What Types of Financial Assets Do People Hold?

In today’s information age, the monetary costs of participating in financial markets are low and uniform across the U.S. However, the use of many types of financial assets remains low, according to data from the recently released Survey of Consumer Finances. These low participation rates are at odds with modern portfolio theory, which implies that households would benefit by participating in more types of financial assets.

Financial Asset Participation in 2016

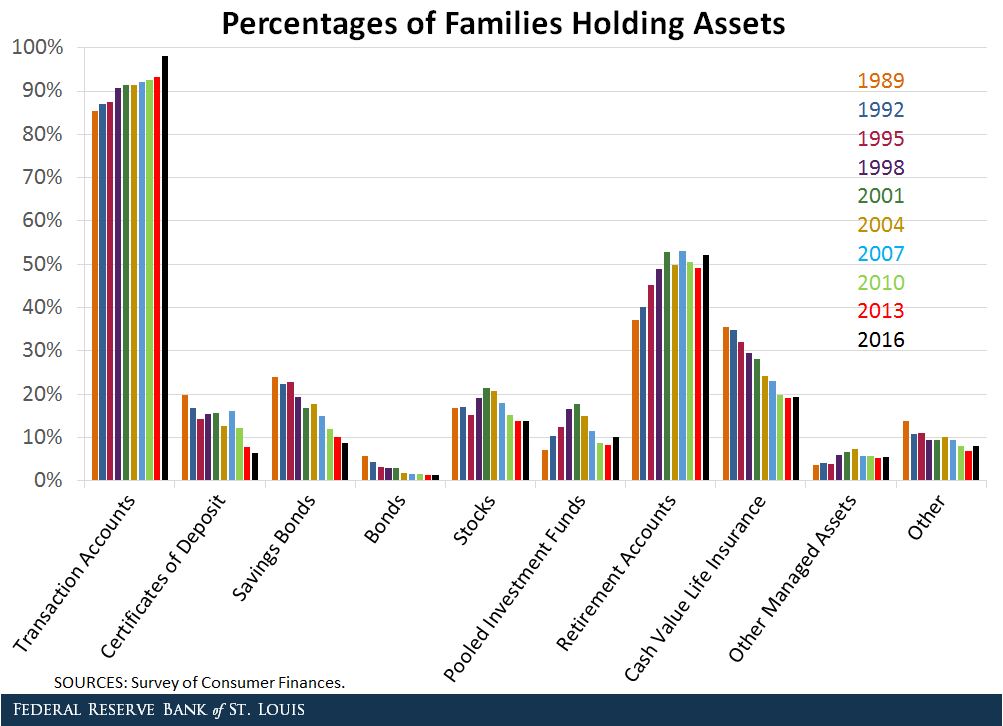

Most households in the U.S. do not use many of the financial assets available to them. Transaction accounts and retirement accounts are the only categories with high participation rates, as seen in the figure below.

According to the survey, almost all U.S. households had transaction accounts (98 percent) and around half of the households owned retirement accounts (52.1 percent).1 The participation rates for other financial assets, such as stocks and bonds, were low for purposes other than retirement.

People can hold financial assets indirectly through pooled investment funds, which include mutual funds and exchange-traded funds. The percentage of households holding pooled investment funds was only 10 percent.

Alternatively, households can hold financial assets directly:

- Regarding longer-term safe assets, only 6.5 percent held certificates of deposit and 8.6 percent held savings bonds.

- While still a relatively small share, the direct holding for stocks was slightly higher at 13.9 percent.

- For risky bonds such as corporate and mortgage-backed bonds, the participation rate has fallen to 1.2 percent.

In addition, 19.4 percent of households held cash value life insurance, which refers to any life insurance policy with a positive cash value from which the holder can withdraw funds.

Finally, the survey also indicates low participation rates for “other managed assets” and “other” at 5.5 percent and 8.1 percent, respectively.

Trends in Financial Asset Participation

Over the past three decades, the development of the financial markets did not increase households’ participation rates for financial assets other than transaction accounts, as can also be seen in the figure.

Direct participation in certificates of deposit, savings bonds, bonds and cash value life insurance have all declined, indicating that these assets have become less popular over time.

Both direct holding of stocks and indirect participation through pooled investment funds, which significantly reduce the costs of participating in many financial markets, have fluctuated while remaining relatively low.

Participation in retirement accounts increased in the '90s, from 37.1 percent in 1989 to 48.9 percent in 1998. Since 2001, the rate has been stable at around 50 percent.

Why Don’t More Households Participate?

The low participation rate for financial assets other than transaction accounts and retirement accounts indicates a high participation cost. Given today’s state of information technology, the monetary cost of participation should be low.

However, nonmonetary participation costs, such as cognitive and time costs of understanding the assets, could be quite high. This empirical evidence suggests that nonmonetary costs remain high for most households and are the major hurdle to participation even with the help of modern technology.

Notes and References

1 Detailed definitions of the financial assets discussed in this post are available in the Federal Reserve’s bulletin “Changes in U.S. Family Finances from 2013 to 2016: Evidence from the Survey of Consumer Finances.”

Additional Resources

- On the Economy: Are Rising Stock Prices Related to Income Inequality?

- On the Economy: Do Institutional Investors Chase Returns?

- On the Economy: How Might Increases in the Fed Funds Rate Impact Other Interest Rates?

Citation

ldquoWhat Types of Financial Assets Do People Hold?,rdquo St. Louis Fed On the Economy, Oct. 19, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions