Why Are More Young Adults Still Living at Home?

Nationally, nearly half of 25-year-olds lived with their parents in 2012-2013, up from just over a quarter in 1999. A recent article in The Regional Economist examined statistics and reviewed some of the literature on millennials moving back home.1

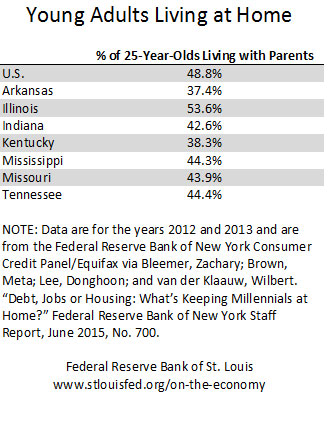

Economist Maria Canon and Regional Economist Charles Gascon noted that many factors have been suggested for why young adults return to or continue living at home, including significant student debt, weak job prospects and an uncertain housing market. The table below breaks down the percentage of 25-year-olds who were living at home for the period 2012-2013 in each state in the Federal Reserve’s Eighth District as well as in the country as a whole.2

Labor Market and Higher Education

One potential reason for the increase in young adults living with their parents is the labor market. The authors highlighted research showing that individuals at the beginning of their careers often need more time to transition into the labor market.3 This is reflected in the unemployment rates of those between 21 and 27, which are often higher than for other age groups.

Earning a college degree can help with labor market outcomes, as young adults with a college degree are more likely to live independently.4 However, additional research has shown that the underemployment rate for recent graduates was about 40 percent during the Great Recession.5 Canon and Gascon noted: “An implication is that a significant portion of recent graduates were earning lower wages than what they should have been, given their education.”

Also affecting many young adults is that they started their post-education careers during a recession. Canon and Gascon discussed a study noting that those entering the job market during a recession pay a price for about a decade.6 They wrote: “That’s because they start work for lower-paying employers and slowly work their way up toward better-paying jobs.”

Housing Market

The nation’s recovery may also play a role in young adults remaining at home. As the economy has grown, so have house prices. Canon and Gascon pointed out that national house prices have increased 21 percent since 2012, and rental prices have grown even faster in many areas. They wrote: “Because most youth would be first-time homebuyers, they have no housing equity to regain from the rebound in house prices after the housing crash.”

In the Eighth District, housing generally remains more affordable. The authors noted that the median house costs 3.3 times the median household income nationally, but less than 3 times the median household income in most District states.

Student Debt

According to a 2014 survey, more than half of first-time homebuyers said student loan debt was delaying saving for a down payment for a house.7 A 2015 report from the Federal Reserve Bank of New York found that a $10,000 increase in a student’s average debt increases the probability of living with parents or other family members by the age of 25 by about 2 percentage points.8

Around the Eighth District, the average borrower tends to have slightly lower student debt levels than the national average, but student debt growth has generally been faster than the national average in recent years.

Notes and References

1 Millennials are often identified as those born between 1981 and 2000.

2 The Eighth District includes all of Arkansas and parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. The data reported in this article, however, are for entire states, not just the portion within Eighth District boundaries.

3 Abel, Jaison R.; Deitz, Richard; and Su, Yaqin. "Are Recent College Graduates Finding Good Jobs?" Federal Reserve Bank of New York Current Issues in Economics and Finance, 2014, Vol. 20, No. 1.

4 Fry, Richard. "More Millennials Living with Family despite Improved Job Market." Pew Research Center, Washington, D.C.; July 2015.

5 Abel, Jaison R.; Deitz, Richard; and Su, Yaqin. "Are Recent College Graduates Finding Good Jobs?" Federal Reserve Bank of New York Current Issues in Economics and Finance, 2014, Vol. 20, No. 1.

6 Oreopoulos, Philip; von Wachter, Till; and Heisz, Andrew. "The Short- and Long-Term Career Effects of Graduating in a Recession." American Economic Journal: Applied Economics, 2012, Vol. 4, No. 1, pp. 1-29.

7 National Association of Realtors. "2014 Profile of Home Buyers and Sellers."

8 Bleemer, Zachary; Brown, Meta; Lee, Donghoon; and van der Klaauw, Wilbert. "Debt, Jobs, or Housing: What's Keeping Millennials at Home?" Federal Reserve Bank of New York Staff Report, June 2015, No. 700.

Additional Resources

- Regional Economist: “Leaving the Nest” Is Easier in Arkansas than Elsewhere in the District and Nation

- On the Economy: How Have Prime-Age Workers in School Affected the Labor Market?

- On the Economy: Delinquent Student Loan Borrowers Are Getting Further Behind

Citation

ldquoWhy Are More Young Adults Still Living at Home?,rdquo St. Louis Fed On the Economy, Oct. 26, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions