Startups Create Many Jobs, but They Often Don't Last

Millions of jobs have been created since the last recession ended. From 2011 to 2014 alone, the U.S. economy added approximately 2.5 million jobs per year. Much of this job growth has come from the formation of new businesses (i.e., startups) and their initial growth.1

When many people hear about startups, they may think just about the tech startups in places like Silicon Valley. However, startups occur in all industries and in many places around the country. Granted, the startup rate may be higher in industries with low barriers to entry (e.g., retail), and the rate may be lower in industries with high barriers to entry (e.g., capital-intensive industries such as manufacturing).

In this article, we look closely at how firms of different ages contributed to the net growth in jobs between 2011 and 2014. We started in 2011 since this is the year with solid aggregate employment growth after the recession ended, and we ended in 2014 since it is the latest year available in the data we used.

We show what happened on the national level and within the four largest metropolitan statistical areas (MSAs) in the Eighth District: St. Louis; Little Rock, Ark.; Louisville, Ky.; and Memphis, Tenn.

For this analysis, we used data from the Business Dynamics Statistics collected by the U.S. Census Bureau. This data set contains annual aggregate statistics describing establishment openings and closings, firm startups, and job creation and destruction by firm age and metropolitan area, among other characteristics.2 The data include establishments with paid employees and cover most of the nonfarm private sector. The data provide a snapshot of firms and their employees on March 12 of each year.

The National Scene

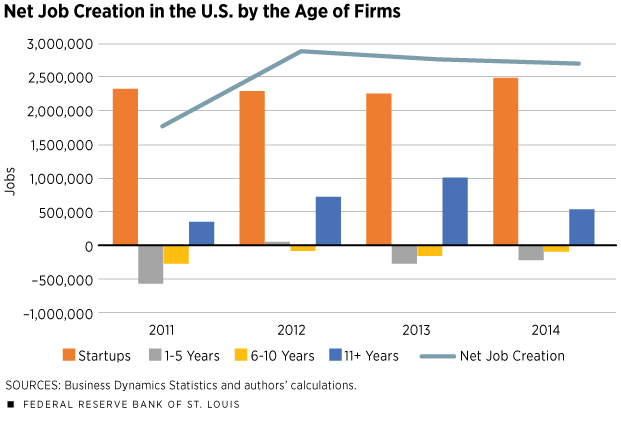

The figure shows total net job creation in the U.S. from 2011 to 2014. The line shows the total net job creation across all firms, while the bars disaggregate job creation based on the age of the firm.

A very important pattern emerges from the figure. Business startups, that is, firms that are less than a year old, account for most of the net job creation. Apart from startups, the only other firms with a positive contribution to job creation are very mature firms, those with 11 or more years in operation.

Although startups make a very large contribution to net job creation, they account for only 2 percent of total employment in the U.S. economy. Moreover, a business startup in any given year will join the 1 to 5 year cohort the following year if it remains in business. The figure shows that net job creation for that group is very small and in many cases negative. This small contribution is due to the high probability of exit that young firms face. Successful young firms will continue to add more jobs on net, but about half of these firms will fail and close, resulting in considerable net job losses.

On balance, this up-or-out process leads to low levels of net job creation after the initial year for the firm. Finally, by the time firms are 11 years old, they have sorted into two groups: subsistence entrepreneurs (that is, “mom and pop” shops) that are unlikely to hire additional workers and high-growth firms that continue to grow and hire. Regardless of the type, the firms with 11 or more years in operation are, on average, composed of more successful firms, and since fewer of them exit, their contribution to net job creation tends to be positive.3

Net Job Creation in the Eighth District

Looking at the Eighth District, the table summarizes net job creation dynamics by firm age for the four largest metropolitan areas (and, for comparison purposes, the U.S. as a whole). In general, startups account for a slightly smaller share of total employment in the District than they do for the nation overall.

There are some important differences in the contribution to net job creation by startups during the recovery in the four MSAs.

The case of St. Louis is similar to the national average, with startups accounting for about 1.6 percent of total employment but 83 percent of net job creation.

In Louisville, startups comprise a slightly greater share of total employment than they do in St. Louis, but older firms account for 45 percent of net job creation compared with the U.S. average of 24 percent. Similar to the situation in St. Louis, firms in Louisville aged 1 to 10 years reported net job losses over the economic recovery.

In Little Rock, 2 percent of employment is accounted for by startups, which is the highest among the four major MSAs in the District. Startups accounted for 22,261 new jobs, on net, which is about four times the net job growth in the region. The contribution to net job creation of firms in other age groups was negative, on net.

Memphis shows a pattern of net job creation that is similar to that in Little Rock. Startups added 30,633 jobs, essentially all the net job growth during this period.

Net Job Creation in the Largest Metro Areas of the Eighth District

| Contribution to Net Job Growth | ||||||

| Startup Employment Share | Net Job Growth 2011-14 | Startups | 1 to 5 Years | 6 to 10 Years | 11+ Years | |

| U.S. | 2.0% | 10,173,430 | 9,271,799 | -1,058,923 | -519,623 | 2,480,177 |

| St. Louis | 1.6% | 92,533 | 76,846 | -10,762 | -4,800 | 31,249 |

| Louisville | 1.7% | 52,092 | 37,465 | -4,796 | -4,193 | 23,616 |

| Little Rock | 2.0% | 5,459 | 22,261 | -5,317 | -2,175 | -9,310 |

| Memphis | 1.4% | 26,634 | 30,633 | -770 | -3,590 | 361 |

SOURCES: Business Dynamics Statistics and authors' calculations.

Summary

Despite the important role startups play in job growth, the importance of mature firms should not be understated. An important difference between young and old firms is the wage they pay. Older firms pay, on average, a much higher wage than younger firms. This is because a firm’s success is a function of productivity: Output per worker at surviving older firms is higher and, therefore, workers are paid a higher wage.

Thus, while startups are very dynamic and have an important role in net job creation, in terms of total employment and earnings they tend to have a modest impact. Only the few firms that survive to the 11+ year age group have a lasting impact on employment.

Maximiliano Dvorkin is an economist and Charles Gascon is a regional economist, both at the Federal Reserve Bank of St. Louis. For more on Dvorkin’s work, see https://research.stlouisfed.org/econ/dvorkin. For more on Gascon’s work, see https://research.stlouisfed.org/econ/gascon. Research assistance was provided by Evan Karson and Hannah Shell, both senior research associates at the Bank.

Endnotes

- See, for example, Haltiwanger, Jarmin and Miranda. [back to text]

- The data can be accessed at www.census.gov/ces/dataproducts/bds/. [back to text]

- A nice summary of this process is described in Decker et al. [back to text]

References

Decker, Ryan A.; Haltiwanger, John C.; Jarmin, Ron S.; and Miranda, Javier. The Role of Entrepreneurship in U.S. Job Creation and Economic Dynamism. Journal of Economic Perspectives, Summer 2014, Vol. 28, No. 3, pp. 3-24.

Haltiwanger, John C.; Jarmin, Ron S.; and Miranda, Javier. Who Creates Jobs? Small versus Large versus Young. The Review of Economics and Statistics, May 2013, Vol. 95, No. 2, pp. 347-61.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us