Why Has Household Debt Declined?

Total household debt in the U.S. fell considerably following its peak in 2008. A recent Economic Synopses essay examined whether this drop was caused by a lack of credit creation or by additional credit destruction.

Senior Economist Juan Sánchez and Technical Research Associate Lijun Zhu noted that total household debt increased at an annual rate of 8.3 percent from the first quarter of 2004 through the fourth quarter of 2008. Following that peak, household debt declined until stabilizing in the first quarter of 2013 at a level 13 percent below the peak. Since then, it has moved modestly back toward its previous levels.

To shed light on the sources of these changes, the authors calculated “credit change” over quarters. This is simply calculated as credit creation minus credit destruction:

- Credit creation could stem from, for example, additional credit card debt or a new mortgage.

- Credit destruction could mean repaying debt or simply defaulting.

However, credit change alone doesn’t necessarily indicate what happened in these two categories for a given period. As the authors noted: “A stable level of debt (a net change of 0) could be the result of a large credit creation offset by an equally large credit destruction. Or it could indicate no creation and no destruction at all.”

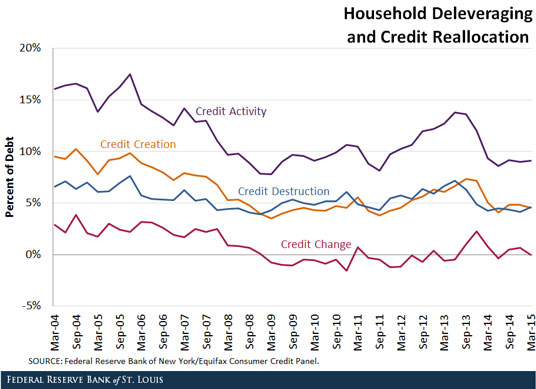

To examine the magnitude, they also calculated “credit activity,” which is simply credit creation combined with credit destruction. They wrote: “This is a useful measure because it captures credit activity ignored by the change in total debt.” The four categories—activity, creation, destruction and change—are shown in the figure below.

The expansion of debt in the early period seems due to above-average credit creation, not insufficient credit destruction. (In fact, credit destruction was slightly above average during this period as well.) The authors noted that credit activity was extensive during this period.

During the deleveraging period, credit creation fell considerably, dropping below 5 percent of total household debt after the financial crisis. Credit destruction, however, did not grow during this period. The authors wrote: “Thus, the deleveraging period of 2009-11 saw a very low level of credit activity, mainly due to the small amount of new credit issuance.”

Since 2011, total household debt has been relatively stable:

- For the period 2011-13, credit creation and destruction both increased, but offset each other.

- In the past year, very low levels of credit creation and destruction have also offset each other.

The authors concluded: “Overall, this analysis of household debt suggests that reduced credit creation, and not increased credit destruction, has been the key driver of the recent evolution of U.S. household debt.”

Additional Resources

- Economic Synopses: What Drives Household Debt?

- On the Economy: Deposits Grow across Banks Following Financial Crisis

- On the Economy: 3 Reasons Families Gain Wealth as They Age

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions