How Do Women-Led Firms Differ from Those Led by Men?

Despite women’s growing role in the workforce, the share of firms led by women CEOs was relatively stable from 2000 to 2014, a recent Regional Economist article shows. However, the share of new firms with women CEOs climbed in the same period.

St. Louis Fed Economist Fernando Leibovici and Research Associate Matthew Famiglietti investigated the role played by women in leading U.S. firms using a sample from the National Establishment Time-Series database collected by Dun & Bradstreet, which contains detailed information on firms in the U.S. over recent decades.

The authors found that female CEOs tended to lead smaller and younger firms and that women tended to lead firms with similar credit ratings as their male-led counterparts. The research also showed that women were more likely to lead nonprofits and proprietorships than men were, while male-led firms were more likely to be partnerships, corporations and government contractors.

An Increase in Women-Led Firms

Leibovici and Famiglietti first examined the extent to which the prevalence of women-led firms has increased over time. They found that the share of all firms with a female CEO was very stable from 2000 to 2014, with the percentage of women-led firms rising only gradually from 17.6% to 18.8%.

These findings contrast markedly with increased female labor force participation in the postwar era, the authors pointed out. “While women are becoming increasingly integrated into the labor market, it seems that much progress remains to be done to increase female participation as business leaders and top executives,” the article said.

During the same period, the share of women-led firms across new firms increased at a faster rate—from 19.7% in 2000 to 24.1% in 2014. “Despite the significant change in the share of new firms led by women, the small portion of new firms across all firms implies that the share of women-led firms among existing firms had increased very slowly over this time period,” the authors wrote.

Women-Led Firms Differ from Male-Led Counterparts

The research also looked at how firms led by female CEOs compared with their male-led counterparts in terms of size, credit rating and the form of organization.

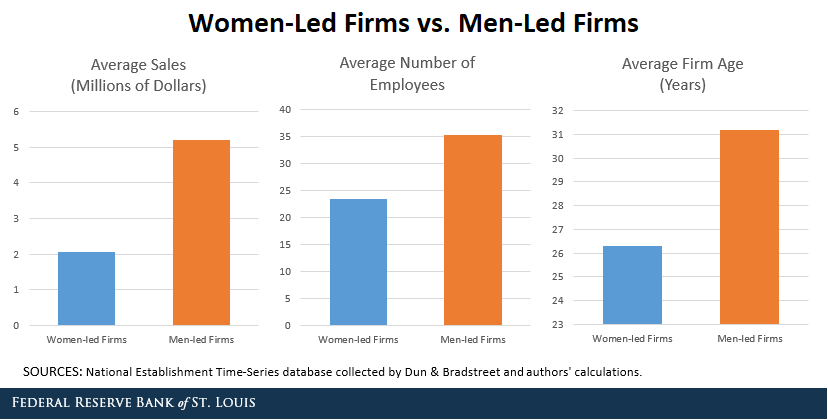

Firm Size

Compared with firms led by male CEOs, women-led firms had less than half the sales, on average, and about two-thirds of the number of workers, Leibovici and Famiglietti found. “Note that firms led by male CEOs are also older than those with female CEOs, which may account for part of the size difference,” the article said.

Credit Ratings

Leibovici and Famiglietti also found that the creditworthiness of the firm did not differ materially between firms led by women and firms led by men. On average, women-led firms had a slightly higher Paydex credit score and a slightly lower credit appraisal rating than male-led firms; however, the differences were minor, they wrote.

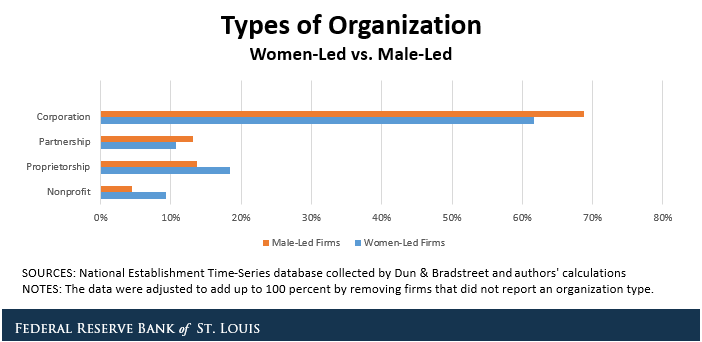

Firm Type

The article also examined the relationship between gender leadership and the composition of firms across:

- Public versus private

- Types of organization (i.e., nonprofits, proprietorships, partnerships and corporations)

- Type of vendor (i.e., government contractor)

They found that 0.05% of firms with female CEOs were public firms, compared with 0.25% of firms with male CEOs, and they found that male CEOs were more likely to work for firms that are government contractors.

Leibovici and Famiglietti also found that female CEOs were more likely to work for nonprofits and proprietorships than their male counterparts, while the latter were more likely to work for partnerships and corporations.

Conclusion

The research showed that women are significantly less likely to lead U.S. businesses than men and that this share has remained surprisingly unchanged over the period 2000-14. Moreover, conditional on leading a business, women are likely to be CEOs of smaller and younger firms, the article said. Yet, the creditworthiness of female-led firms is on par with that of their male-led counterparts.

“These findings suggest that more work needs to be done to integrate women into the labor force,” the authors wrote. “In particular, the findings suggest that despite the significant increase in female labor force participation in the postwar era, this does not appear to have led to greater participation of women in the highest executive position at the organizations where they work.”

While these findings describe salient differences between firms led by male and female CEOs, they do not explain the causes behind these features, Leibovici and Famiglietti point out, and further research needs to be conducted.

Additional Resources

- On the Economy: Gender and the Risk of Unemployment

- On the Economy: Married Men Outearn Single Men (and Women as a Whole)

- Regional Economist: Startups Create Many Jobs, but They Often Don't Last

Citation

ldquoHow Do Women-Led Firms Differ from Those Led by Men?,rdquo St. Louis Fed On the Economy, June 13, 2019.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions