Why Has the Share of Mortgage Debt in Default Fallen?

The share of mortgage debt in default has fallen significantly since the Great Recession, and this is largely due to changes in the number of households falling behind in their mortgage payments, according to a recent Economic Synopses essay.

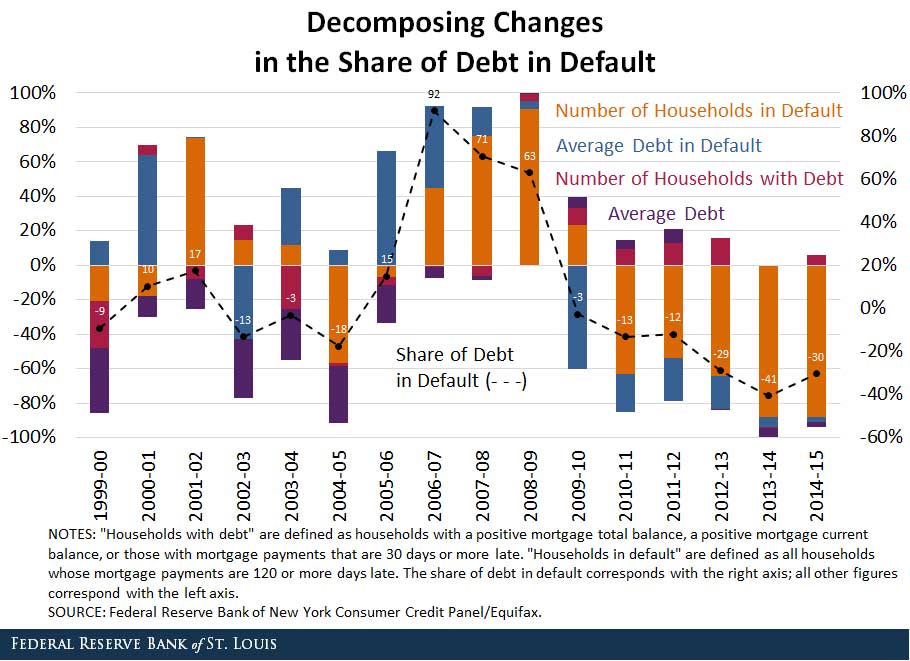

Research Officer and Economist Juan Sanchez and Technical Research Associate Helu Jiang decomposed changes in the share of debt in default into changes in four components:

- Average debt in default

- Number of households in default

- Average debt

- Number of households with debt

They computed the percentage change in the share of debt in default by adding the changes in average debt in default and number of households in default, then subtracting the changes in average debt and number of households with debt. The figure below shows the results of the decomposition by year.

Sanchez and Jiang noted three interesting findings:

Cause of Debt in Default Fluctuations

The authors explained that the share of households in default was very large when defaults were both increasing (2006-09) and decreasing (2010-15). They wrote: “The changes in the number of households in default confirm our earlier claim that the drastic decline in house prices between 2006 and 2009 caused negative home equity for more households.”

Sanchez and Jiang gave two possible reasons for this. First, a negative income shock triggered default for some households, leading to the sharp increase in mortgage debt default. Second, long delays in foreclosure proceedings gave homeowners a greater incentive to default: longer periods of “free rent.”

Increasing Debt Amounts

Sanchez and Jiang also noted that the average amount of homeowner debt from 2003 to 2007 put downward pressure on the share of debt in default. They wrote: “That is, since the average amount of debt was increasing, if the other three components had not increased, the share of debt in default would have decreased.”

Importance of Average Amount of Debt in Default

For the period 2006-08, part of the increase in the share of debt in default was actually due to an increase in the debt amounts of households in default. Declining house prices had a larger effect on households with larger amounts of debt, with more households from this group defaulting. As the authors pointed out: “Later in the recession, the importance of the average amount of debt was overtaken by the number of households in default as more and more households with similar characteristics chose to default.”

Conclusion

Sanchez and Jiang concluded that “the evolution of the share of mortgage debt in default can be accounted for mostly by changes in the number of households in default rather than changes in the overall amount of mortgage debt and the number of households with mortgages. Changes in the amount of debt in default also played a nonnegligible role, especially during the pre-crisis to early crisis periods.”

Additional Resources

- Economic Synopses: The Dynamics of Mortgage Debt in Default

- On the Economy: Not All Interest Rates May Rise after Liftoff

- On the Economy: Why Did Loan Growth Stay Negative So Long after the Recession?

Citation

ldquoWhy Has the Share of Mortgage Debt in Default Fallen?,rdquo St. Louis Fed On the Economy, Feb. 11, 2016.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions