Does Trading with the U.S. Make the World Smarter?

International technology diffusion determines how fast the world’s technology frontier may grow in the future. It helps explain convergence in income per capita across countries.

Channels for Spreading Ideas

Empirical studies have found that international trade of goods and services helps spread ideas around the world.1

International trade could be a direct channel of technology diffusion if, by importing intermediate products from different exporters, the importer benefits from the technology or ideas embodied in those products.

For instance, a firm that imports a machine from a more innovative country may learn from the technology embodied in the production of such machine and may start producing with better technologies.

International trade could also be an indirect channel of technology diffusion. When countries establish bilateral trade relationships, a new form of technology diffusion arises. Through the trade network, importers can learn from new technologies developed by foreign suppliers and vice versa.

More Trade, More Ideas

Therefore, country-pairs that trade more with each other may experience more technology diffusion through both the direct and indirect channels of trade.

One way to determine the strength of the indirect channel is by looking at bilateral royalty payments, or receipts between two countries. Royalty payments represent payments made to the owner of a patent.2

When a domestic firm pays to use a foreign patent, there is diffusion of ideas since the firm is using the technology developed abroad. For that to happen, the domestic firm needs to know about it, of course, which could be facilitated through international trade relations.

The U.S.’s Role in Sharing Ideas

The U.S. is one of the most innovative countries in the world, based on its research and development (R&D) intensity (calculated as R&D expenditures as a percentage of GDP). Hence, it has the potential to be an important source of technology diffusion.

Countries that trade a lot with the U.S. may experience larger flows of ideas through both the direct and indirect channels of trade. Here I focus on how trade may facilitate flows of ideas through the indirect channel. That is, how does establishing a trading relationship with the U.S. help a country know about ideas?

Royalty Payments

When using royalties as an indicator of diffusion, we find that royalty payments received by American firms from foreign firms (i.e., royalty receipts in the U.S.) are larger than those that the U.S. pays to foreign firms to use their ideas (i.e., royalty payments in the U.S.). That is, the U.S. is a net sender of technologies to the rest of the world, for which it receives royalties.

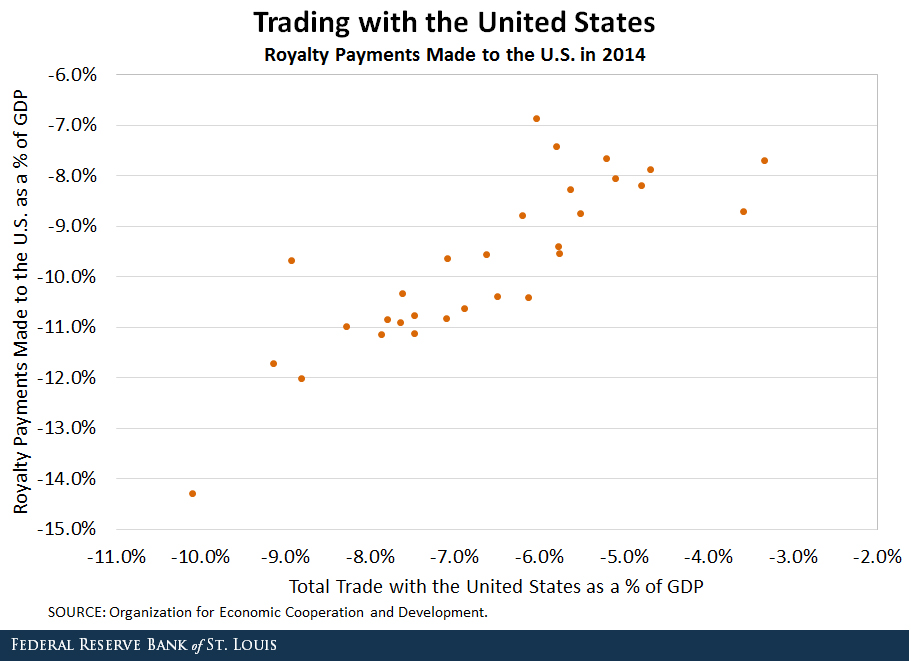

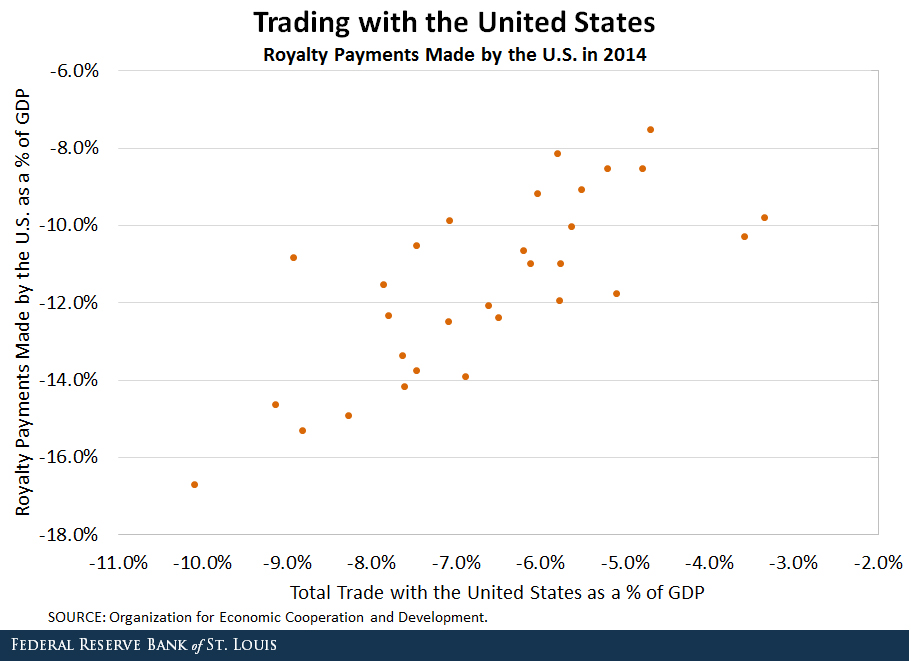

Furthermore, we find a positive relationship between how much a country trades with the U.S. and royalty payments from each country to the U.S. and royalty payments from the U.S. to each of its trading partners.

The figures below show how royalty payments from the U.S. to its trading partners (and royalty receipts by the U.S. from its trading partners) are related to the total volume of bilateral trade.

The evidence suggests that the stronger the trade relationship between the U.S. and its trading partners is, the stronger the flow of ideas between them. In turn, this suggests a stronger potential for the U.S. to diffuse technologies to other countries or receive technologies from those countries.

Notes and References

1 Other channels include multinational activity through which parent companies transfer knowledge to its affiliates in other countries, human capital or migration.

2 See Santacreu, Ana Maria. “Trading Ideas between Countries.” Federal Reserve Bank of St. Louis, On the Economy Blog, April 17, 2017. Also see Santacreu, Ana Maria. “Royalty Payments and the Incentives to Conduct Research and Development.” Federal Reserve Bank of St. Louis, FRED Blog, April 17, 2017.

Additional Resources

- On the Economy: Trading Ideas between Countries

- On the Economy: The Exports of Innovative Countries

- On the Economy: Which States Account for Our Trade Deficit with Mexico?

Citation

Ana Maria Santacreu, ldquoDoes Trading with the U.S. Make the World Smarter?,rdquo St. Louis Fed On the Economy, May 11, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions