Did the Dodd-Frank Act Make the Financial System Safer?

This post is part of a series titled “Supervising Our Nation’s Financial Institutions.” The series, written by Julie Stackhouse, executive vice president and officer-in-charge of supervision at the St. Louis Federal Reserve, is expected to appear at least once each month throughout 2017.

One of the outcomes of the 2008 financial crisis was recognizing the cascading effects that the severe financial stress or failure of a large institution can have on financial markets and the economy at large. A primary goal, therefore, of post-crisis financial reform was heightened supervision and regulation of those institutions whose sheer size or risk-taking posed the greatest threat to financial stability.

These reforms were primarily codified in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Under the Dodd-Frank Act, financial institutions with $50 billion or more in assets are subject to enhanced prudential regulatory standards. These standards are designed to accomplish two primary objectives:

- Improve an institution’s resiliency to both decrease its probability of failure and increase its ability to carry out the core functions of banking

- Reduce the effects of a bank’s failure or material weakness on the financial system and the economy at large

To meet these objectives, the Federal Reserve employs a number of tools to monitor institutions and reduce the risks they pose to the U.S. financial system.

Capital Stress Testing

The Fed annually assesses all bank holding companies with more than $50 billion in assets to ensure they have sufficient capital to weather economic and financial stress. This exercise, called the Comprehensive Capital Analysis and Review (CCAR), also allows the Fed to look at the impact of various financial scenarios across firms.

If the Fed determines that an institution cannot maintain minimum regulatory capital ratios under two sets of adverse economic scenarios, the institution may not make any capital distributions such as dividend payments and stock repurchases without permission.

A complementary exercise to CCAR is Dodd-Frank Act stress testing (DFAST). The DFAST exercise is conducted by the financial firm and reviewed by the Fed. It aids the Fed in assessing whether institutions have sufficient capital to absorb losses and support operations during adverse economic scenarios. This forecasting exercise applies to banks and bank holding companies with more than $10 billion in consolidated assets.

Liquidity Stress Testing

The financial crisis made it clear that a firm’s liquidity, or ability to convert assets to cash, is important during periods of financial stress. In response, the Fed launched the Comprehensive Liquidity Assessment and Review (CLAR) in 2012 for the country’s largest financial firms.

CLAR allows the Fed to assess the adequacy of the liquidity positions of the firms relative to their unique risks and to test the reliability of these firms’ approaches to managing liquidity risk.

Resolution and Recovery Plans

Banking organizations with total consolidated assets of $50 billion or more are also required to submit resolution plans to the Fed and the Federal Deposit Insurance Corp. Each plan must describe the organization’s strategy for rapid and orderly resolution in the event of material financial distress or failure.

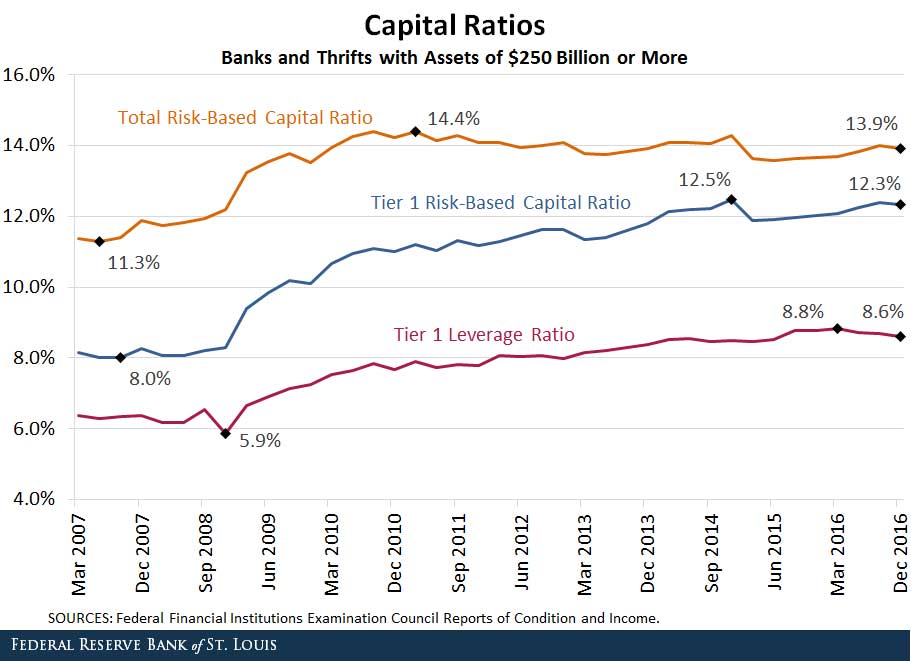

Have these tools made a difference? The answer is clearly “yes,” as shown in the figure below.

The capital ratios of the country’s largest firms (those with more than $250 billion in assets) have shown solid positive progress. In fact, one important measure of capital strength for this group of institutions, the average Tier 1 risk-based capital ratio, has increased 48.1 percent since 2007.

Some in the industry and in Washington, D.C., are calling for a re-evaluation of the Dodd-Frank Act provisions. While modifications for smaller, non-systemic firms would be welcomed by many, the damage from the financial crisis makes it sensible to continue strong expectations for the largest firms.

Follow the Series

- Why Are Banks Regulated?

- Did the Dodd-Frank Act Make the Financial System Safer?

- Bank Supervision and the Central Bank: An Integrated Mission

Additional Resources

- Federal Reserve: Large Institution Supervision Coordinating Committee

- On the Economy: The Timing of Labeling a Bank “Too Big to Fail” Matters

- On the Economy: When Banks Expand Credit, Who Actually Receives It?

Citation

Julie L Stackhouse, ldquoDid the Dodd-Frank Act Make the Financial System Safer?,rdquo St. Louis Fed On the Economy, Feb. 19, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions