Challenges to the Fed’s New Monetary Policy Strategy

This is the second post of a two-part blog series about the Federal Open Market Committee’s (FOMC) new monetary policy strategy. The new strategy reflects changes that were adopted in response to the “framework review” that concluded a few months ago. The review was a public discussion of the FOMC’s monetary policy strategy, tools and communications practices.

The first post discussed the motivation for the review, the key changes that were incorporated into the FOMC’s revised Statement on Longer-Run Goals and Monetary Policy Strategy (PDF) and how the strategy embodied in this new statement differs from the previous version. In this follow-up post, we discuss some of the challenges that the FOMC may face in implementing the new monetary policy strategy, particularly the goal of achieving an average inflation rate of 2% over time.

Changes from the Previous Strategy

A key aspect of the new framework is the adoption of a new strategy to achieve 2% inflation over the longer run. To see how this differs from the previous strategy, the specific changes from the previous statement can be seen below. The bold text reflects new additions to the statement; struck-through text shows language that has been deleted from the previous statement.

The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for inflation. The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate. The Committee would be concerned if inflation were running persistently above or below this objective. Communicating this symmetric inflation goal clearly to the public helps keep judges that longer-term inflation expectations firmly that are well anchored, thereby at 2 percent fostering price stability and moderate long-term interest rates and enhancing enhance the Committee’s ability to promote maximum employment in the face of significant economic disturbances. In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.

Fed Chair Jerome Powell and Vice Chair Richard Clarida have called the Fed’s new approach a flexible form of average inflation targeting, or simply flexible average inflation targeting.See Powell’s Aug. 27 speech and Clarida’s Aug. 31 speech. As discussed below, the words “flexible” and “average” are key elements of the new approach.

The Previous Framework

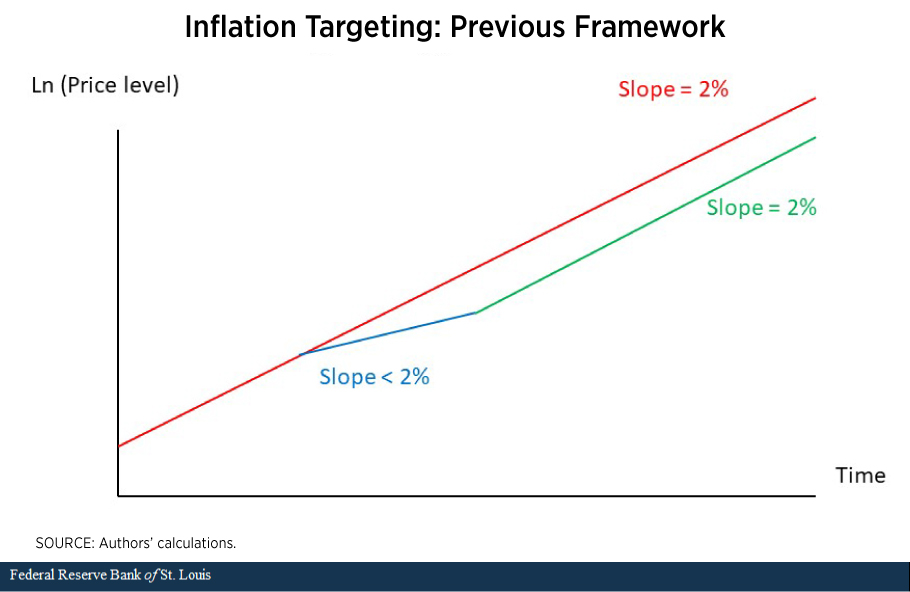

Under the previous framework, the goal of policy was to achieve the 2% inflation goal “on a sustained basis.” Thus, if inflation has been running below 2%, the monetary policy goal would be to bring it back to 2%. This policy is shown visually in the first figure below.

In the figure, the red line is the path of the price level that increases at the Fed’s goal of 2% per year since the adoption of the statement in January 2012. Now suppose there is an adverse shock that drives the actual inflation rate below 2% for a period of time. This shock causes the actual price level—represented by the blue line—to fall relative to the red price level.

Under the previous framework, the FOMC would adjust policy to increase actual inflation back up to 2%. As a result, the new price level path—shown as the green line in the figure—would have the same slope as the red line: inflation increasing by 2% per year.

However, there is no explicit attempt to return to the original 2% price level path (the red line). In other words, inflation bygones are bygones—that is, there is no attempt by the FOMC to make up for past misses under the previous framework. This is demonstrated by the gap between the red and green lines.

A New Strategy to Achieve 2% Average Inflation

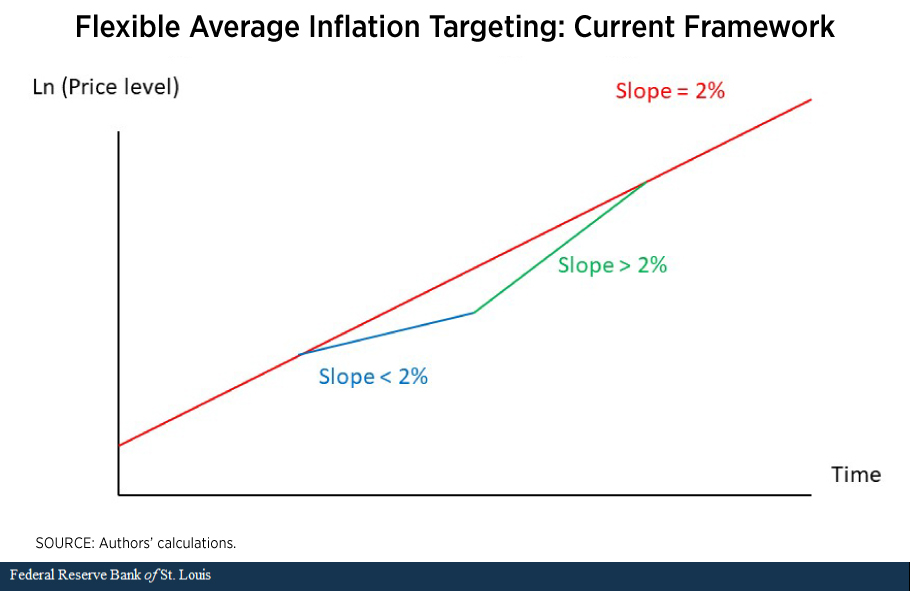

The new strategy adopted by the Fed disavows the bygones-be-bygones strategy. Specifically, as highlighted above, the new statement says that in order to achieve the 2% inflation goal, “appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

The second figure illustrates how the new inflation targeting approach would work. In the new framework, the FOMC intentionally pursues a policy to get the price level—shown as the green line in the second figure—back on the original path (the red line). In this sense, the new approach is similar to temporary price level targeting.

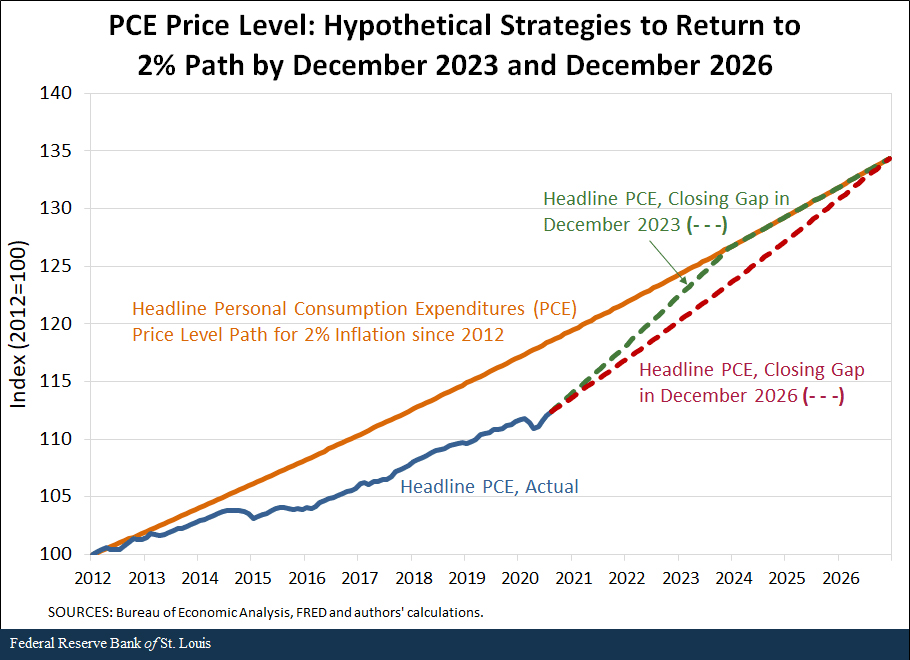

The third figure below illustrates how this might work in practice. It plots the actual personal consumption expenditures (PCE) price level (the solid blue line) and the 2% price level path since January 2012 (the solid orange line). The figure adds two hypothetical strategies to return the actual level of the PCE price index to the 2% path.

The first hypothetical strategy, represented by the dashed green line, returns the price level to the 2% path by December 2023. We chose this date because it is the last year of the three-year-ahead projections in the FOMC’s Summary of Economic Projections. The second hypothetical strategy, represented by the dashed red line, returns the PCE price level to the 2% path three years later, in December 2026.

Returning to the 2% Path

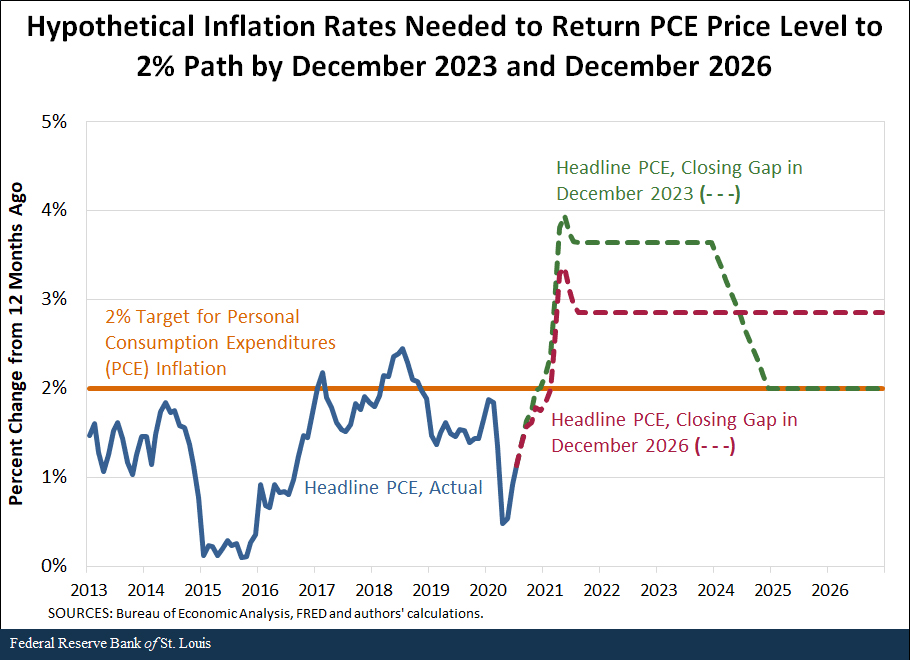

As the second figure above suggested, making up for past misses means running a higher rate of inflation to return to the 2% path. How much higher would inflation need to be?

The fourth figure below shows that returning to the 2% path from September 2020 to December 2023 (the first hypothetical strategy) results in an inflation rate that averages 3.6%. However, the inflation rate does not return to the 2% goal until December 2024 since inflation is measured on a 12-month basis. Under the second hypothetical strategy, inflation averages 2.9% per year from September 2020 to December 2026. For the reason noted above, the inflation rate does not return to 2% until a year later, December 2027 (not shown in the chart).

[NOTE: These are hypothetical scenarios and should not be interpreted as the likely outcome over the near term. Indeed, the September Summary of Economic Projections shows that the median FOMC participant believes appropriate policy will achieve inflation below 2% for most of the next three years.]

There are two key points to emphasize about the hypothetical inflation overshoot in the fourth figure. First, the magnitude and extent of the inflation overshoot depends on the convergence date chosen in the third figure. A shorter convergence date implies a higher inflation overshoot in the interim, while a later convergence date implies a smaller inflation overshoot.

Second, a strict linear convergence to the 2% path creates end-point problems. That is, inflation is well above the 2% goal when the price level converges to the 2% price level path. To keep the price level on the 2% path after convergence would thus require a contractionary monetary policy. This could be a significant issue if the economy was in a recession or was slowing.

One option to get around this problem is for an even slower convergence—perhaps in a nonlinear fashion—to the price path, whereby the actual inflation rate is 2% by the time the price level converges to the 2% path. However, as demonstrated in the second figure, the slower convergence would imply that returning to the price level path would occur well after December 2026—how long after would depend on the approach chosen.

Other Challenges to the New Approach

The FOMC has said that it intends to explicitly anchor longer-term inflation expectations at 2% to foster price stability. The rationale is that inflation expectations appear to be important in determining actual inflation outcomes.

At this point, it might be useful to emphasize that the FOMC is targeting longer-run inflation expectations rather than shorter-run inflation expectations. Shorter-run inflation expectations that rise above 2% because of adverse shocks would be less of a concern as long as longer-term inflation expectations remain anchored at 2%. But with inflation having run persistently less than 2% since 2012, the appropriate policy going forward will seek to achieve inflation “moderately above 2 percent for some time.”

The FOMC believes that this approach will provide two benefits: It will reinforce the FOMC’s guidance that 2% inflation is not a ceiling, and it will help pin down longer-run inflation expectations at 2%. The FOMC’s intent to boost inflation temporarily above 2% could increase short-term inflation expectations, but that would be less of a concern to policymakers.

This approach raises several questions. First, how high of an inflation overshoot will the FOMC accept? Second, how long will it tolerate inflation above the 2% goal? Third, suppose the Fed succeeds in raising inflation above 2%, but it remains there longer than desired. Will the FOMC then target, say, below 2% inflation “for some time?” Because the new statement does not answer these important questions, the FOMC may face a significant communications challenge in the future.

Another potential challenge of running inflation above the 2% target for a period of time is that it may begin to lift longer-term inflation expectations. Since the FOMC believes that “well-anchored” inflation expectations at 2% are crucial for achieving price stability, this would require tighter monetary policy to reduce longer-term inflation expectations. But what if employment or financial stability concerns do not support tighter policy?

Finally, there is an implementation challenge. Can the FOMC reliably increase inflation using its existing tool kit? It hasn’t since January 2012. The Bank of Japan’s experience for the past decade or more suggest that achieving its inflation target is an exceptionally difficult endeavor. The FOMC has, for now, ruled out a negative interest rate policy and a yield curve control approach. Instead, the committee has emphasized that it will continue to employ variants of the same policies it has pursued since 2008: forward guidance and balance sheet policies. Over the next few years, the FOMC will find out whether these two policy tools are enough to implement this new approach successfully.

Notes and References

- See Powell’s Aug. 27 speech and Clarida’s Aug. 31 speech.

Additional Resources

- On the Economy: Key Elements of the Fed’s New Monetary Policy Strategy

- Economic Synopses: Gauging the Evolution of Monetary Policy Communication Before and After the Financial Crisis

- Regional Economist: Same Target, Different Economies: A Cross-Country Analysis of Inflation

Citation

Kevin L. Kliesen and Kathryn Bokun, ldquoChallenges to the Fed’s New Monetary Policy Strategy,rdquo St. Louis Fed On the Economy, Oct. 22, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions