Did the Pandemic Hit Small Firms Harder than Large Firms?

The COVID-19 pandemic has had significant negative effects on the labor market. However, were smaller employers hit harder than larger ones? In a March Economic Synopses essay, Economist Serdar Birinci and Research Associate Aaron Amburgey examined the employment effects of the crisis from the perspective of small and large firms.

Factors to Consider

Birinci and Amburgey noted a few factors germane to studying the effects of the pandemic on employers of varying size. Chief among them:

- Firms with more than 500 employees were ineligible for Paycheck Protection Program (PPP) loans, making it important to analyze the changes in employment by firms that were and were not eligible.

- The pandemic hit small firms, which generally have a smaller financial cushion, harder—especially those in service sectors impacted by social distancing policies and other measures aimed at curtailing the virus’s spread.

Sharp Jump in Separations among Smallest Firms

The authors worked with Job Opening and Labor Turnover Survey (JOLTS) data, dividing firms into three groups by workforce size:

- Those with 1-49 employees

- Those with 50-999 employees

- Those with 1,000 or more employees

The authors found that, despite being eligible for PPP loans, small firms experienced the largest jump in job separations during the early months of the pandemic. In March 2020, the smallest firms (1-49 employees) saw more than a tripling of separations from the previous month. By comparison, the largest firms (1,000 or more employees) had only a 50% uptick in separations during the same time. The Bureau of Labor Statistics, which compiles JOLTS data, defines separations as both involuntary (layoffs) and voluntary (quits) separations from payroll.

“This result may be due to relatively larger firms being less prone to complications from containment measures because their workers are more likely to be able to work from home,” Birinci and Amburgey wrote.

New Hires Rise Faster for Small Firms

The JOLTS data showed that the number of monthly hires declined at a similar rate for all three groups at the start of the pandemic. The authors found that from January to April 2020, hires fell by 33% for small firms (those with fewer than 1,000 employees) and by 36% for the largest firms. However, small firms bounced back much faster than large ones. In May 2020, the smallest firms (1-49 employees) hired about 75% more employees than they did in January 2020, while the number of hires by the largest firms was near the same level during that time.

Birinci and Amburgey pointed out that the stronger rebound of small firms “likely reflects these firms replacing a larger number of workers due to having more separations at the onset of the pandemic.”

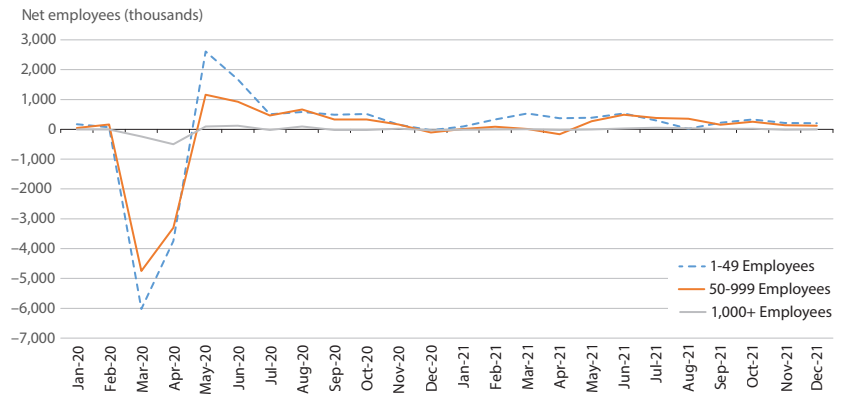

The authors also looked at the monthly net change in employment among the three employer size groups. The results, shown in the figure below, reveal that the smallest firms faced a bigger initial drop and subsequent rebound to employment than the larger firms.

Net Employment Change by Firm Size

SOURCES: JOLTS and authors’ calculations.

NOTES: The authors obtained the net change in employment by subtracting the total number of separations from the total number of hires. Data are seasonally adjusted.

“Overall, we document that the negative effects of the COVID-19 crisis were larger for small firms, even under the presence of PPP loans provided to them,” the authors concluded. “However, the recovery of employment to pre-pandemic levels is nearly complete given the strong and persistent recovery throughout 2021.”

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions