Why Are Banks Regulated?

This post is the first in a series titled “Supervising Our Nation’s Financial Institutions.”

The topic of financial deregulation is once again generating news stories. It raises a foundational question: “Why is the U.S. banking system so heavily regulated?”

Banking regulation has existed in some form since the chartering of banks and its goals have evolved over time. Today, banking regulation serves four main purposes.

Financial Stability

Instability in the financial system can have material ripple effects into other parts of the domestic and international financial sectors. Supervision that is focused on financial stability (often called macro-prudential supervision) looks at trends and analyzes the likelihood for financial contagion and the possible impacts across firms that pose systemic risks.

Protection of the Federal Deposit Insurance Fund

Since Jan. 1, 1934, the Federal Deposit Insurance Corp. has insured the deposits held in U.S. banks up to a defined amount (currently $250,000 per depositor per bank). The federal government serves as a backstop to the insurance fund.

In exchange for this insurance guarantee, banks pay an insurance premium and are also subject to safety and soundness examinations by state and/or federal regulators. Oversight of individual financial institutions by banking regulators is called micro-prudential supervision.

While the insurance fund protects depositors, it does not protect shareholders of banks. When inappropriate risks are taken and prove unsuccessful, banks will fail and be liquidated.

Consumer Protection

Since the creation of the Federal Trade Commission in 1914, the federal government has had a formal obligation to protect consumers across industries. Since that time, numerous laws and regulations have been crafted by various agencies to protect bank customers and promote fair and equal access to credit.

Banks conduct financial transactions with consumers either directly (lending to consumers and taking consumer deposits) or indirectly (through financial technology on the front end, for example). Banking regulators enforce consumer protection regulations by conducting comprehensive reviews of bank lending and deposit operations and investigating consumer complaints.

Competition

A competitive banking system is a healthy banking system. Banking regulators actively monitor U.S. banking markets for competitiveness and can deny bank mergers that would negatively affect the availability and pricing of banking services.

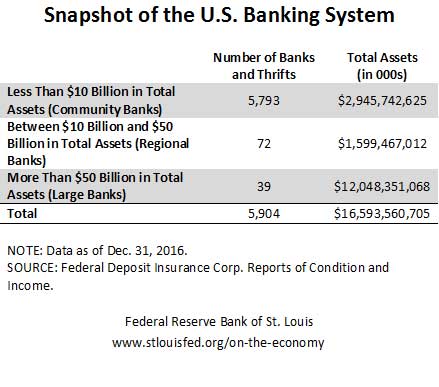

Although fewer than 40 banks account for more than 70 percent of all U.S. banking assets, as shown in the table below, there are nearly 6,000 institutions of all sizes operating in communities across the country.

While all banks are regulated, not all regulations apply to every bank. We’ll discuss some of these differences in future posts. In my next post, I’ll discuss how the banking system has changed over time—especially over the past 25 years—adding to the complexity and scope of banking regulation in the U.S.

Additional Resources

Citation

Julie L Stackhouse, ldquoWhy Are Banks Regulated?,rdquo St. Louis Fed On the Economy, Jan. 30, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions