A Look at the Fed’s Dual Mandate

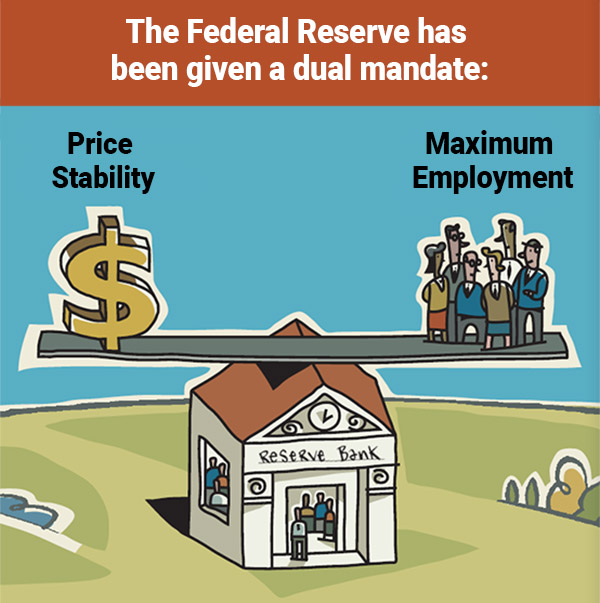

You’ve most likely heard that the Federal Reserve has a dual mandate regarding monetary policy. But do you know what that means? The Fed’s dual mandate is commonly understood as pursuing the economic goals of:

- Maximum employment: Maximum sustainable employment is the level at which cyclical unemployment—the type of unemployment that rises during economic downturns—is eliminated.

- Price stability: If prices for goods and services are stable, that preserves the purchasing power of money. The Federal Open Market Committee, or FOMC, has equated price stability with a low, measured rate of inflation. (Inflation is a general, sustained upward movement of prices for goods and services in an economy.) To achieve this part of the mandate, the FOMC targets an inflation rate of 2 percent over the longer run.

As the central bank, the Fed works toward this dual mandate by influencing the supply of money and interest rates in the economy.

A Bit of History

When Congress created the Fed in 1913, there was no mandate carved in stone, although the goal for our nation’s new central bank was to promote badly needed economic and financial stability for the country.

As detailed in the St. Louis Fed’s 2017 annual report, the Fed in the 1940s inched closer to an explicit mandate when Congress required the federal government to promote:

- Maximum employment

- Production

- Purchasing power

Then, in the late 1970s, during a period of high unemployment and high inflation, Congress directed the Fed “to increase production, so as to promote effectively the goals of”:

- Maximum employment

- Stable prices

- Moderate long-term interest rates

The Countdown

But wait a minute: None of this sounds like a dual mandate. Rather, it sounds as if Congress has given the Fed three mandates—if not four. Over the years, the mandates were boiled down to two: maximum employment and price stability. And now, some say the central bank can focus on price stability. Count the St. Louis Fed’s president, James Bullard, among this group.For further reading, see: Unconventional: A Policymaker’s Reflections on Crisis to Recovery. St. Louis Fed 2017 Annual Report, pp. 32. (PDF); Hawks, Doves, Bubbles, and Inflation Targets. Invited lecture, Utah State University. April 16, 2012. (PDF); President’s Message: The Fed’s Dual Mandate: Lessons of the 1970s. St. Louis Fed 2010 Annual Report; and President’s Message: St. Louis Fed’s Approach to Monetary Policy Won’t Change. Regional Economist, July 2008.

And Then There was One

Why not keep maximum employment as a key mandate? For one thing, the links between monetary policy and employment are weak and inexact. Because of this, the Fed has no explicit numerical target for the unemployment rate or for the growth of employment.

In contrast is the mandate for price stability, which is usually interpreted as low and stable inflation. The connections between monetary policy and price stability are strong in the medium to long run. Therefore, the Fed can and does set a target goal for inflation (that 2 percent target mentioned earlier). This is measured as the year-over-year percentage change in the price index for personal consumption expenditures.

Over the years, many policymakers across the globe have found that price stability is the only mandate needed. For example, the European Central Bank has had this single mandate since that bank got off the ground in the 1990s. Central bankers have found that other goals fall into line when the target for inflation is being met.

James Bullard, president and CEO of the St. Louis Fed and a participant on the Federal Open Market Committee, said recently, “The central bank can control the inflation rate over the medium term, and because of that, I think it’d be better to have a single mandate. The optimal way to deliver on the dual mandate is to pursue low and stable inflation, which in turn helps the real economy.”

Notes and References

1 For further reading, see:

- Unconventional: A Policymaker’s Reflections on Crisis to Recovery. St. Louis Fed 2017 Annual Report, pp. 32.

- Hawks, Doves, Bubbles, and Inflation Targets (PDF). Invited lecture, Utah State University. April 16, 2012.

- President’s Message: The Fed’s Dual Mandate: Lessons of the 1970s. St. Louis Fed 2010 Annual Report.

- President’s Message: St. Louis Fed’s Approach to Monetary Policy Won’t Change. Regional Economist, July 2008.

This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us