Investigating the U.S. Reliance on Foreign Suppliers

During the past two decades, the production process has become more fragmented, with different stages occurring in different parts of the world (often referred to as global value chains). Understanding the risks of the international fragmentation of production has been the focus of debate among academics and policymakers—especially since the start of the COVID-19 pandemic.

Indeed, the ongoing health crisis has exposed the vulnerabilities of being highly dependent on foreign suppliers to provide intermediate inputs for domestic production. In a 2021 paper, Ana Maria Santacreu, Fernando Leibovici and Jesse LaBelle found that U.S. sectors relying more heavily on foreign intermediate products fared slightly worse in terms of output and employment growth during the first period of the pandemic (January to June 2020).

In this blog, we also look beyond manufacturing. Although global value chains are more prevalent in the manufacturing sector, they are also becoming important in the business services sector, which includes IT services and transportation and storage services.

The Main Suppliers of Intermediate Inputs

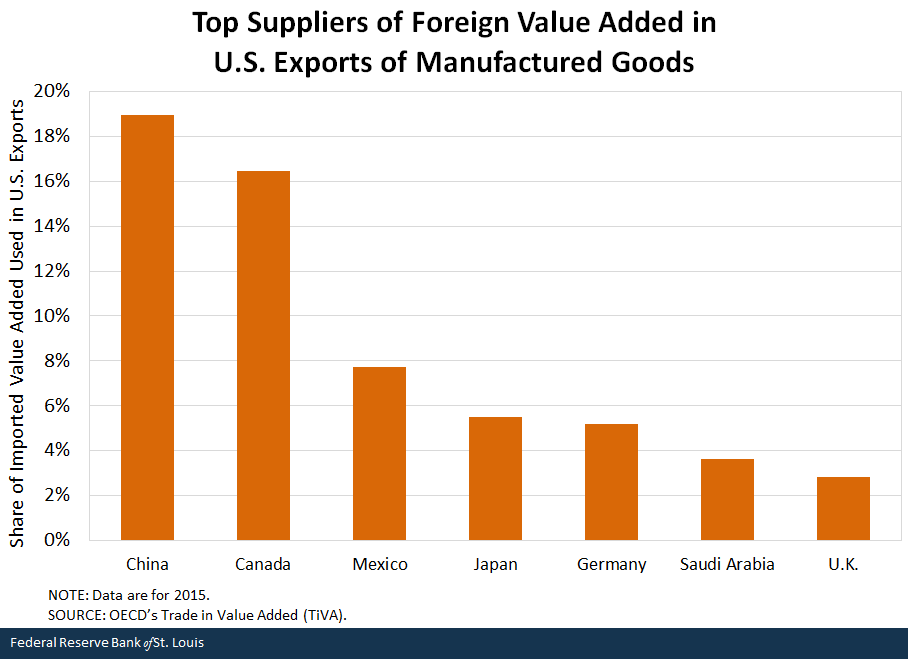

In the U. S., 15.6% of the value added embodied in exports of the manufacturing sector in 2015 was created abroad, whereas it was only 4% in the business services sector. The top five suppliers accounted for over half the foreign value added in U.S. manufactured exports: China (18.9%), Canada (16.5%), Mexico (7.7%), Japan (5.5%) and Germany (5.2%). (See the figure below.)

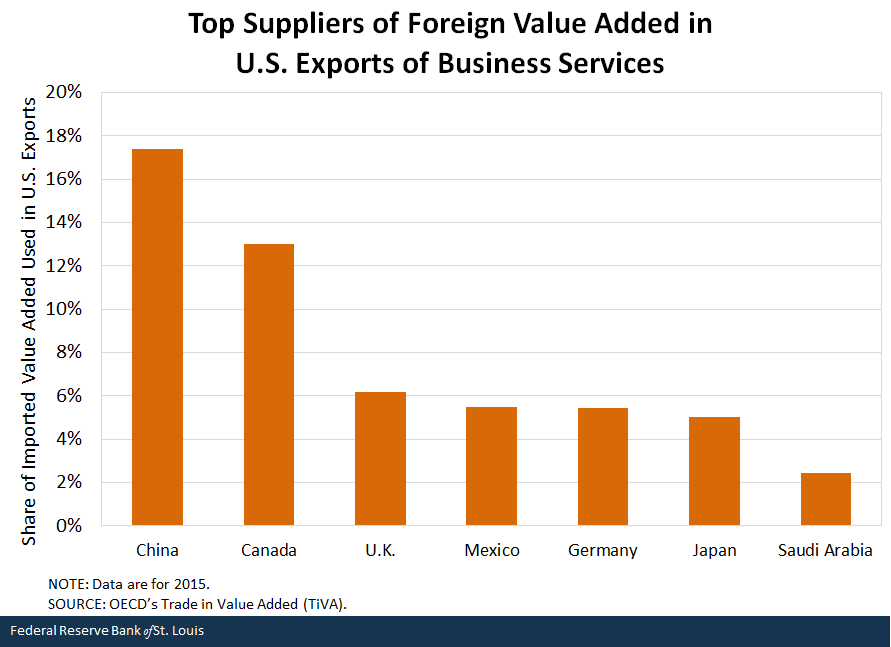

In the U.S. business services sector, the top five suppliers accounted for nearly half the foreign value added in its exports: China (17.4%), Canada (13%), the U.K. (6.2%), Mexico (5.5%) and Germany (5.4%). (See the figure below.)

Which Industries Rely More on Foreign Suppliers?

In a further breakdown of the U.S. manufacturing sector, the five industries that rely most heavily on foreign value added in their exports were coke and refined petroleum (25.9% of the exports’ value added was produced abroad); motor vehicles, tractor-trailers and semitrailers (23.7%); machinery and equipment (18.4%); basic metals (16.8%); and electrical equipment (16.5%).

China dominated the foreign value added in the motor vehicle (24.2%), machinery (25%) and electrical equipment (25.8%) industries. The leading supplier in the coke and refined petroleum and the basic metals industries, however, was Canada, which provided 44.7% and 18.1%, respectively.

For the business services sector, the top three industries with the highest percentage of foreign value added in their exports were transportation (7.6%), other business services (3.7%) and wholesale and retail (3.3%).

In the breakdown of business services, China again dominated in most of the top industries, being the leading foreign provider in exports of U.S. telecommunications (33.3%), accommodation and food services (17.4%), IT services and other information services (28.4%). Canada, however, is the leading provider of foreign value added in transportation and storage, accounting for 20.1%.

Conclusion

The heavy reliance on a few foreign suppliers in some industries could make the U.S. economy more susceptible to foreign economic shocks. The current policy debate has centered on the benefits of diversifying global value chains (reducing the dependence on a few countries) versus renationalizing these chains (using more domestic inputs).Yet, in the context of the COVID-19 pandemic, Santacreu, Leibovici and LaBelle found that because of the global nature of the shock, perfect diversification or even renationalization would not have helped the U.S. hedge against the risks of virus containment policies implemented around the world.

However, when shocks are localized, diversifying global value chains may reduce the dominance of the largest foreign suppliers, and renationalization may be a desirable alternative in some critical industries from a national security standpoint.

Additional Resources

- On the Economy: Comparing Value-Added Trade and Gross Trade

- Regional Economist: Will Tech Improvements for Trading Services Switch the U.S. Into a Net Exporter?

- Dialogue with the Fed: The Economics of Trade

Citation

Ana Maria Santacreu and Jesse LaBelle, ldquoInvestigating the U.S. Reliance on Foreign Suppliers,rdquo St. Louis Fed On the Economy, May 13, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions