Getting Ready for the Golden Years

Are Americans saving enough money for their golden years? A recent article in the Regional Economist explored the state of retirement readiness for U.S. families.

Senior Economist YiLi Chien and Senior Research Associate Paul Morris looked at whether households participated in a retirement account and how much they saved if they did. Retirement account participation and balances were obtained from the 2016 Survey of Consumer Finances (SCF), which was released in September 2017.

“Overall, our analysis indicates that many households either do not utilize or underutilize the retirement savings plans available to them,” they wrote.

Low Participation Rates

In their analysis, the authors looked at the two most common types of financial accounts designed exclusively for retirement:

- Employer-sponsored pension plans, including traditional defined-benefit plans and defined-contribution plans, such as 401(k)s

- Retirement plans independent of the workplace, including individual retirement accounts (IRAs) and Keogh accounts

According to the authors, economists have previously documented low participation rates among households and low account balances for those that do participate. In particular, a 2016 study by economist Monique Morrissey using earlier SCF data found that participation in employer-sponsored pension plans was quite low, and many families had little or no retirement savings.Morrissey, Monique. The State of American Retirement: How 401(k)s Have Failed Most American Workers. Economic Policy Institute, March 3, 2016.

Retirement Savings Options at Jobs

Chien and Morris said their findings from the latest data are generally in line with Morrissey’s results.

“The most recent SCF data show that not all employers offer pension plans to their employees and not everyone who has access chooses to participate,” they wrote.

The authors found that only 27 percent and 33 percent of households had defined-benefit and defined-contribution plans, respectively, at current jobs; 8 percent of households had both at current jobs.

For all households, about 56 percent had an employer-sponsored pension plan associated with their current or previous employment, they noted.

Retirement Savings Options outside Jobs

Chien and Morris also found that households that lacked access to an employee-sponsored pension plan weren’t more likely to use an IRA or Keogh account.

Of the households that lacked an employer-sponsored pension plan, only 20 percent used any IRAs or Keogh accounts, while that figure was 38 percent among households that had an employer-sponsored pension plan, according to the authors.

“This implies that participating in one type of retirement account increases one’s likelihood of participating in additional retirement accounts,” they wrote.

Overall, they noted, 35 percent of U.S. households did not participate in any retirement plan.

Low Balances

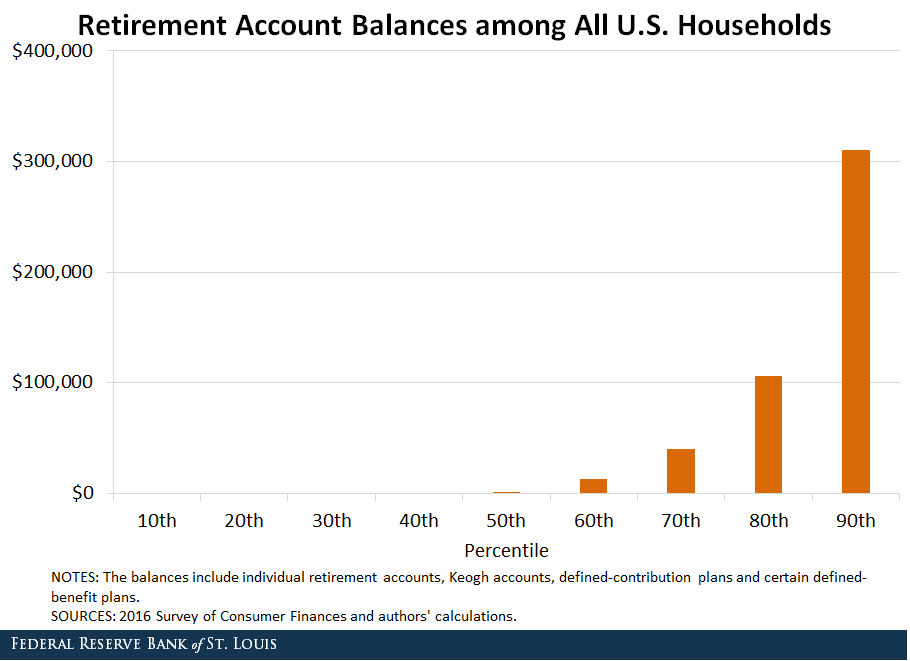

Even among those households that had retirement accounts, many had very low balances, the authors observed. The figure below plots retirement balances by percentile of all households.

The median (50th percentile) U.S. household held only $1,100 in its retirement account. Even the 70th percentile of households had only about $40,000.

Meanwhile, the 90th and 95th (not shown in the figure) percentiles held about $310,000 and $612,000, respectively, they noted.

“This implies a high degree of inequality in retirement account balances across households,” they wrote.

Adjusting for Household Age

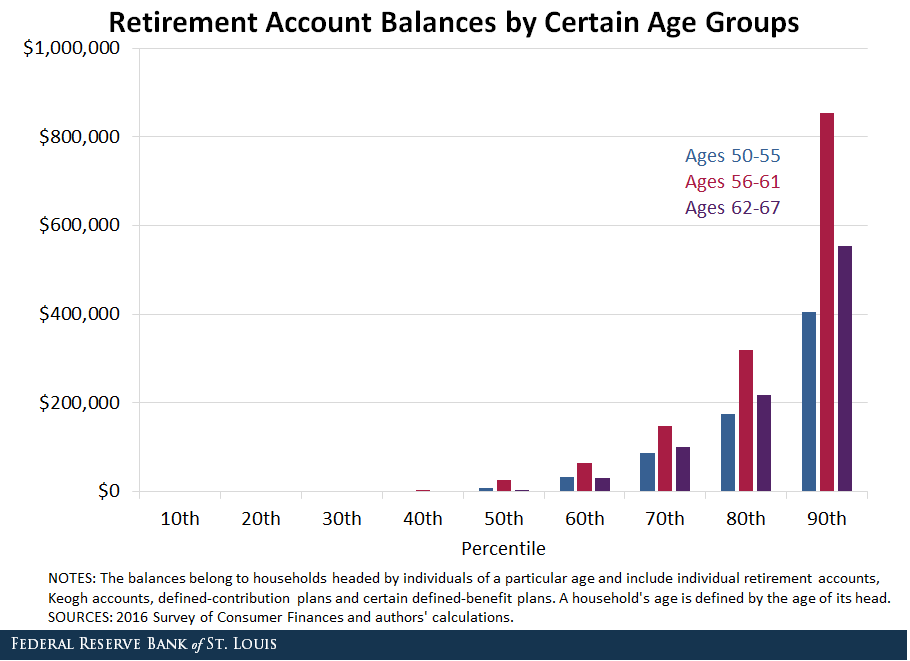

Chien and Morris noted that studying all households regardless of age could downwardly bias the results since younger households are likely to be saving for expenses, like a house, and may increase their savings as they approach retirement.

To avoid this bias, the authors looked specifically at households approaching retirement. They examined households with heads that were in three age groups:

- Ages 50 to 55

- Ages 56 to 61

- Ages 62 to 67

They described them as “pre-retirement” households.

The authors found that the participation rate improved very little for pre-retirement households. This indicates “that age plays only a small role in the decision to participate and that younger households that do not participate may not be very likely to participate even by the time retirement approaches,” they said.

Among these three age groups, households with heads who were ages 56 to 61 had the most savings, but underparticipation continued to be a problem: The median of this group held only $25,000.

That figure improved at higher percentiles, with the inequality more pronounced among the wealthiest retirement savers: The 90th percentile of households held around $855,000, while the 95th percentile (not shown in the figure) held almost $1.47 million, according to the authors’ findings.

Other Options

The authors acknowledged that the lack of retirement accounts doesn’t imply that households aren’t saving for retirement. They pointed out that households could be saving through other financial or nonfinancial assets, such as home equity.

To gauge the size of such savings, they examined the net worth of pre-retirement households (those with heads ages 50 to 67) that didn’t participate in retirement accounts versus all pre-retirement households.

Chien and Morris found the net worth of those households that weren’t participating in retirement accounts was much lower relative to that of all pre-retirement households among all percentiles.

However, such households may have other options that fall outside of the scope of this analysis, the authors said. These include:

- Social Security

- Postponing retirement or taking a part-time job after retirement

- A potential inheritance

- Financial support or housing assistance from family and friends

Still, this analysis documents that many households either do not use or underuse retirement accounts, the authors concluded.

“It could be worrisome that, for many American households, the total balances of their retirement accounts may not be sufficient to ensure a solid life in retirement,” they wrote.

Notes and References

1 Morrissey, Monique. The State of American Retirement: How 401(k)s Have Failed Most American Workers. Economic Policy Institute, March 3, 2016.

Additional Resources

- Regional Economist: Many Americans Still Lack Retirement Savings

- On the Economy: How Worried Are Americans about Retirement?

- On the Economy: How Has Stock Ownership Trended in the Past Few Decades?

Citation

ldquoGetting Ready for the Golden Years,rdquo St. Louis Fed On the Economy, April 26, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions