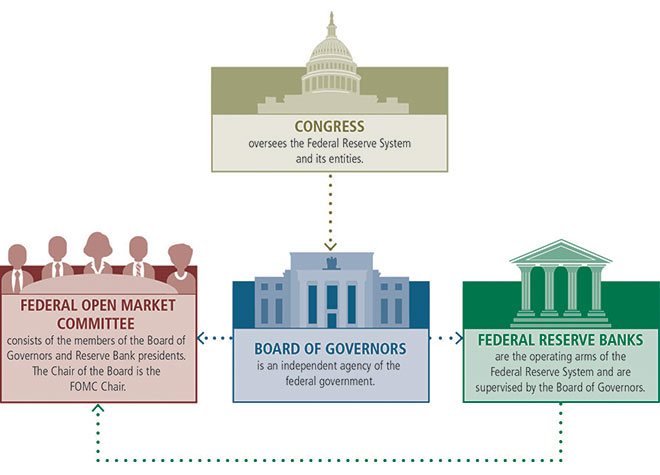

3 parts of the Federal Reserve System

What people commonly refer to as “the Fed” includes the Board of Governors, regional Reserve banks and the FOMC. The Fed was structured so that monetary policymakers hear from diverse voices around the country.

Image courtesy of the Board of Governors

The Board of Governors serves as a central governing board, reporting to and directly accountable to Congress. The members of the Board of Governors are political appointees, chosen by the U.S. president and confirmed by the Senate. The Board oversees the Reserve banks.

The regional Reserve banks—including the St. Louis Fed—provide our central banking system with a decentralized operating structure. They are designed to represent the voice of Main Street. The Reserve bank presidents are nonpolitical appointees, chosen by the members of a bank’s Board of Directors and subject to approval by the Board of Governors.

4 well-known tools to conduct monetary policy

In order to achieve the dual mandate, the Fed has different tools to conduct monetary policy. Four well-known ones are:

- Open market operations: The selling and buying of U.S. government securities.

- Reserve requirements: The percentage of deposits commercial banks are required to hold, either in their vaults or on deposit at a Reserve bank.

- Interest on reserves: The interest rate paid to commercial banks for their reserves on deposit. This includes interest on required reserves and on excess reserves.

- Discount rate: The interest rate charged to commercial banks and other depository institutions that borrow money from a regional Reserve bank.

However, the way the Fed influences interest rates has changed over time, Economic Education Coordinator Scott Wolla explained in a recent essay.

Prior to 2008, the FOMC set a specific target rate for the federal funds rate and used open market operations to move the rate toward its target. The Fed could increase reserves to lower the rate, thereby encouraging economic activity. Or, it could reduce reserves to increase the rate in an attempt to restrain spending when inflation exceeded the 2% target.

Amid the Great Recession, the Fed had lowered the federal funds rate to a range of 0%-0.25%. To provide further stimulus and liquidity, the Fed made a series of large-scale asset purchases (also open market operations), increasing the size of the Fed's balance sheet and the amount of reserves in the banking system.

With such an ample quantity of reserves, Wolla said, the Fed could no longer effectively influence the federal funds rate by small changes in the supply of reserves.

These days, the Fed sets a target range for the federal funds rate; it uses the interest rate paid on excess reserves to influence banks’ decision to hold more or fewer reserves.

Meanwhile, another tool called the “overnight reverse repurchase agreement facility” (ON RRP) helps to set a floor on interest rates. The ON RRP facility is considered an open market operation. An institution essentially deposits reserves at the Fed overnight and earns interest on the deposit. Wolla said this is similar to a consumer buying a certificate of deposit, holding it for a specified time, and being paid interest when it is redeemed.

5 functions of the Fed

The Fed has a lot of responsibilities, as outlined in The Federal Reserve System Purposes & Functions. Its five key functions are:

- Conducting monetary policy

- Promoting financial system stability

- Supervising and regulating financial institutions and activities

- Fostering payment and settlement system safety and efficiency

- Promoting consumer protection and community development

This video from the Board of Governors explains the first function, conducting monetary policy.

6 states partially represented by the St. Louis Fed (plus 1 whole state)

Did you know the St. Louis Fed’s District not only spans all of Arkansas, but also covers parts of six additional states? Our region includes eastern Missouri, southern Illinois, southern Indiana, western and central Kentucky, western Tennessee and northern Mississippi.

To better serve the area, we have branch offices in Little Rock, Ark., Louisville, Ky., and Memphis, Tenn.

The seals of all the states in our District are proudly carved into the limestone walls of our headquarters in downtown St. Louis, as well as emblazoned in metal on the sidewalk.

7 members of the Board of Governors

When fully staffed, the Board of Governors consists of seven members whom the U.S. president appoints and the Senate confirms.

The Board is based in Washington, D.C. Each member has a 14-year term, and one governor’s term expires every two years. This staggering of terms is designed to ensure political independence.

Duties of Fed governors include participating in FOMC meetings, overseeing regional Reserve banks, and writing regulations that foster a stable and strong U.S. banking system and economy.

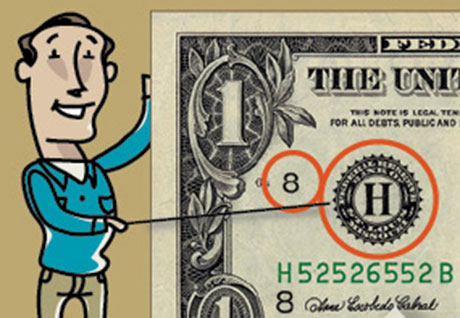

8H is the code for the Federal Reserve Bank of St. Louis

Each bill has an alphanumeric code signifying the Reserve bank that accounts for it. It also has a unique serial number.

Each of the 12 Federal Reserve districts can be identified with a unique code that includes a number and a letter.

The regional Reserve banks each receive a number, 1 through 12. The number assigned to a district increases from East to West. For example, the Boston Fed is No. 1 and the San Francisco Fed is No. 12.

The letter in the alphabet that corresponds to the number of the bank accompanies it to form the unique code. For example, the St. Louis region is 8H since H is the eighth letter of the alphabet.

If you look at a Federal Reserve note, you can see the district that accounts for it.

However, the Fed doesn’t actually print money. The Fed places an order for currency with the U.S. Treasury’s Bureau of Engraving and Printing, based on new notes needed to meet public demand. Regional Reserve banks, including the St. Louis Fed, distribute those notes to financial institutions.

9 is the most states included in a Fed district

The San Francisco District contains the largest number of states of all the Fed districts and is the largest in terms of population, economic and geographic size. It represents Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington, in addition to American Samoa, Guam and the Commonwealth of the Northern Mariana Islands.

When Fed districts were founded, San Francisco was an obvious candidate for a Western headquarters. It had emerged as the Pacific center for export and trade; its trade ties to other nations, notably Great Britain, led to the city’s development as a financial center. In addition, gold and currency accumulated there amid the Gold Rush and silver mining.

Since the Twelfth District bank spans vast distances, it has branches in Los Angeles, Portland, Salt Lake City and Seattle and a cash processing facility in Phoenix.

The $10 Federal Reserve note features Hamilton

Image courtesy of U.S. Currency Education Program

"The 10 dollar / Founding Father without a father / Got a lot farther by working a lot harder, by being a lot smarter ..."

Alexander Hamilton led the charge to establish the First Bank of the United States, the nation’s first central bank.

Hamilton knew how the Bank of England provided liquid capital as a way to expand commerce, which helped Britain become a global trading power. He believed a U.S. central bank was similarly necessary to transform the nation from a largely rural and agrarian country into a commercial powerhouse.

Although the Bank only existed from 1791 to 1811, Hamilton’s work helped lay the foundations for a central banking system in America.

11 bank presidents rotate as voting members on the FOMC

In addition to the New York Bank president (a permanent FOMC voting member), four regional Reserve bank presidents serve as members of the FOMC on a rotating basis.

Most Reserve Bank presidents serve one-year terms on a three-year rotating schedule; however, the presidents of the Cleveland and Chicago Feds serve on a two-year rotating schedule.

12 votes at each FOMC meeting

At an FOMC meeting, there are 12 voting members:

- The Board of Governors (seven votes when fully staffed)

- Five Regional Reserve bank presidents

But all of the Reserve bank presidents attend FOMC meetings and participate in discussions about the economy. In fact, everyone is given an equal opportunity to offer perspectives on monetary policy and report on economic conditions in their districts.

After each meeting, the FOMC issues a statement explaining its decision. You don’t have to be an economist or financial expert to understand it. Here’s how to read an FOMC statement.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us