Key Elements of the Fed’s New Monetary Policy Strategy

This is the first post of a two-part blog series about the Federal Open Market Committee’s (FOMC) recently announced completion of its public “framework review” that resulted in a new monetary policy strategy. The review was public in the sense that the Federal Reserve held several open forums with interested members of the public and conducted a conference to discuss publicly available academic papers.

This first part will discuss the motivation for the review, the key changes that were incorporated into the FOMC’s revised Statement on Longer-Run Goals and Monetary Policy Strategy (PDF), and how the strategy embodied in this new statement differs from the previous version. The second part will discuss some of the challenges that the FOMC may face in implementing key aspects of the new monetary policy strategy—particularly the goals of achieving an average inflation rate of 2% over the longer run.

Background

The Federal Reserve announced in late 2018 that it would undertake a public review of its monetary policy framework. The framework review encompassed the Fed’s policy strategy, tools and communications practices. The purpose was to ensure that the FOMC is using the best tools and strategies to fulfill its statutory mandate of promoting maximum employment, stable prices and moderate long-term interest rates in response to structural changes in the economy as well as in how the Fed’s policies affect the economy over time in the pursuit of these goals.

The outcome of the review and its key elements were described by Fed Chair Jerome Powell in an Aug. 27, 2020, speech. In tandem with the chair’s speech, the FOMC also released the new statement. There were two important changes. First, the statement introduced a modified description of maximum employment. Second, the statement described the FOMC’s new strategy of average inflation targeting. In subsequent speeches by Chair Powell and Vice Chair Richard Clarida, the approach was dubbed a flexible form of average inflation targeting.

What was the previous strategy?

Prior to this new policy, the Statement on Longer-Run Goals and Monetary Policy Strategy (PDF) that was adopted in January 2012 introduced a symmetric inflation target of 2%. Under this framework, known as flexible inflation targeting, the FOMC viewed inflation of 3% equally as bad as 1% and aimed to minimize deviations from the 2% inflation target. Monetary policy was also designed to minimize deviations of employment from its maximum level. Although the 2012 statement emphasized that maximum employment was largely determined by nonmonetary factors, the strategy sometimes presented a communications challenge, since it implied that unemployment could be too low or employment could be too high.

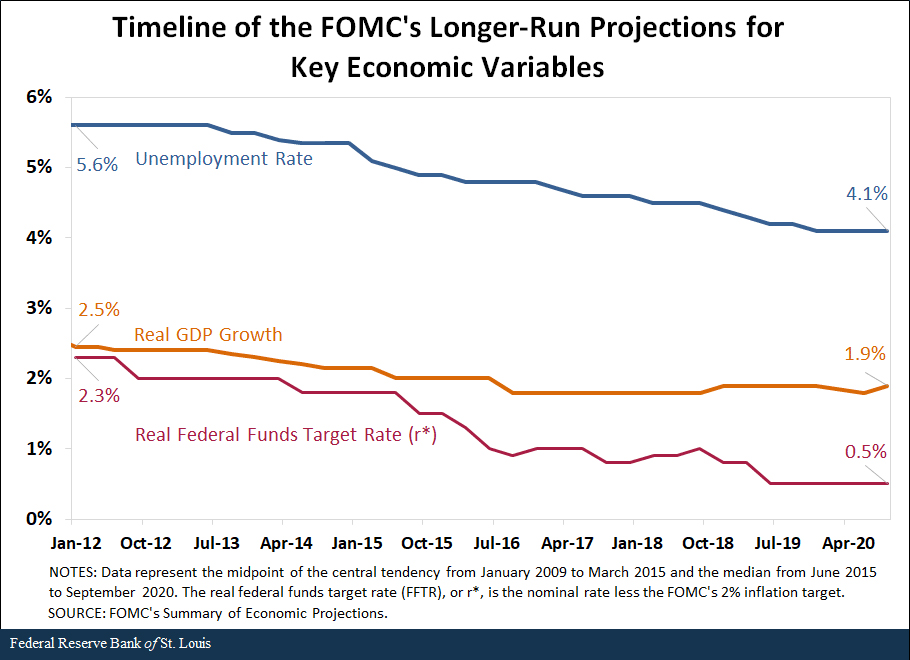

Chair Powell emphasized that the framework review was motivated by several changes in the economy since 2012.A follow-up speech on Aug. 31 by Vice Chair Richard Clarida provided additional detail. First, longer-run estimates of (i) real GDP growth, (ii) the unemployment rate and (iii) the FOMC’s assessment of the real federal funds target rate (FFTR) have declined. These changes can be seen in the first figure, which plots the FOMC’s longer-run projections for these three important variables since 2012.

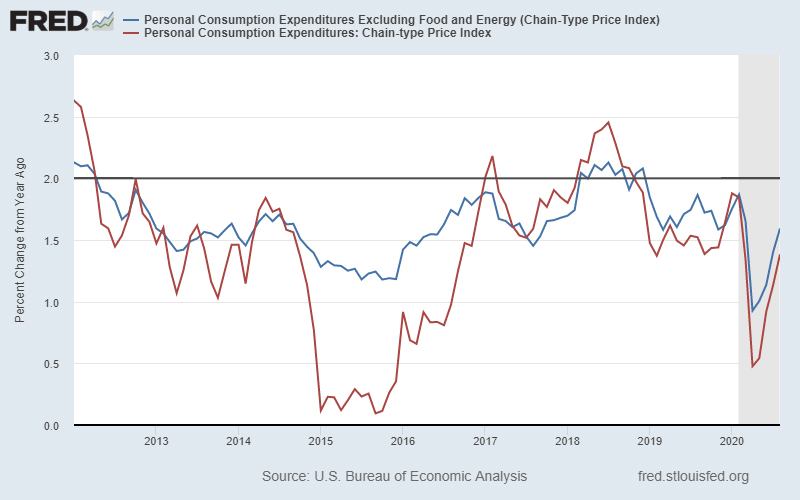

A second key development is that the Fed has struggled to meet its 2% inflation target, as measured by the 12-month percent change in the price index for “headline” personal consumption expenditures (PCEPI). The figure below shows headline and core PCE inflation since 2012; the latter excludes food and energy prices. The FOMC officially targets headline inflation, but many FOMC participants also carefully monitor core inflation. Regardless, by both metrics inflation has been below 2% for most of the last eight years.

To many Fed policymakers, the failure of inflation to attain 2% on a sustained basis—the crux of the inflation targeting framework—was especially puzzling given the steady decline in the unemployment rate to a 50-year low. There were also concerns that financial market participants viewed the 2% target as a ceiling. In other words, the FOMC would preemptively tighten policy to prevent inflation from rising above 2%. Thus, a key element of the new strategy was devising a framework that used the FOMC’s existing tools, instruments and communications practices to achieve 2% inflation on a sustained basis.

The New Strategy: What Didn’t Change?

Despite persistently below-target inflation rates, Fed Vice Chair Clarida nonetheless asserted in an Aug. 31 speech that the framework established in 2012 has served the FOMC well and supported its statutorily assigned goals established by Congress. Thus, the strategy adopted in the revised framework did not change with respect to the initial statement adopted in January 2012 in three key aspects:

- Policy will continue to strive for maximum employment.

- A 2% inflation rate over the longer run is consistent with price stability.

- Monetary policymaking must remain forward-looking.

Key Elements of the New Strategy

The new statement reflects the FOMC’s evolving understanding of structural changes in the economy over the past several years. One of the changes the FOMC highlighted was the expectation that “the federal funds rate is likely to be constrained by its effective lower bound more frequently than in the past.” In other words, the FOMC believes that in the future, if economic events demand it, the committee will be unable to reduce the federal funds target rate as much as it would in the past because of its relative closeness to zero (effectively, 12 basis points).

To help overcome the inability of lowering the FFTR at the zero lower bound, the FOMC is now prepared to use “its full range of tools” to achieve its statutory goals. The full range of tools includes balance sheet policy and forward-guidance language. Conceivably, the full range of tools could also include negative interest rate policy or yield curve control at some point in the future.

A second notable change is that the new strategy now defines maximum employment as a “broad-based and inclusive goal.” This definition is admittedly murky, perhaps because there is no widely agreed upon measure of maximum employment.

The FOMC has now elevated the importance of employment in its reaction function in two ways. First, the employment goal is now listed before the price stability goal in the new statement. Second, policy decisions will now be based on estimates of “shortfalls” of employment from its maximum level, rather than from “deviations” of employment from its maximum level. These changes, while perhaps subtle, suggest that the FOMC will no longer pursue preemptive tightening policies to forestall a possible future acceleration in inflation as long as threats to price stability or risks to the financial system remain muted.

And this brings us to the third major change in the FOMC’s new strategy: a new approach to achieving and sustaining inflation that averages 2% over time. The second part of this blog series will discuss the new strategy and some potential challenges the FOMC might face in pursuing this flexible average inflation targeting approach.

Notes and References

- A follow-up speech on Aug. 31 by Vice Chair Richard Clarida provided additional detail.

Additional Resources

- On the Economy: What Is Yield Curve Control?

- On the Economy: A Primer on Negative Interest Rates

- Open Vault: How the Fed Has Responded to the COVID-19 Pandemic

Citation

Kevin L. Kliesen and Kathryn Bokun, ldquoKey Elements of the Fed’s New Monetary Policy Strategy,rdquo St. Louis Fed On the Economy, Oct. 20, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions