Would Economic Nationalism Benefit the U.S.?

Economic nationalism can mean different things to different people. However, features that are usually associated with it are concerns about imports and foreign ownership of a nation’s assets. Such concerns may lead to higher barriers to trade and foreign investment. Among other factors, this issue of economic nationalism has gained traction because of rising inequality in recent decades.

According to an October paper, the average pre-tax income of the bottom 50 percent of adults in the U.S. has remained at about $16,000 per adult (in constant 2014 dollars) since 1980. When looking at the entire distribution, however, average national income per adult grew by 60 percent to $64,500 in 2014.1

Therefore, in spite of relatively low unemployment rates and increasing prosperity of certain segments of the population, some imports that may be destroying U.S. manufacturing jobs are being seen with greater suspicion. In turn, this has given new life to the idea of mercantilism, which favors positive trade balance (that is, the value of exports being greater than the value of imports).

Gaining from Trade

Trade balance does not reflect a nation’s potential for gains from trade. Consider a nation that does not trade and, hence, has a trade balance of zero. When this nation opens up to trade and pays for imports with exports, the trade balance is again zero. However, its welfare is higher because of gains from specialization and trade.

Furthermore, notice that imports and exports are two sides of the same coin. When a nation specializes in certain goods to raise its exports, its resources move away from other goods that are also needed and are therefore imported. In other words, as exports expand, so must imports. This process is critical to gains from trade.

Trade Deficit Impacts on Economies

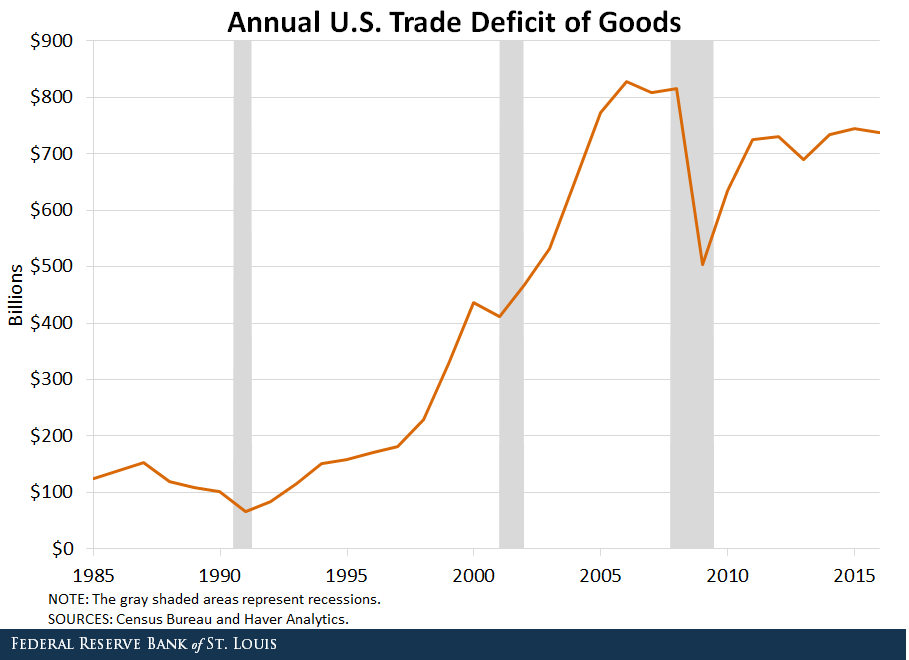

But, are trade deficits harmful for an economy? The figure below shows that the U.S. trade deficit rose every time the economy made its way out of the last three recessions.

In these contexts, a rising trade deficit was associated with greater vitality of the U.S. economy, where consumption and investment picked up as business optimism rose. Therefore, rather than attributing rising trade deficits to trade openness, we should be looking at underlying macroeconomic factors behind trade deficits.2

Trade and Inequality

Given the current state of inequality, we cannot dismiss the potential loss for U.S. labor from greater import competition, even if there are aggregate gains from trade. I will make two points about this.

First, it is debatable whether trade has been a net destroyer of U.S. jobs. A recent study shows that job gains from exports have more than offset job losses from imports in the U.S. between 1995 and 2011.3

Second, erecting trade barriers may not help reduce job losses. Technological change and automation will incentivize employers to move away from lower skilled jobs that can be easily automated.

What is called for is a better education system to improve skills to levels that are harder to automate and that yield higher productivity and wages. Sensible tax and transfer policies will also help wage growth and help reduce inequality.

Notes and References

1 Piketty, Thomas; Saez, Emmanuel; and Zucman, Gabriel. “Distributional National Accounts: Methods and Estimates for the United States.” The Quarterly Journal of Economics, October 2017.

2 Bernanke, Ben S. “The Global Saving Glut and the U.S. Current Account Deficit.” Remarks at the Sandridge Lecture, Virginia Association of Economists, March 10, 2005.

3 Feenstra, Robert C.; and Sasahara, Akira. “The ‘China Shock,’ Exports and U.S. Employment: A Global Input-Output Analysis.” Working Paper, University of California, Davis, August 2017.

Additional Resources

- On the Economy: Productivity Growth: Learn from Other Countries or Innovate Yourself?

- On the Economy: U.S. Trade Deficit Driven by Goods, Not Services

- On the Economy: Does Trading with the U.S. Make the World Smarter?

Citation

Subhayu Bandyopadhyay, ldquoWould Economic Nationalism Benefit the U.S.?,rdquo St. Louis Fed On the Economy, Dec. 18, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions