Households Less Likely to Say Using Credit Is OK

By Juan Sanchez, Research Officer and Economist, and Helu Jiang, Technical Research Associate

In previous articles, we saw that household debt has been declining and why debt has dropped since the financial crisis. Total household debt, which peaked in 2009, stabilized at 13 percent below the previous peak in the first quarter of 2013. One of the most relevant questions regarding this trend is: Was it caused by supply or demand factors?

While credit supply factors capture the behavior of lenders (banks and other financial institutions), credit demand factors represent the willingness of households to borrow. In this blog post, we present data on households’ attitude toward credit to evaluate potential changes in credit demand.

We used data from the Survey of Consumer Finances (SCF). This survey asks households questions on credit attitudes. In particular, households are asked if they think it is generally a good or bad idea for people to buy things by borrowing or on credit. The survey also asked specifically about borrowing money:

- To cover the expenses of a vacation trip

- To cover living expenses when income is cut

- To finance the purchase of a fur coat or jewelry

- To finance the purchase of a car

- To finance educational expenses

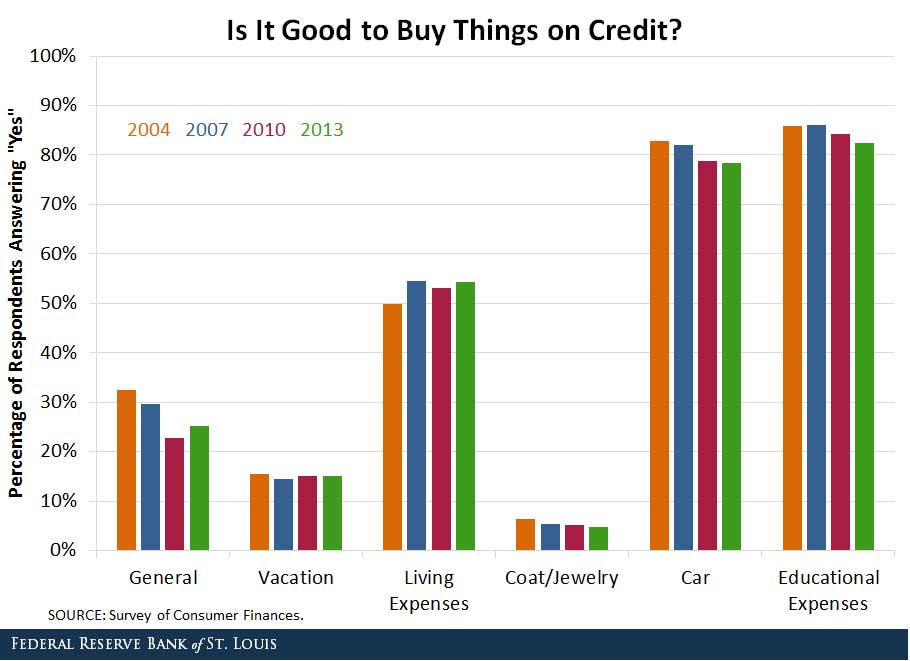

The figure below shows the percentage of individuals who answered that it is generally a good idea to buy things on credit.

In general, fewer households are responding that it is a good idea to buy things on credit. The share with positive answers decreased from 32.4 percent in 2004 to 29.7 percent in 2007 to 25.2 percent in 2013. A similar pattern is observed for answers about vacation, coat/jewelry, car and educational expense categories. The only category with an increase in the share with positive answers is “living expenses.”

Overall, the results suggest that households’ attitude toward credit has changed, signaling a reduction in credit demand. This is an important topic for further research, because the policy recommendations are very different if the reduction in household credit was caused by a reduction in the availability of credit (credit supply) or by households’ attitude toward credit.

Additional Resources

- On the Economy: Do Demographics Affect Loan Delinquency?

- On the Economy: Why Has the Share of Mortgage Debt in Default Fallen?

- On the Economy: How Credit Card Debt Default Has Evolved

Citation

ldquoHouseholds Less Likely to Say Using Credit Is OK,rdquo St. Louis Fed On the Economy, June 27, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions