How Has the COVID-19 Recession Affected U.S. Labor across Occupations and Industries?

Amid the COVID-19 recession, aggregate labor market activity has sharply decreased in the U.S. The unemployment rate increased from 3.5% to 14.7% from February to April, respectively, and decreased since then to 7.9% in September. However, labor market outcomes have significantly differentiated across the economy. Both employment levels and working hours of the employed have changed heterogeneously across occupations and industries. In this post, we investigate these differences.

Reduced Employment Levels

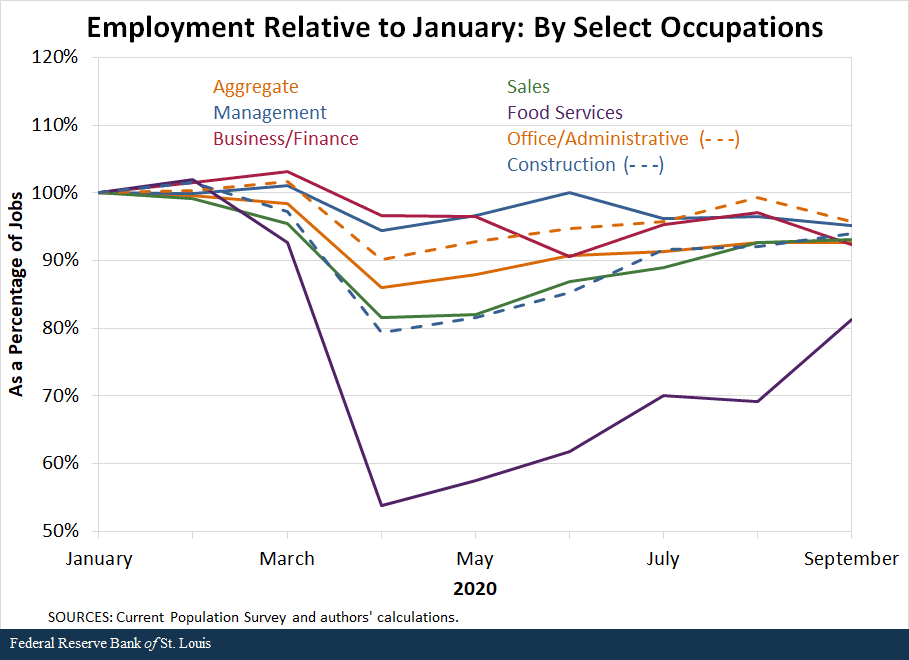

First, using the Current Population Survey data, we calculated the total number of workers in each occupation for each month. In the figure below, we plotted employment levels of select occupations from January to September 2020, relative to their own levels in January 2020.

Aggregate employment as a percentage of its January level sharply decreased from 98.4% in March to 86.1% in April. From April to September, employment steadily increased to 92.6% of its January level.

While these trends were generally consistent across occupations, the magnitude of change varied significantly. Management, business and finance, and office and administrative occupations experienced less drastic decreases, while employment in sales, construction, and especially food services occupations faced the brunt of COVID-19’s initial impact. While business and finance occupations experienced the least aggressive initial shocks, employment in these occupations uniquely decreased between April and September.

Reduced Working Hours

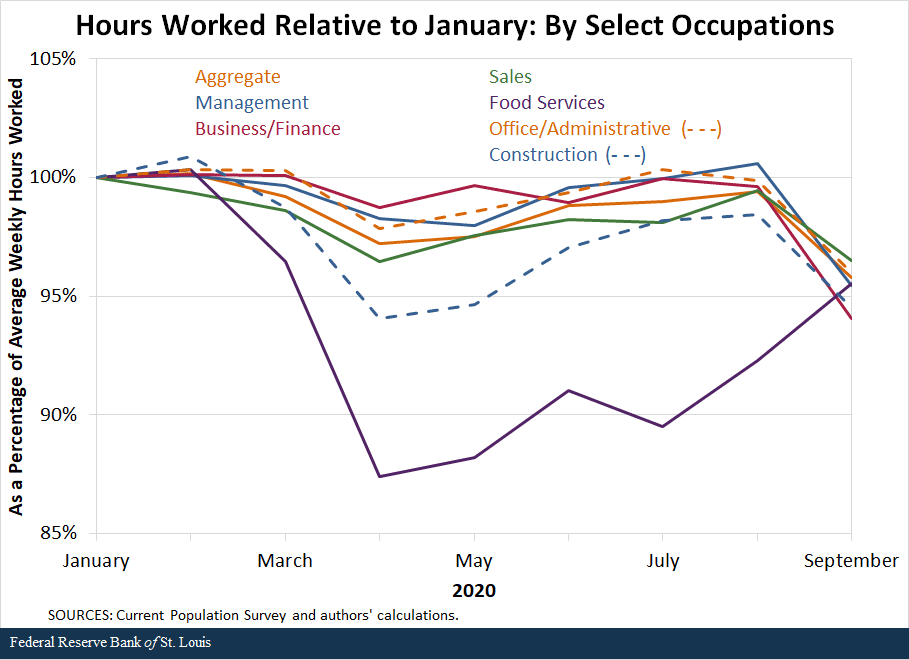

The most significant reductions in labor market activity have been through drops in employment, but even employed workers have spent less time working since January. The next figure shows that, in the aggregate, the average weekly hours worked of the employed decreased at the onset of the pandemic, before steadily increasing back to 99.4% of the January level by August.

Unlike employment levels, however, the average weekly working hours of the employed experienced another sharp decrease from August to September to a year low of 95.7% of January levels. Those working in management, business and finance, and office and administrative occupations experienced only mild initial drops in the working hours, while those in sales, construction, and especially food services occupations saw more severe initial drops in their working hours. Workers in business and finance occupations experienced the largest drop in working hours between August and September, while food service workers continued to increase their working hours between these months.

Differences by Industries

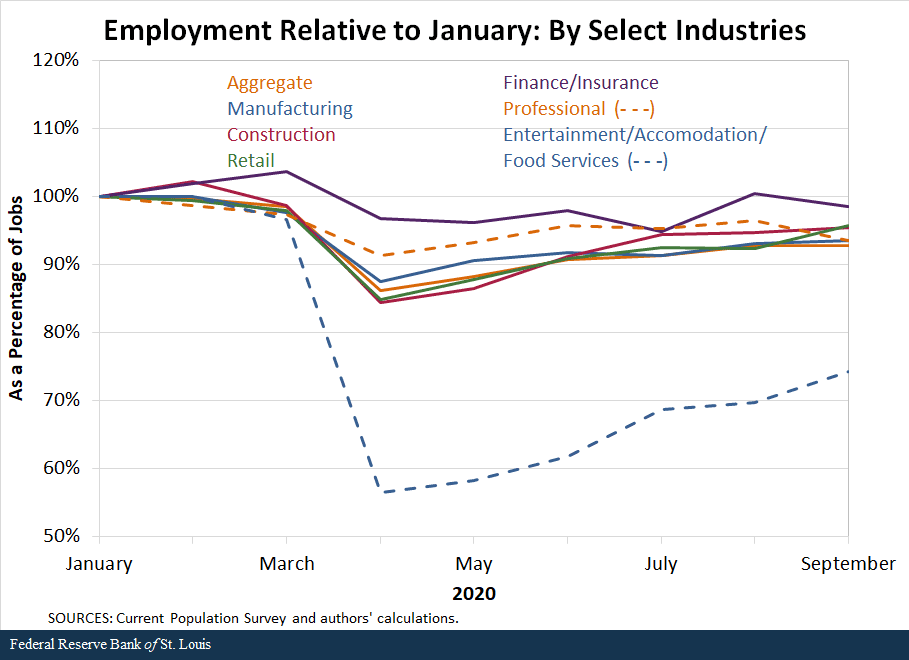

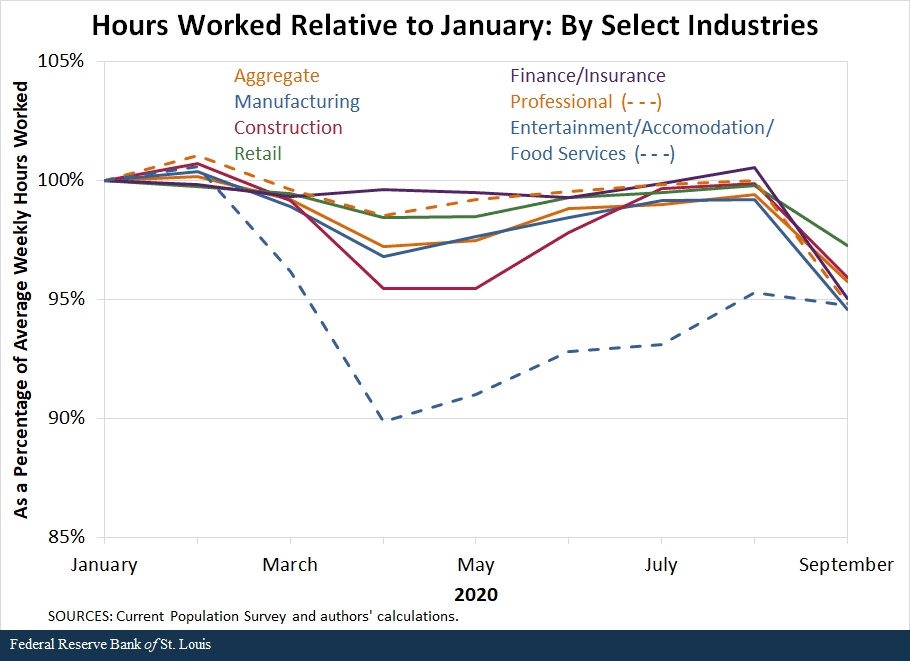

Workers were also disproportionately affected based on industry. The two figures below plot the results from the two previous exercises when workers are split by industry rather than occupation.Occupation describes the type of work done by the employee, while industry describes the employer’s business activity. For example, bricklayers and lawyers employed by a general contractor work in the construction industry, but their occupations are different—construction and legal, respectively.

Specifically, we investigated workers in select industries:

- Manufacturing

- Construction

- Retail

- Finance and insurance

- Professional

- Entertainment, accommodation and food services

Notably, workers in the entertainment, accommodation and food services industry faced significantly larger initial decreases in employment than other workers and only slightly closed this gap in the following months.

Employment levels in the finance and insurance industry remained largely unaffected, but the number of those working reduced hours increased significantly between August and September. The manufacturing, construction, retail, and professional industries all showed similar trends to the aggregate, both in employment and hours worked.

The COVID-19 recession had strong negative initial effects on aggregate labor market activity. Workers across the entire economy have experienced these negative effects, but the magnitude of these outcomes has varied significantly across occupations and industries. Employment levels continue to steadily increase back to pre-pandemic values, but working hours decreased sharply between August and September. This suggests that those returning to work may be doing so with reduced hours, or those who remained full-time workers at the onset of COVID-19 have recently transitioned to part-time work.CPS considers working less than 35 hours per week to be part-time work.

Notes and References

1 Occupation describes the type of work done by the employee, while industry describes the employer’s business activity. For example, bricklayers and lawyers employed by a general contractor work in the construction industry, but their occupations are different—construction and legal, respectively.

2 CPS considers working less than 35 hours per week to be part-time work.

Additional Resources

Citation

Serdar Birinci and Aaron Amburgey, ldquoHow Has the COVID-19 Recession Affected U.S. Labor across Occupations and Industries?,rdquo St. Louis Fed On the Economy, Nov. 8, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions