What Is Yield Curve Control?

Traditionally, the Federal Open Market Committee (FOMC) targets the federal funds rate as a primary tool to conduct monetary policy. The fed funds rate is a rate with a very short maturity. Movements in the fed funds rate—which is an overnight interest rate rate—are thought to influence longer-term rates. Based on the most recent Summary of Economic Projections, the FOMC expects to keep the fed funds rate at zero through 2022. This has led to discussion of additional tools to conduct monetary policy with the federal funds rate effectively at zero. One of these policies that has received some attention in the press: yield curve control (YCC).Yield curve control is also sometimes referred to as yield curve targeting or yield curve caps.

How Does Yield Curve Control Work?

Similar to a policy rate, YCC aims to control interest rates along some portion of the yield curve. The yield curve is usually defined as the range of yields on Treasury securities from three-month Treasury bills to 30-year Treasury bonds. However, YCC targets longer-term rates directly by imposing interest rate caps on particular maturities. Because bond prices and yields are inversely related, this also implies a price floor for targeted maturities. If bond prices (yields) of targeted maturities remain above (below) the floor, the central bank does nothing. However, if prices fall (rise) below (above) the floor, the central bank buys targeted-maturity bonds—increasing the demand and thus the price of those bonds.

The minutes of the FOMC meeting on June 9-10 noted that the staff highlighted three examples of YCC policies: Federal Reserve policy during and after World War II, the Bank of Japan’s policy adopted in 2016 and the Reserve Bank of Australia’s policy adopted in March 2020.

YCC in the U.S.

The U.S. incurred massive debt expenditures to finance World War II, and the Fed capped yields in order to keep borrowing costs low and stable. In April 1942, short- and long-term (25 years and longer) interest rates were pegged at 3/8 percent and 2.5%, respectively. These rate caps were largely arbitrary and were set at approximately pre-1942 levels.

As the U.S. continued to incur debt, the Fed was obligated to keep buying securities to maintain the targeted rates—forfeiting some control of its balance sheet and the money stock. The public generally preferred to hold higher-yielding, longer-term bonds. Consequently, the Fed purchased a large amount of short-term bills, which also increased the money supply, to maintain the low interest rate peg.

After the war ended, FOMC members grew more concerned with addressing the rapid inflation that materialized. However, President Harry S. Truman and his treasury secretary still favored a policy that maintained YCC (which also protected the value of wartime bonds by implying a price floor). By 1947, inflation was over 17%, as measured by the year-over-year percent change in the consumer price index (CPI), so the Fed ended the peg on short-term rates in an attempt to combat developing inflationary pressures.

In combination with rising debt from the U.S. entering the Korean War in 1950, the peg on longer-term rates contributed to faster money growth and increased inflationary pressures. In 1951, annualized inflation was over 20%, and monetary policymakers insisted on combating inflation. Against the desires of fiscal policymakers, interest rate targeting was brought to an end by the Treasury-Fed Accord in March 1951.

YCC in Japan

The Bank of Japan implemented YCC in 2016 with the goal of exceeding its 2% inflation target. The short-term policy rate and 10-year rate on government bonds were set at -0.1% and zero percent, respectively.

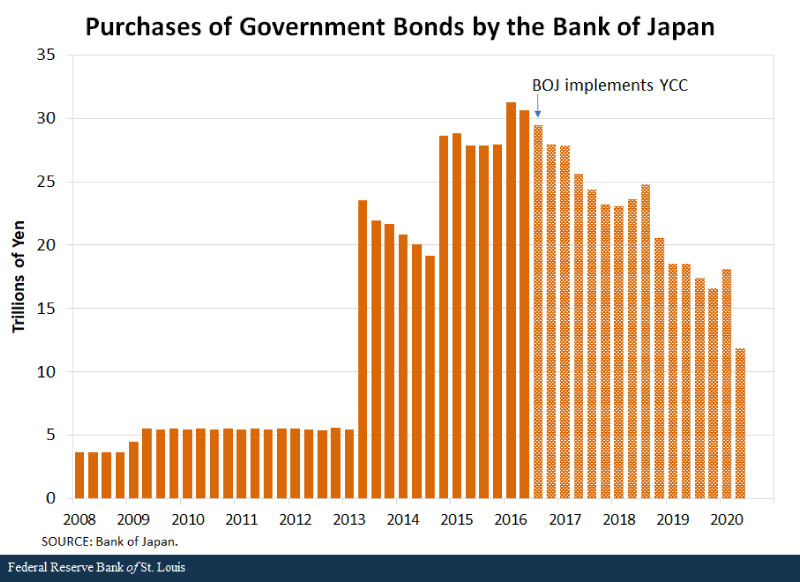

YCC complements Japan’s quantitative and qualitative monetary easing (QQE) and negative interest rate policies. QQE policy resulted in annual bond purchases of about 100 trillion yen until 2016—sharply increasing the size of the Bank of Japan’s balance sheet. QQE with YCC lowered bond purchases to about 70 trillion yen in 2019. Additionally, the monthly inflation rate, as measured by the year-over-year percent change in the CPI, has remained above zero since enacting YCC.

YCC in Australia

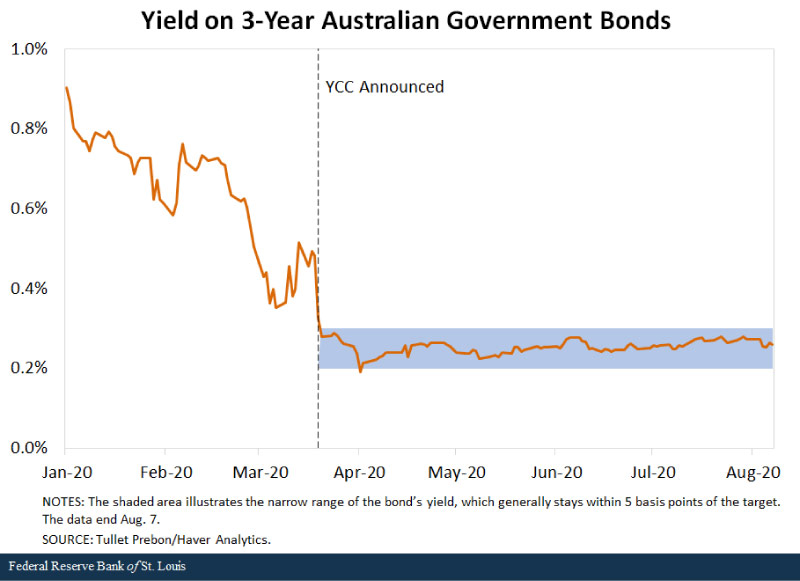

More recently, the Reserve Bank of Australia (RBA) implemented YCC. Since its announcement on March 19, 2020, the RBA has purchased bonds worth 52 billion Australian dollars to maintain the 0.25% target on three-year bonds. The bulk of purchases occurred between March 19 and May 6; purchasing stopped until August 5-6, when the central bank purchased 1 billion Australian dollars, as the three-year yield was slightly above the target. Further purchases will continue if the yield deviates from the target rate. The yield generally stays within 5 basis points of the target, as shown in the figure below.

Costs and Benefits

Current experiences in Japan and Australia, as well as the Fed’s experience in the 1940s, suggest that YCC has been an effective tool at targeting interest rates along some portion of the yield curve. As the minutes of the June FOMC meeting noted, the lessons from these three episodes suggest that a YCC policy can be implemented in such a way as to avoid a significant expansion in the central bank’s balance sheet—assuming the absence of an explicit exit strategy designed to reduce the size of the balance sheet. However, those minutes also noted that many FOMC participants had remarked that it was not clear there would be a need to adopt YCC as long as forward guidance remains credible on its own.

However, it is important to acknowledge that every policy has drawbacks. For example, if the Fed were to adopt such a policy and if the public perceives that the Fed is engaged in deficit financing, then it is possible that inflation expectations could rise, threatening the Fed’s long-run goal of price stability; this happened in the U.S. in the 1940s and early 1950s and led to the Treasury-Fed Accord in 1951.

Another worry is that YCC could distort market signals, thereby diminishing the value of information that monetary policymakers glean from the Treasury market. Finally, if the Fed were to adopt YCC, policymakers would have to grapple with the challenge of how to exit from policies designed to be temporary departures from normal. Thus, once the economy normalizes, it would be important to convey the YCC exit strategy to the public in a clear manner to avoid potentially destabilizing outcomes.

Complementing Other Policies

Overall, YCC can complement other policies, such as quantitative easing and forward guidance, especially when a central bank’s nominal interest rate target is near zero. The policy can thus help align market expectations with the FOMC’s expectations. Nevertheless, there are other risks associated with YCC, including potential threats to central bank independence and the requirement that the market believe that the central bank would keep interest rates on a path consistent with its target. Credibility is thus key to YCC—or any policy, for that matter.

Notes and References

- Yield curve control is also sometimes referred to as yield curve targeting or yield curve caps.

Additional Resources

- Open Vault: Understanding the Role of Monetary Policy in the Economy

- On the Economy: A Primer on Negative Interest Rates

Citation

Kevin L. Kliesen and Kathryn Bokun, ldquoWhat Is Yield Curve Control?,rdquo St. Louis Fed On the Economy, Aug. 10, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions