Will Tech Improvements for Trading Services Switch the U.S. into a Net Exporter?

KEY TAKEAWAYS

- Innovations have played significant roles in expanding global trade throughout history.

- A simple trade innovation—the shipping container—may have triggered an escalation in international trade over the past 50 years.

- Technological innovations may give the U.S. a significant advantage in global trade of services, potentially helping the country close its trade deficit.

Technological and organizational innovations have historically driven the global expansion of production and trade across countries. In this article, we visit how the global expansion of trade in the past 50 or so years has driven the behavior of the U.S. trade balances, which switched from large surpluses to large deficits during the late 1970s and early 1980s.

We argue that the development and diffusion of some rather basic trading and communication technologies lie at the root of the growth of U.S. and global trade. Then, we advance the notion that the diffusion of information and communication technologies (ICT) might end up turning the U.S.’s trade deficit back into a surplus. We close our article taking stock on the current trends in U.S. policymaking, since, to be sure, history also shows that policy decisions can have either encouraging or disruptive effects.

The Role of Innovations in Trade

We first visit the connection between the escalation in international trade observed in the past 50 years and a rather simple innovation: the use of containers. We argue that the stunning growth in trade volumes and the spreading out of production and supply chains are both closely associated with the development of a global trade network based on the use of containers.

A crucial aspect of such trade network expansion is that it has allowed new (mostly developing) countries to produce manufactures and directly compete with incumbent production centers, including those in the U.S. Naturally, foreign competition in manufactures has been linked to the U.S.’s relatively recent negative trade balances and an acceleration of the already ongoing contraction in U.S. manufacturing employment.

We then show that the U.S. trade of services has recently exhibited a growing surplus, and we also argue that this growing surplus can be linked to technological innovations, namely the introduction and diffusion of ICT embedded in devices such as smartphones and tablets.

Once available in the U.S. and the rest of the world, ICT allows U.S. producers to at least partially access foreign markets. Clearly, the country has a comparative (and absolute) advantage in finance, education, health and other high-skilled service sectors, most clearly with respect to developing countries.

It has been well-established that much of the growth of developed countries is precisely in high-skilled service sectors.See, for example, Buera, Francisco J.; and Kaboski, Joseph P. "The Rise of the Service Economy." American Economic Review, October 2012, Vol. 102, No. 6, pp. 2540-69. As ICT enables these sectors to be more tradeable, one can confidently predict that the U.S. would expand its net exports in those sectors. However, this would require the U.S. to use its geopolitical might to engage other countries to open their markets to high-skilled U.S. service producers, rather than direct efforts to protecting domestic sectors that don’t have competitive advantages.

Historical Trade Innovations

A quick look into history may motivate our argument. Past major global trade expansions can be closely associated with technological changes, which helped with transporting goods across the planet.

For example, from the third century B.C. to the second century A.D., the celebrated “Silk Road” facilitated not only the trade of silk and other luxury goods between the West and China/India, but also the diffusion and exchange of all kinds of ideas. The Silk Road was ultimately conducted by a surprisingly basic innovation: the domestication of the Bactrian camel.

Indeed, the establishment of a network of cities and merchant groups along the different trading routes depended on the ability to transport goods across very challenging terrains. None of this would have been possible without the humble but tough Bactrian camel.Obviously, trade was enabled by the political stability afforded by the empires involved, especially the Han dynasty in China; the Kushan and Parthian Empires in Central and South Asia, respectively; and the Roman Empire in Europe, Asia Minor and the territories around the Black and Mediterranean seas. Interestingly, the issue of trade imbalances was also present during the Silk Road era.Pliny the Elder, writing in 77-79 A.D., in Naturalis Historia complained that “India, China and the Arabian peninsula take one hundred million sesterces from our empire per annum: that is what our luxuries and women cost us.”

Similarly, the Atlantic and Pacific trade expansions observed in the 16th, 17th and 19th centuries were closely associated with the geographic discoveries by Vasco da Gama and Christopher Columbus and the political power realignment that led to the expansion of European colonialism. Yet, trade and political power were ultimately supported by the galleon and other multiple advances in maritime technological and organizational knowledge.

The Adoption of Containers in Global Trade

During the past 50 years, the world has experienced one of the most rapid expansions in international trade in history. Between 1970 and 2018, total world exports (the sum of the exports of all countries) increased from $384 billion to $25 trillion, or more than 65 times. In constant U.S. dollars (that is, controlling for inflation), total exports have grown by a factor of 10 times.

Indeed, trade has outgrown production by a large margin. Regarding global GDP, the fraction of internationally traded goods and services in the entire world has moved from less than 14% in 1970 to more than 30% in 2018.Data taken from the World Bank. For the U.S., the ratio of exports to GDP moved from just 5.6% in 1970 to 12.2% in 2018.

This rapid “globalization” has been driven by two broad factors. First, the vast majority of countries switched from very protectionist and state-interventionist policies to much more market-oriented and open policies.See the global and regional patterns discussed in Buera, Francisco J.; Mongeâ€Naranjo, Alexander; and Primiceri, Giorgio E. “Learning the Wealth of Nations.” Econometrica, January 2011, Vol. 79, No. 1, pp. 1-45.

Second, the pervasive adoption of containers and corresponding infrastructure eventually led to drastic reductions in the cost of transporting goods. In the words of Peter Drucker: “[W]ithout [the container], the tremendous expansion of world trade in the last forty years—the fastest growth in any major economic activity ever recorded—could not possibly have taken place.” Drucker, Peter F., Innovation and Entrepreneurship, Butterworth-Heinemann, 2007.

Malcolm McLean, an American trucking entrepreneur, first introduced the use of containers in a 1956 sailing trip from the port of Newark-Elizabeth, N.J., to the port of Houston, Texas. He went on to further the “intermodal” possibilities rendered by containers. Specifically, a container can be transferred directly from a truck to a ship to another ship to a truck or railcar, and so on, until it ultimately arrives at its final destination. Under normal circumstances, transporters do not have to directly handle the goods being transported. Moreover, containers carrying goods of very different natures or with very different final destinations can be transported alongside one another.

In their review of the history and diffusion of containerization, professors Jean-Paul Rodrigue and Theo Notteboom state: “The container is thus much more than a box; it is a vector of production and distribution. Its introduction has led to various changes in the economic and transport geography and particularly how production and physical distribution interact. The container can be considered revolutionary, as completely new practices have taken place after its introduction in the transport system. For instance, its impacts on supply chain management can be considered as revolutionary since it's a completely new means of distribution. … It has become a ubiquitous transport product servicing mobility requirements at almost all stages of supply and commodity chains and being able to be carried virtually everywhere there are transport infrastructures.” Rodrigue, Jean-Paul; and Notteboom, Theo. “The geography of containerization: half a century of revolution, adaptation and diffusion.” GeoJournal, 2009, Vol. 74, No. 1, pp. 1–5.

The Impact of Containerization on Trade

Obviously, a vast and complex network of ports and logistics capabilities had to be developed to exploit the possibilities afforded by containerized and intermodal transportation. The diffusion and adoption of this mode of transport started in the 1970s, and its acceleration during the 1980s and 1990s led to the economies of scale and of scope needed to achieve substantial gains in productivity and lower costs. By the 1990s, containers had become the dominant support of global trade that included major developing and emerging economies.

Nowadays, all the major ports in the world—from China to North America, Singapore to Europe, Japan to Latin America, etc.—are all integrated into a global maritime transport system.For a much more detailed description and analysis of the geographic diffusion of containers, see Rodrigue and Notteboom’s article as well as Rua, Gisela. "Diffusion of Containerization (PDF)," Finance and Economics Discussion Series 2014-88, Board of Governors of the Federal Reserve System, November 2014. This has led to drastic reductions of one, two and possibly three orders of magnitude in the transportation costs for most goods.

In fact, some goods previously deemed “nontradeable” because of their prohibitively high costs of transportation (such as goods that need refrigeration) became not only tradeable but in some cases vastly traded. Moreover, the drastic reduction of transportation costs has expanded not only the international trade of final goods but also (and even more dramatically) the trade of intermediate goods.

Indeed, the proliferation of global supply chains has profoundly changed the organization of the manufacturing sector in the U.S., allowing for the outsourcing and offshoring of many aspects of the production process from multiple locations across the globe, partly because firms from developed countries can transfer their know-how to production units in developing countries.See a formal treatment of those knowledge transfers in Burstein, Ariel T.; and Monge-Naranjo, Alexander. "Foreign Know-How, Firm Control, and the Income of Developing Countries," The Quarterly Journal of Economics, February 2009, Vol. 124, No. 1, pp. 149-95.

The Effects on U.S. Trade

From the point of view of the U.S. trade balances, the 75 years since the end of World War II can be split into two broad periods. The first one is from the end of WWII until the late 1970s. The U.S. was the major global producer of manufactures, partly as a reflection of the destruction of production capacity in Europe and Japan and the incipient productivity of most of the rest of the world. During this subperiod, the country exhibited a positive trade balance, as it was the main net supplier of manufactures to the world.

The second period is from the early 1980s on, when the U.S. became a global net importer of manufactures, exhibiting sustained and persistently growing deficits.For a brief historical review, see Reinbold, Brian; and Wen, Yi. "Historical U.S. Trade Deficits," Federal Reserve Bank of St. Louis Economic Synopses, No. 13, May 17, 2019. The annual trade deficit reached a high of $800 billion in 2006, just before the Great Recession caused it to decline significantly. In the past few years, the trade deficit has been growing again, reaching more than $600 billion in 2017.See my discussion in my On the Economy blog post “U.S. Trade Imbalances with China and Others.” Many observers link the growth in trade to these deficits and, in turn, link these deficits to the accelerating contraction in the U.S. manufacturing sector’s employment and output.See the careful discussion in Tatom, John A.; & Kliesen, Kevin L. "U.S. Manufacturing and the Importance of International Trade: It’s Not What You Think," Federal Reserve Bank of St. Louis Review, January/February 2013, Vol. 95, No. 1, pp. 27-50. These concerns have been reinforced with the growth of Chinese exports in recent years.

How much international trade can be blamed for the contraction of manufacturing employment in the U.S. is debatable.A decline in manufacturing employment is naturally expected for developed countries from the observed historical patterns. See Herrendorf, Berthold; Rogerson, Richard; and Valentinyi, Akos. “Growth and Structural Transformation.” Handbook of Economic Growth, 2014, Vol. 2, pp. 855-941. After all, it was already declining in the 1970s, way before the trade expansion of the 1980s.

However, the dissemination of containers and the resulting trading networks facilitated the expansion of trade, allowing trade patterns (that is, direction and volumes of exports and imports) to be reorganized according to the costs of production rather than geographic distance. Thus, production location decisions can be based more on cost differences, as goods can be more efficiently transported across the map.

A crucial aspect of such trade network expansion is that producers can consider new sites and exploit the lower costs of labor typically found in developing countries. Shifting production to these new sites, in turn, displaces some incumbent production centers, including those located in the U.S. Naturally, foreign competition in manufactures has been linked to both:

- The observed negative trade balances of the U.S. since the 1980s

- An acceleration of the already ongoing contraction in U.S. manufacturing employment

At the root of it, this global reorganization of production is a simple idea (the container) without which geography would still be bonding the location of production to that of consumption.

ICT and Trade in Services

Behind the diffusion of containerization underlies a complex adoption of logistics and ICT. Of course, these technologies are not exclusively used to transport goods. Embedded in hardware such as smartphones, tablets and satellites, and software such as WhatsApp, Zoom and Skype, ICT has significantly enhanced communication and virtual meetings, which already have profoundly reshaped social and production interactions all over the world.

The effect of those innovations on production organization has been extensively studied and has focused on manufacturing.For example, see Autor, David H.; Katz, Lawrence F.; Kearney, Melissa S. “The Polarization of the U.S. Labor Market.” American Economic Review, May 2006, Vol. 96, No. 2, pp. 189-194, and subsequent work by these and related authors. More recently, the impact of those technologies on service sectors and their geographic distribution within the U.S. has also been noticed.Hsieh, Chang-Tai; and Rossi-Hansberg, Estaban. “Industrial Revolution in Services.” Becker Friedman Institute Working Paper, June 17, 2019. Here, we follow up by emphasizing the impact of diffusion of ICT on international trade and examining the expanding possibilities for U.S. producers in the world economy.

U.S. Potential in Exporting Services

The U.S. is a world leader in most high-skilled professional service sectors, such as health, finance and many sectors of research and development. Moreover, leading American producers have been ahead of others in the adoption of ICT in their production networks.Bloom, Nicholas; Sadun, Raffaella; and Van Reenen, John. “Americans Do IT Better: US Multinationals and the Productivity Miracle.” American Economic Review, February 2012, Vol. 102, No. 1, pp. 167-201.

The global diffusion of ICT—including possibly the expansion of 5G networks—is prone to make many of these services tradeable for servicing households and businesses. For households, online access to shopping, banking and education is practically routine. Similarly, the day-to-day activities of many businesses all involve tasks that can be automated and/or performed remotely and, of course, across national boundaries. Thus, a natural prediction would be that the U.S. should become a net exporter of high-skilled, knowledge-intensive professional services because of its comparative advantage.

Trends in Services Trade

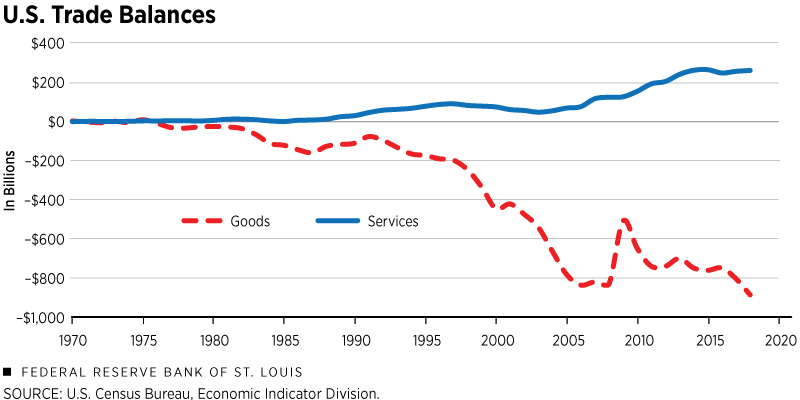

Figures 1 and 2 show that such a prediction has started manifesting itself in the data. Figure 1 shows that the U.S.’s balance of trade in services has behaved exactly the opposite of trade in goods. Following the 1970s (when both forms of trade were essentially balanced), the U.S. surplus in services has consistently grown, reaching $263 billion in 2015 and remaining around the same level since. This surplus substantially reduced the overall trade deficit of the country and would have been enough to overturn the deficit in any of the years up to the late 1990s.

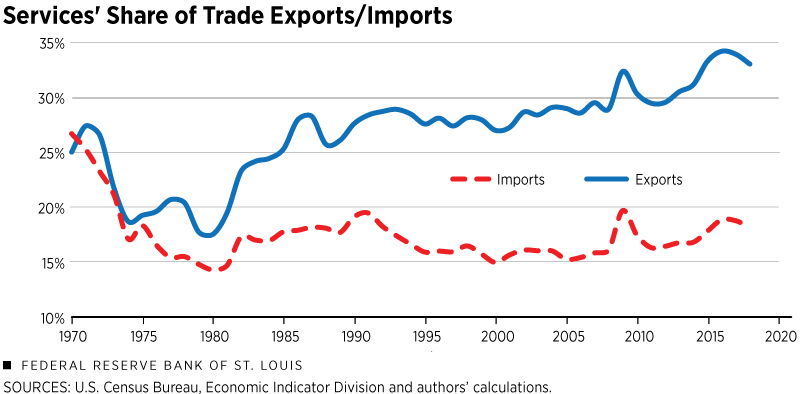

Figure 2 shows that the share of services on total exports has been growing consistently since 1980, reaching more than a third in recent years. At the same time, the share in total imports has remained flat.

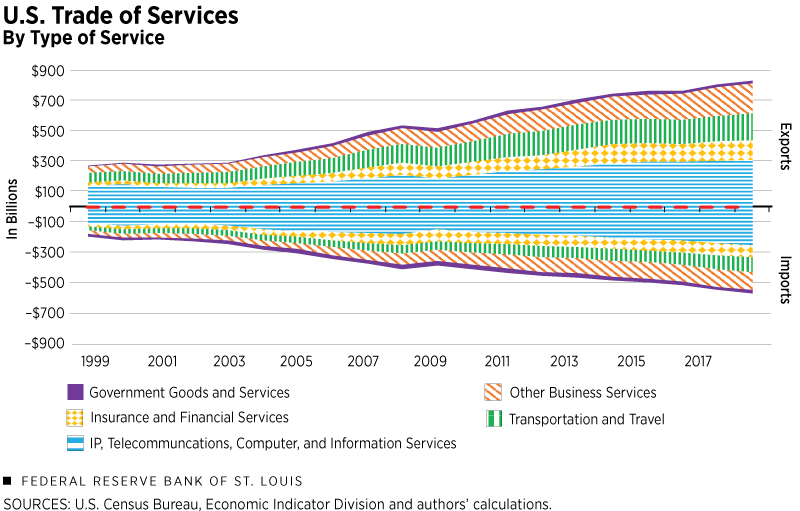

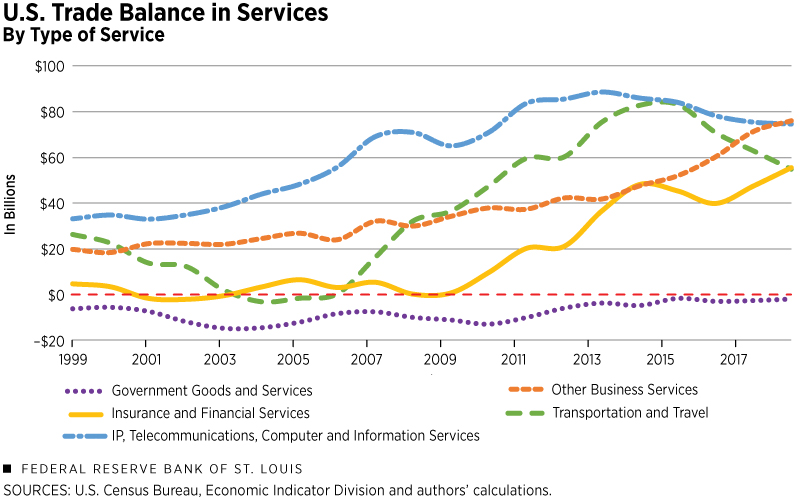

For the period 1999-2018, Figures 3 and 4 break down the trade balances across five groups of services:

- Government goods and services

- IP, telecommunication, computer and information services

- Transportation and travel

- Insurance and financial services

- Other business services

Figure 3 shows the two directions of U.S. trade, with exports in the upper segment and imports in the lower segment. To simplify the discussion, Figure 4 shows the trade balances (exports minus imports) of each of these groups. Overall, trade in services has grown at a rapid pace and has shown surpluses for the U.S.

Figures 3 and 4 show that the U.S. has recently consolidated as a major exporter of transportation and travel, as well as IP, telecommunication, computer and information services. In particular, the export of transportation and travel constituted 37% of the total export in services in 2018, while the export of IP, telecommunication, computer and information services constituted about 21%. (Trade also goes both ways, as the U.S. is also a major importer of transportation and travel, which accounted for 45% of the total import in services in 2018.)

Over the past 20 years, the U.S. experienced the fastest growth in its export of insurance and financial services, from $22 billion in 1999 to $129 billion in 2018. Other business services—which would include areas such as professional and management consulting, technical services, and research and development services—grew the second-fastest, from $45 billion in 1999 to $197 billion in 2018.

Aside from services associated with the government, all these groups show persistent surpluses. Evidently, these high growth rates manifest the U.S.’s comparative advantage in high-skilled professional sectors. They also suggest ample possibilities for growth in a world economy in which these services become more tradeable by the adoption, diffusion and improvement of ICT and portable devices.

Employment and aggregate production in the U.S. and world economies have been trending toward high-skilled, knowledge-intensive sectors and are expected to continue trending in that direction. Whether such trends would eventually lead to positive trade balances in the U.S. would depend on two key issues.

The first is whether the U.S. can keep its leadership in those sectors. This would require the country to keep its leadership in R&D and higher education, as well as its openness toward foreign ideas and human talents. If the U.S. loses this leadership, then it may experience offshoring and outsourcing high-skilled services from other countries, very much as we observed in manufactures.

The second issue is whether the U.S. can access foreign markets for high-skilled tradeable sectors. As noted before, this would require the country to use its geopolitical might to engage other countries to open their markets to high-skilled U.S. service producers instead of trying to protect U.S. producers that have lost their competitive advantages.

Taking Stock

In the past 40 years, the U.S. economy has exhibited persistent and growing deficits on its trade balance. These deficits have made U.S. trade relationships with the rest of the world a very hot political subject, as shown by media coverage, political debates and actual policy. Influential observers have deemed these deficits to be detrimental and have successfully blamed the trade policies of multiple trade partners (such as China, Europe and Mexico) as their cause, to the point that trade-skeptic positions have transitioned from the fringes to the dominant paradigm of the current administration.

This was clearly proclaimed recently by President Donald Trump in his address to the United Nations: "The future does not belong to globalists. The future belongs to patriots. The future belongs to sovereign and independent nations who protect their citizens, respect their neighbors and honor the differences that make each country special and unique.”“Remarks by President Trump to the 74th Session of the United Nations General Assembly.” White House Remarks, Sept. 24, 2019. In practice, this isolationist and protectionist stance has translated into the country’s withdrawal from previously agreed trade expansions (such as the Trans-Pacific Partnership) and the threat to revoke existing trade agreements, most notably NAFTA.

One key aspect that protectionist and isolationist rhetoric has largely ignored is that the recent dramatic global trade expansion—of which the U.S. trade imbalances are just one manifestation—has been largely driven by technological innovations. These innovations have not only helped to improve the production of goods and services, but also made their trade possible at much lower costs of transportation. In the end, much of the global production has been reorganized into complex supply chains, which often involve multiple countries and even continents.

Like it or not, we live in a world in which low trade and communication costs allow firms and consumers to seek the advantages of cost differences and greater variety from all developed or developing countries alike. While the ability of protectionist policies to curtail trade is far from gone, their distributive and efficiency costs are more complex and deeper than in a world in which only final goods were traded in markets where consumers and producers had clearly defined nationalities. In this article, we have advanced the possibility that the dissemination of ICT can bring back the positive trade balances for the U.S. and, hopefully, a more rational outlook about international trade and its benefits for the country as a whole.

Endnotes

- See, for example, Buera, Francisco J.; and Kaboski, Joseph P. "The Rise of the Service Economy." American Economic Review, October 2012, Vol. 102, No. 6, pp. 2540-69.

- Obviously, trade was enabled by the political stability afforded by the empires involved, especially the Han dynasty in China; the Kushan and Parthian Empires in Central and South Asia, respectively; and the Roman Empire in Europe, Asia Minor and the territories around the Black and Mediterranean seas.

- Pliny the Elder, writing in 77-79 A.D., in Naturalis Historia complained that “India, China and the Arabian peninsula take one hundred million sesterces from our empire per annum: That is what our luxuries and women cost us.”

- Data taken from the World Bank.

- See the global and regional patterns discussed in Buera, Francisco J.; Mongeâ€Naranjo, Alexander; and Primiceri, Giorgio E. “Learning the Wealth of Nations.” Econometrica, January 2011, Vol. 79, No. 1, pp. 1-45.

- Drucker, Peter F., Innovation and Entrepreneurship, Butterworth-Heinemann, 2007.

- Rodrigue, Jean-Paul; and Notteboom, Theo. “The geography of containerization: half a century of revolution, adaptation and diffusion.” GeoJournal, 2009, Vol. 74, No. 1, pp. 1-5.

- For a much more detailed description and analysis of the geographic diffusion of containers, see Rodrigue and Notteboom’s article as well as Rua, Gisela. "Diffusion of Containerization (PDF)," Finance and Economics Discussion Series 2014-88, Board of Governors of the Federal Reserve System, November 2014.

- See a formal treatment of those knowledge transfers in Burstein, Ariel T.; and Monge-Naranjo, Alexander. "Foreign Know-How, Firm Control, and the Income of Developing Countries." The Quarterly Journal of Economics, February 2009, Vol. 124, No. 1, pp. 149-95.

- For a brief historical review, see Reinbold, Brian; and Wen, Yi. "Historical U.S. Trade Deficits," Federal Reserve Bank of St. Louis Economic Synopses, No. 13, May 17, 2019.

- See my discussion in my On the Economy blog post, “U.S. Trade Imbalances with China and Others.”

- See the careful discussion in Tatom, John A.; and Kliesen, Kevin L. "U.S. Manufacturing and the Importance of International Trade: It’s Not What You Think." Federal Reserve Bank of St. Louis Review, January/February 2013, Vol. 95, No. 1, pp. 27-50.

- A decline in manufacturing employment is naturally expected for developed countries from the observed historical patterns. See Herrendorf, Berthold; Rogerson, Richard; and Valentinyi, Akos. “Growth and Structural Transformation.” Handbook of Economic Growth, 2014, Vol. 2, pp. 855-941.

- For example, see Autor, David H.; Katz, Lawrence F.; and Kearney, Melissa S. “The Polarization of the U.S. Labor Market.” American Economic Review, May 2006, Vol. 96, No. 2, pp. 189-194, and subsequent work by these and related authors.

- Hsieh, Chang-Tai; and Rossi-Hansberg, Estaban. “Industrial Revolution in Services.” Becker Friedman Institute Working Paper, June 17, 2019.

- Bloom, Nicholas; Sadun, Raffaella; and Van Reenen, John. “Americans Do IT Better: US Multinationals and the Productivity Miracle.” American Economic Review, February 2012, Vol. 102, No. 1, pp. 167-201.

- “Remarks by President Trump to the 74th Session of the United Nations General Assembly.” White House Remarks, Sept. 24, 2019.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us