Worker Types in the U.S. Labor Market

Recessions do not affect every worker equally; the depth of the decline and the speed of recovery differ along a variety of observable dimensions such as sex, race, education and age.

The pandemic-induced recession and the following recovery have made this glaringly apparent, prompting discussion and investigation around phrases such as a “k-shaped” recovery—in which some workers have done well and others still struggle—and the “she-cession”—in which labor turmoil disproportionately affected women.

But asymmetric recessions are nothing new. As we argue, the dynamics of recent recessions, with their slow recoveries, are driven more importantly by which workers are searching for jobs, not the jobs themselves. Yet, while some groups of workers have always experienced higher unemployment rates during recessions, the lines that group these more vulnerable workers are not always clear.

The Alpha, Beta and Gamma Workers

In a recent working paper and Economic Synopses, we identified and characterized three types of workers in the U.S. labor market: alphas, betas, and gammas. These worker types differ in the patterns exhibited in their work histories. The largest group, the alphas, make up 57% of the labor force, are often found in stable and long-lasting jobs, and infrequently experience unemployment. Gammas, in contrast, make up 17% of the labor force and are likely to hop between different short-term jobs and go through long periods of unemployment. Betas comprise the remainder of the labor force and are in between the alphas and the gammas. Our findings also revealed that, after a job loss, gammas take the longest time to recover their level of earnings before the job loss.

The Impact of Recessions on these Worker Types

The same logic that means gammas experience job loss more strongly than alpha-workers carries over to business cycles. The figure below plots the unemployment rate of each type relative to its level before the Great Recession, which lasted from December 2007 to June 2009.

SOURCES: Census Bureau's Longitudinal Employer-Household Dynamics (LEHD) and authors’ calculations.

While all worker types had an increase in unemployment at the start of the recession, gammas’ unemployment rose by the most—over 20 percentage points, compared with 8 percentage points for betas and 4 percentage points for alphas. The gammas’ unemployment rate also stayed elevated for a longer period. By 2014, unemployment for alphas and betas had returned to its pre-recession level, whereas gammas continued to experience an unemployment rate that was 10 percentage points higher.

Why Are Gammas More Sensitive?

Gamma workers are more sensitive to the business cycle for several reasons. They are more likely to separate in the first place because they tend to be in marginal jobs—jobs in which the costs of separating to the firm and the worker are very close to the benefits to both parties of remaining employed. These jobs are more likely to be destroyed when a recession hits. Another reason is that upon a job loss, gammas have a difficult time finding new, stable employment. They are prone to experiencing repeated job separations until they find a job that sticks.

The existence of these groups of workers who differ in their abilities to find and keep jobs can explain why unemployment remained high for many years following the Great Recession. Although gammas make up less than one-fifth of the labor force, they dominated the unemployment pool following the Great Recession and contributed the most to the lingering high unemployment rate.

The Link to Productivity

The type-composition of the workforce can also help explain the dynamics in average labor productivity (or output per worker) that occurred around the Great Recession. When many gammas lose their jobs at the start of a downturn, the composition of employment changes towards alphas and betas, who have higher productivity. This force increases the average labor productivity an economist would observe from the outside.

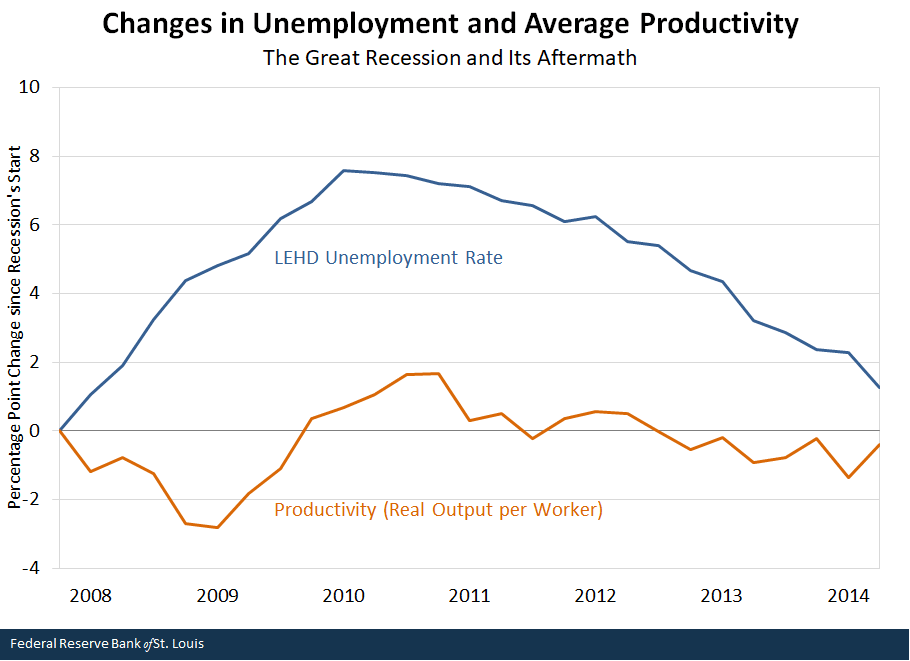

This is exactly what played out over the Great Recession, as shown in the figure below. Average labor productivity declined slightly at the start of the recession before it eventually overshot its pre-recession level. At the same time, the overall unemployment rate exhibited a large increase and remained elevated for years after average labor productivity had gone back to normal. This reflects the fact that the higher productivity and more numerous alphas and betas returned to stable jobs sooner than the gammas.

SOURCES: Census Bureau's Longitudinal Employer-Household Dynamics (LEHD), U.S. Bureau of Labor Statistics and authors’ calculations.

Our results also have important insights into the debate about whether the economy is creating “bad” jobs late in the recession or early in the recovery. As gammas are repeatedly searching for jobs, the matches that are created will be the lower-productivity, unstable jobs that they often find. However, this is not a demand-driven phenomenon. Instead, it is driven by the type-composition of individuals who are seeking work.

Additional Resources

- On the Economy: How Job Separations Differed between the Great Recession and COVID-19 Recession

- On the Economy: A Tale of Two Business Cycles during the Pandemic

Citation

Victoria Gregory, Guido Menzio and David Wiczer, ldquoWorker Types in the U.S. Labor Market,rdquo St. Louis Fed On the Economy, Aug. 12, 2021.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions