Gender and the Risk of Unemployment

Researchers have documented that women earn less than male peers who work in the same job despite similar education and experience—a phenomenon known as the gender wage gap. A recent article in the Regional Economist explored whether a similar gap existed between men and women when it comes to the risk of being unemployed.

Economist and Research Officer Guillaume Vandenbroucke and Senior Research Associate Heting Zhu examined the unemployment rate between men and women over the past 70 years.

The Gender Unemployment Gap

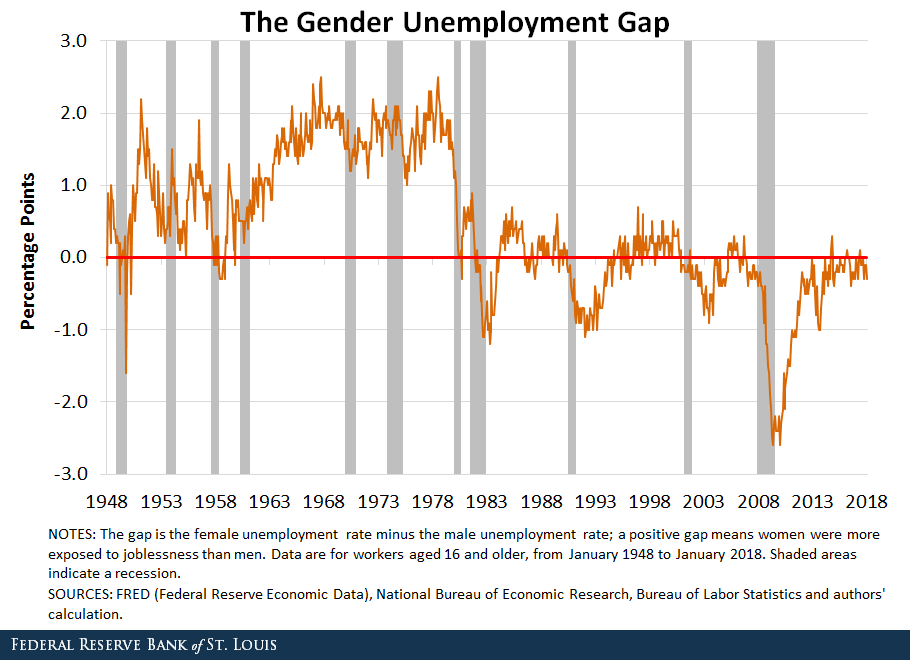

As the figure below shows, the gender unemployment gap tended to be positive before the 1980s, the authors noted, adding that it was arguably large during the 1960s and 1970s.

“This means that for a long period of time, the unemployment rate of women was above that of men, i.e., women faced higher unemployment risk than men,” the authors wrote.

This gap shrank during the 1980s until the last recession: It seemed to hover around zero, suggesting that both genders faced a similar risk of joblessness.

This decline in the gap was particularly clear during the Great Recession (December 2007-June 2009).

In June 2007, the unemployment rate was 4.7 percent for men and 4.4 percent for women, which meant a gap of –0.3 percentage points. By January 2010, the unemployment rate for men rose to 11 percent, while it only increased to 8.4 percent for women, causing a gap of–2.6 percentage points, according to the authors.

“The decline of the gender gap in the unemployment rate indicates that women appear to be less exposed to increased unemployment during recessions than men,” Vandenbroucke and Zhu noted.

Behavior during Recessions

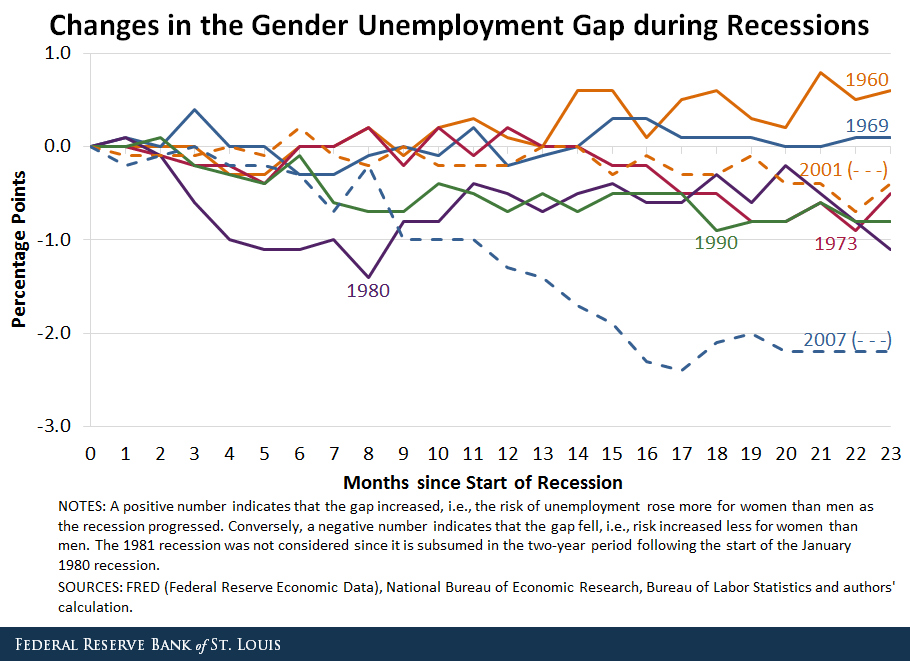

The authors then examined how the gender unemployment gap changed during recessions over the past 58 years.The authors didn’t consider the 1981 recession since it is subsumed in the two-year period following the start of the January 1980 recession. They looked at how the gap changed from the start of the recession through a period of two years, by “normalizing” the gap to zero at the beginning of each recession, as in the figure below.

For example, the unemployment gap between men and women in January 1980 was 1.1 percentage points, a figure that shrank to 0.1 percent point by May 1980. That meant the gap decreased by 1 percentage point in the fourth month after the start of the 1980 recession.

In the 1960 and 1969 recessions, the gap didn’t decrease significantly; that is, the difference in risk of unemployment for women and men stayed largely the same as the recessions progressed. This confirms the earlier observation that women faced higher joblessness risk than men, the authors noted.

For the recessions from 1973 to 2001, there was a decline in the unemployment gap of about 0.5 to 1.0 percentage point two years after the start of each recession.

The recession that began in December 2007 stands out, according to the authors. Like other recessions from 1973 to 2001, women saw a reduced risk of unemployment relative to men during the 2007 recession. However, the magnitude of the reduction was dramatically different, with the gender gap falling 2 percentage points lower two years after the start of the recession.

“In summary, these post-1970 recessions imply a lasting reduction in the unemployment risk of women relative to men, but the last recession stands out in the magnitude of this reduction,” they wrote.

Notes and References

1 The authors didn’t consider the 1981 recession since it is subsumed in the two-year period following the start of the January 1980 recession.

Additional Resources

- Regional Economist: Unequal Pink Slips? Gender and the Risk of Unemployment

- On the Economy: Identifying the Roots of the Gender Pay Gap

- On the Economy: Will the Gender Pay Gap Get Smaller?

Citation

ldquoGender and the Risk of Unemployment,rdquo St. Louis Fed On the Economy, Aug. 16, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions