New Markets Tax Credit Program: Vital to Post-Katrina Recovery

The New Markets Tax Credit (NMTC) Program, signed into law in 2000, incentivizes community development and economic growth in underresourced communities. Another vital attribute of the program was on display in the mid- to late 2000s: It can be a key source of financing after a natural disaster.

Background on the NMTC

The program leverages private investment capital by providing investors with a federal tax credit equal to 39 percent of the investment amount. The credit is claimed over a period of seven years.

The U.S. Department of the Treasury administers the program, which has allocated over $50 billion in tax credit authority to date.

The investments made through the program support commercial real estate development, residential real estate development and business operations.

Critical to Recovery in New Orleans

The NMTC program has been extremely successful with spurring community development and economic growth in underresourced communities. Look no further than New Orleans before and after Hurricane Katrina.

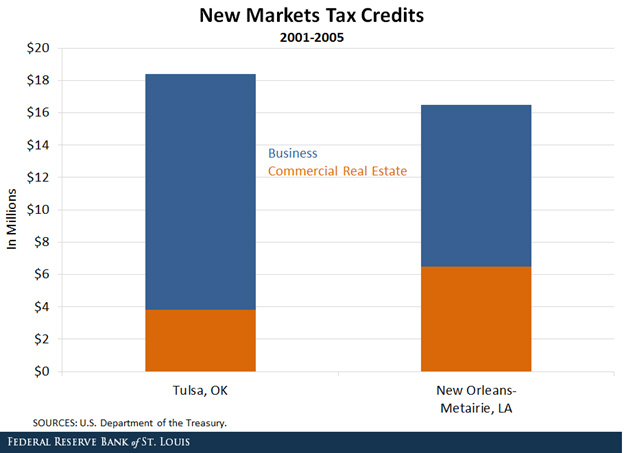

In the approximately five years prior to Katrina (2001-05), the New Orleans metropolitan statistical area (MSA) received nearly the same amount of NMTC investment as did the Tulsa, Okla., MSA, as seen in the figure below.

- Of the $16.5 million that New Orleans received, $10 million supported business operations and $6.5 million supported commercial real estate development.

- Of the $18.4 million NMTC investment received in Tulsa, $14.6 million supported business operations while $3.8 million supported commercial real estate development.

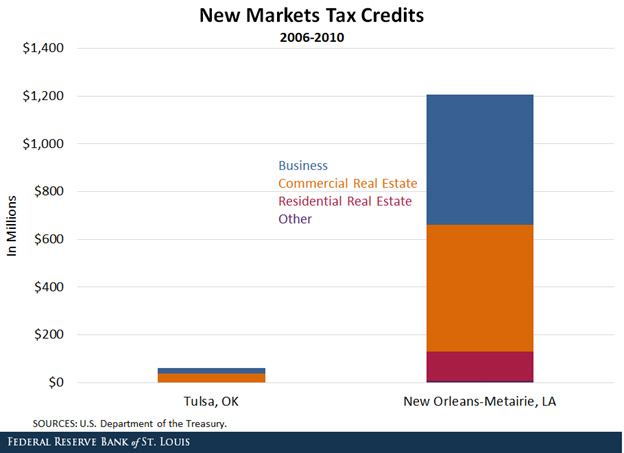

Contrast that with what took place between 2006 and 2010, and it becomes clear how the NMTC program was critical to New Orleans’ recovery.

In the five years post-Katrina, Tulsa received $60.7 million in NMTC investment, while New Orleans received $1.2 billion—nearly 20 times the amount that Tulsa received.

This investment contributed to redeveloping commercial real estate, operating businesses and, to a lesser extent, building affordable housing.

Conclusion

While the NMTC program was not designed to finance disaster-recovery efforts, the experience in New Orleans after Hurricane Katrina shows the flexibility of the program and how it may prove to be a critical source of financing when disaster strikes.

Additional Resources

- Community Development: Community Investment Explorer

- On the Economy: The Community Reinvestment Act’s History and Future

- On the Economy: Middle-Skill Workers Are in Demand

Citation

Michael Eggleston, ldquoNew Markets Tax Credit Program: Vital to Post-Katrina Recovery,rdquo St. Louis Fed On the Economy, Feb. 19, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions