How Worried Are Americans about Retirement?

Americans have plenty of reasons to worry about their financial well-being in retirement. The future of social security is uncertain, the cost of health care is skyrocketing, and many Americans have retirement account balances that are too low to maintain their current living standards.

Given these factors, it is not surprising that the media frequently report on the importance of retirement saving and investing.For examples, see Henricks, Mark. “Reports of a Retirement Crisis Are Off the Mark.” CNBC, July 5, 2017; Moeller, Philip. “5 Reasons the Retirement Crisis Is Getting Worse for Average Americans.” Time, March 22, 2016; and Semuels, Alana. “This Is What Life Without Retirement Savings Looks Like.” The Atlantic, Feb. 22, 2018. Are American households worried about their retirement situations? If so, do their sentiments differ from generation to generation?

How Do Americans Feel about Retirement Savings?

A question in the 2016 Survey of Consumer Finances (SCF) provides insight into this issue. The survey question asks the respondents to rate their retirement income or expected retirement income on a scale from one to five:

- One indicates “totally inadequate.”

- Three indicates “enough to maintain living standards.”

- Five indicates “very satisfactory.”

The average rating across all U.S. households was 2.94, a number indicating that the average household felt that they have or will have enough retirement income to maintain their living standards.

Differences across Generations

It is reasonable to expect that households from different generations have varying perspectives on their retirement readiness. Millennials have grown up hearing about the importance of saving more for retirement but are still far from retirement age. Meanwhile, older generations may have a more concrete view of their financial situation as they near retirement.

To examine this, we divided households into groups based on the age of the household head:

- Millennial (age 20 to 35)

- Generation X (age 36 to 50)

- Preretirement (age 51 to 65)

- Retiree (age 66 and above)

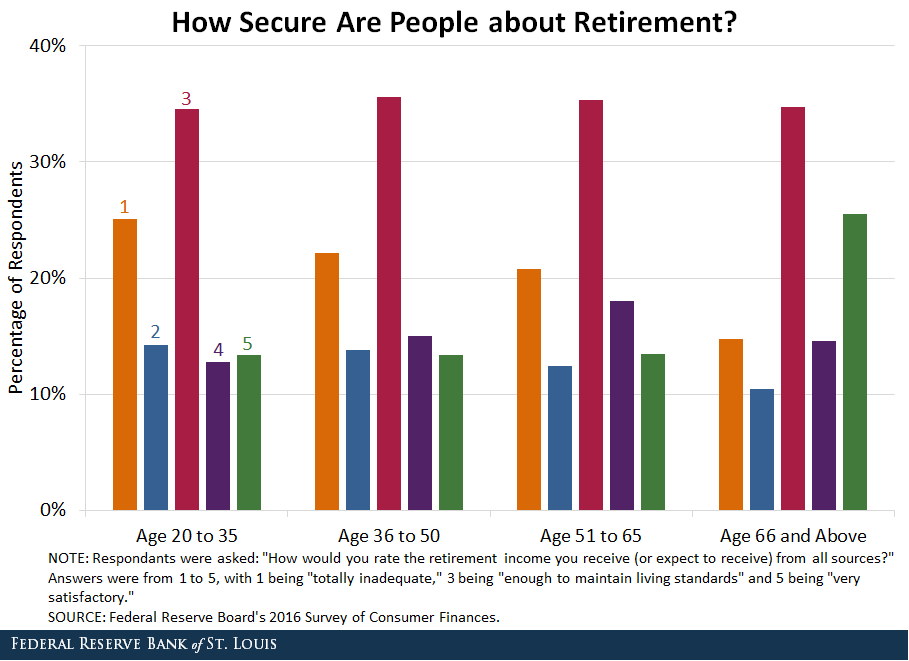

The average rating increased monotonically with age. Millennials were the most concerned with an average rating of 2.75, while retirees were generally happier about their retirement incomes, given their 3.26 average rating. The figure below plots the rating distribution across the age groups.

The share of households reporting a rating of three was roughly constant across all age cohorts at about 35 percent. In contrast, the share of one and two ratings decreased with age. Nearly 40 percent of millennials worried that their retirement incomes would be insufficient to maintain their living standards. The corresponding number among retirees was 25 percent.

In addition, retirees had a sizable share of households reporting that they were very satisfied with their retirement income at 26 percent, relative to all other age groups at roughly 13 percent.

Media Portrayal of Retirement Savings

In short, we see that many American households—especially younger generations—were concerned about their retirement preparation. The older generations were generally less worried, with those over 65 having the highest satisfactory rating.This is consistent with the recent article by Henricks, who noted that many retirees report living comfortably.

The media often report the grim outlook of retirement savings for many Americans, as many people approach retirement age with little or no retirement savings. These reports encourage the popular perception that Americans of all ages, but particularly the younger generations, should respond with concern and increase their savings rate.

Consistent with this perception, our analysis found that the younger generations generally worry more about retirement income than the older generations. This concern may be justified, as younger generations may not have the same financial resources available to them in retirement: The future of Social Security is uncertain, and employers have generally been moving away from defined-benefit pension plans in favor of plans that rely on employee contributions.

If the younger generations fail to save adequately, they may be significantly less satisfied with their retirement income than the current retirees.

Notes and References

1 For examples, see Henricks, Mark. “Reports of a Retirement Crisis Are Off the Mark.” CNBC, July 5, 2017; Moeller, Philip. “5 Reasons the Retirement Crisis Is Getting Worse for Average Americans.” Time, March 22, 2016; and Semuels, Alana. “This Is What Life Without Retirement Savings Looks Like.” The Atlantic, Feb. 22, 2018.

2 This is consistent with the recent article by Henricks, who noted that many retirees report living comfortably.

Additional Resources

- Demographics of Wealth: The Financial Returns from College across Generations: Large but Unequal

- On the Economy: When the Stock Market Rises, Who Benefits?

- On the Economy: How Did Consumer Borrowing Change After the Great Recession?

Citation

YiLi Chien and Paul Morris, ldquoHow Worried Are Americans about Retirement?,rdquo St. Louis Fed On the Economy, March 26, 2018.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions