How Might Chinese Imports Affect House Prices?

There is considerable debate on whether the benefits of trade outweigh adverse effects on the domestic economy. For example, in a working paper with co-authors Lorenzo Caliendo and Fernando Parro, I (Maximiliano) found Chinese imports displaced around 0.8 million U.S. manufacturing jobs between 2000 and 2007.

In today’s blog post, we will look at how a large surge in Chinese imports may affect house prices. As employment in some parts of the economy falls due to trade, workers may default on mortgages or move elsewhere in search of new work, leading to an increase in the supply of houses on the local market.

Defining a Local Housing Market

We started by defining local markets as commuting zones, because economic relationships are not confined by traditional geographic boundaries (such as zip codes, counties and states). Even metropolitan statistical areas exclude rural areas, failing to adequately capture an area’s economic transactions.

Instead, commuting zones use commute-to-work data to aggregate counties into broader labor market areas. Because they are defined using labor movement between counties, the commuting zone is a better representation of economic activity on the sub-national level.

Making the Comparison

We look at two variables on the commuting zone level:

- The change in U.S. imports from China per worker over a 10-year period

- The change in the CoreLogic House Price Index, also over a 10-year period

To calculate Chinese imports per worker, we used data and methodology established by David H. Autor, David Dorn and Gordon H. Hanson, who studied the impact of Chinese imports on local labor markets.

The imports data came from the U.N. Comtrade Database and tracked the dollar amount of bilateral trade between several countries at the industry level from 1991 to 2007. We assigned a certain dollar amount to each worker in a commuting zone based on the commuting zone’s industry employment distribution from county business patterns data.

The CoreLogic index is available at the county level, and we simply weighted the county house price index by population and summed it to the commuting zone level.

Correlation between Imports and House Prices

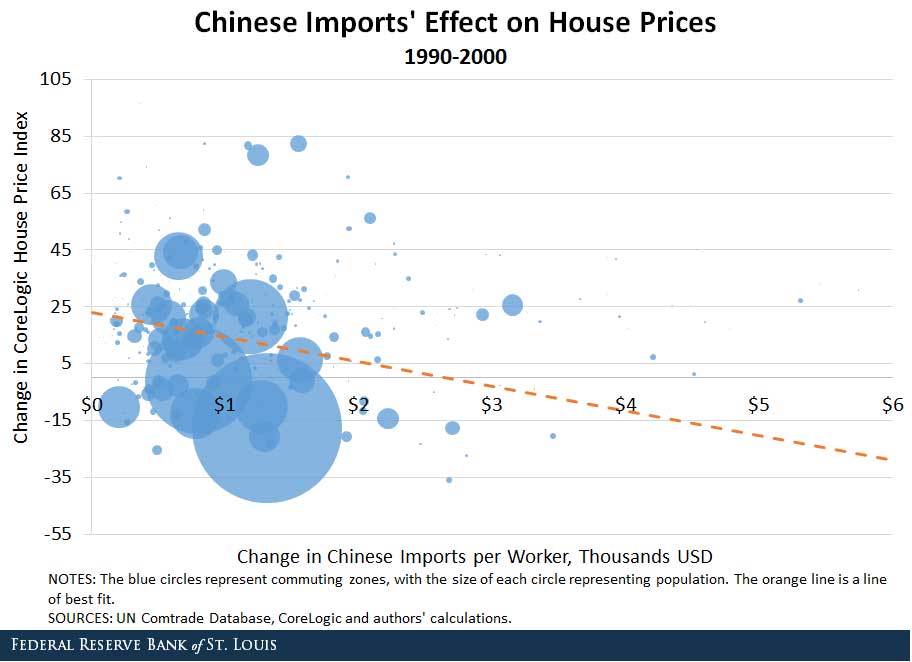

The figure below shows the change in the house price index versus the change in Chinese imports per worker from 1990 to 2000.

The orange line is a line of best fit,1 and the size of the bubbles represents the commuting zone’s population.

The orange line illustrates that an increase in imports per worker in a commuting zone is associated with a decrease, or a lower increase, in house prices. Specifically, a $1,000 increase in real imports per worker in a commuting zone over that decade is associated with an 8.67 percent decrease in house prices, also over that decade, relative to the average house price increase in the economy.

The adverse impact of Chinese imports on house prices does not necessarily mean trade is bad. Many other factors need to be taken into consideration, such as the positive effects from reduced input costs, lower prices faced by domestic consumers on some goods and increased employment in areas outside of manufacturing.

Notes and References

1 This line is calculated using a two-stage least squares regression, in which we instrument Chinese imports per worker using imports per worker from an eight-country composite.

Additional Resources

- Working Paper: Trade and Labor Market Dynamics

- On the Economy: What Is the Impact of Chinese Imports on U.S. Jobs?

- On the Economy: U.S. Trade Deficit Driven by Goods, Not Services

Citation

Maximiliano A. Dvorkin and Hannah Shell, ldquoHow Might Chinese Imports Affect House Prices?,rdquo St. Louis Fed On the Economy, Aug. 7, 2017.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions