U.S. Trade Deficit Driven by Goods, Not Services

The U.S. has a trade deficit in goods and services with the rest of the world. That is, the value of its imports exceeds the value of its exports. In 2016, the U.S. trade deficit with the rest of the world was $416.7 billion.1

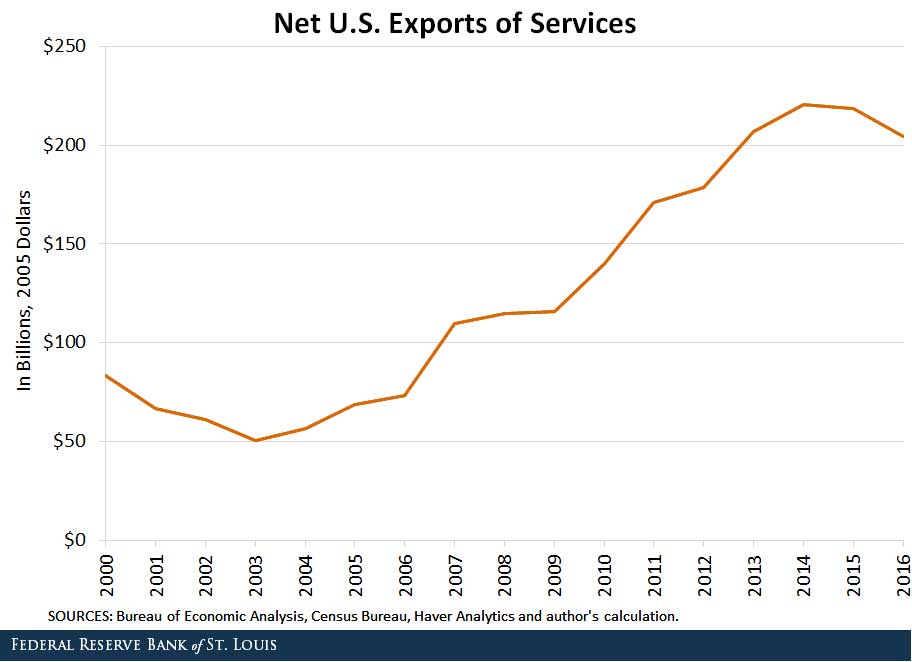

However, this deficit has been driven entirely by a trade deficit in goods. The U.S. is actually a net exporter of services and has experienced a sharp increase in the surplus of trade services since the 2000s, despite a mild decrease after 2014.

Indeed, between 2000 and 2016, the trade surplus in services in the U.S. increased by 145 percent in real terms, as seen in the figure below.

Main Contributors to the Trade Surplus in Services

The main contributor to the surplus in services has been payments for intellectual property rights, which had a surplus of $66.1 billion in 2016. These payments are mainly royalty payments that foreign companies and institutions make to use U.S. technologies.

In a previous blog post, I documented how the U.S., being one of the most innovative countries in the world, is also an important source of technology transfer to other countries. An important part of this technology transfer is reflected in payments for U.S. intellectual property from the rest of the world.2

After 2015, however, travel services became the main contributor of the surplus, surpassing the surplus of payments for intellectual property rights. A key factor of this trend has been trade in health travel services (that is, “medical tourism”), reflecting an increase of travelers coming to the U.S. in search of the high-quality services of the U.S. health system, despite its rising costs.3 In 2016, the trade surplus in travel services was $67.9 billion.

The third contributor to the trade surplus is financial services, with a surplus of $59.9 billion in 2016. The U.S., however, is a net importer of insurance services, transport, and telecommunications, computer and information services.

Summary

Despite an increase in the trade with the rest of the world, the U.S. is a net exporter of services, and it has experienced a sharp increase in the surplus of trade in services. The main contributors have been intellectual property rights and travel services. These trends have been quite consistent since the early 2000s.

Notes and References

1 All dollar amounts are expressed in U.S. dollars, constant prices 2005.

2 Santacreu, Ana Maria. “Does Trading with the U.S. Make the World Smarter?” St. Louis Fed On the Economy, May 11, 2017.

3 Chambers, Arthur. “Trends in U.S. Health Travel Services Trade.” USITC Executive Briefing on Trade, August 2015.

Additional Resources

- On the Economy: Does Trading with the U.S. Make the World Smarter?

- On the Economy: Trading Ideas between Countries

- On the Economy: Which States Account for Our Trade Deficit with Mexico?

Citation

Ana Maria Santacreu, ldquoU.S. Trade Deficit Driven by Goods, Not Services,rdquo St. Louis Fed On the Economy, June 27, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions