Access to Credit and Financial Services: A Bridge to Financial Well-being

The 2023 Federal Deposit Insurance Corp.’s National Survey of Unbanked and Underbanked Households found that 5.6 million U.S. households (4.2%) did not have a bank account, or were unbanked, and 19 million households (14.2%) had a bank account but used at least one of eight alternatives to bank services, such as check cashing and payday loans, meaning they were underbanked. About 1 in 6 U.S. households (15.7%) did not utilize traditional credit products that are reflected in credit records and, as a result, did not have a credit score.Federal Deposit Insurance Corp. 2023 FDIC National Survey of Unbanked and Underbanked Households (PDF). November 2024. The St. Louis Fed’s Eighth District—which covers all of Arkansas, most of Missouri, and parts of Illinois, Indiana, Kentucky, Mississippi and Tennessee—has some of the country’s highest rates of households that are unbanked and have no traditional credit.Federal Deposit Insurance Corp. 2023 FDIC National Survey of Unbanked and Underbanked Households: Appendix Tables (PDF). November 2024.

Access to financial services—including bank accounts and traditional credit, such as a credit card or a student loan—is a cornerstone of financial well-being.Michael S. Barr. “Financial Inclusion: Past, Present, and Hopes for the Future” (PDF). Financial Inclusion Practices and Innovations Conference, Board of Governors of the Federal Reserve System, Washington, D.C., July 9, 2024. Bank accounts allow individuals to securely store and transfer money and can be a first step toward other financial services, like an auto loan from a bank. Traditional credit allows individuals to manage everyday finances, weather financial emergencies and invest in their futures.2023 FDIC survey appendix tables (PDF), loc. cit. These financial services help individuals and households increase economic mobility, strengthen resilience and participate more fully in the economy.

Lower-income individuals have the least access to traditional financial services. They are more likely to have no checking or savings account at a bank or no credit score.Ibid (PDF). They are also more likely to have a credit score below 660, or subprime credit.Satyajit Chatterjee, Dean Corbae, Kyle P. Dempsey and José-Víctor Ríos-Rull. “Credit Scores and Inequality across the Life Cycle” (PDF). National Bureau of Economic Research, Working Paper 34027, July 2025. Research shows that individuals with lower credit scores tend to use credit with higher borrowing costs, like payday loans, that increase the likelihood of debt, delinquency and bankruptcy.Sumit Agarwal, Paige Marta Skiba and Jeremy Tobacman. “Payday Loans and Credit Cards: New Liquidity and Credit Scoring Puzzles?” The American Economic Review, May 2009, Vol. 99, No. 2, pp. 412-17.

Brian T. Melzer. “The Real Costs of Credit Access: Evidence from the Payday Lending Market.” The Quarterly Journal of Economics, February 2011, Vol. 126, No. 1, pp. 517-55.

Paige Marta Skiba and Jeremy Tobacman. “Do Payday Loans Cause Bankruptcy?” The Journal of Law and Economics, August 2019, Vol. 62, No. 3, pp. 485-519.

Marco Di Maggio and Vincent Yao. “Fintech Borrowers: Lax Screening or Cream-Skimming?” The Review of Financial Studies, October 2021, Vol. 34, No. 10, pp. 4565-618. Employers, landlords and insurers may use credit scores to assess financial responsibility and ability to pay on time, so a low credit score can impede an individual’s employment or housing opportunities.Will Dobbie, Paul Goldsmith-Pinkham, Neale Mahoney and Jae Song. “Bad Credit, No Problem? Credit and Labor Market Consequences of Bad Credit Reports.” The Journal of Finance, October 2020, Vol. 75, No. 5, pp. 2377-419. Limited access to traditional credit can have a host of negative effects on financial well-being, like trapping individuals and their families in cycles of debt and stagnating wealth-building.

Consequently, this report focuses on the participation of low- and moderate-income individuals in traditional financial services as a means to financial well-being.

Two analyses holistically characterize access to financial services from the community to the national level. The first is a quantitative analysis of the Federal Reserve Bank of New York’s Consumer Credit Panel from the first quarter of 2023 to the first quarter of 2025. This report measures access to traditional credit in two ways: (1) the percentage of adults without a credit score, and (2) the quality of credit scores. The analysis examines the nation and Eighth District states, including adults in low- and moderate-income communities, where median family income is less than 80% of the region’s median family income.

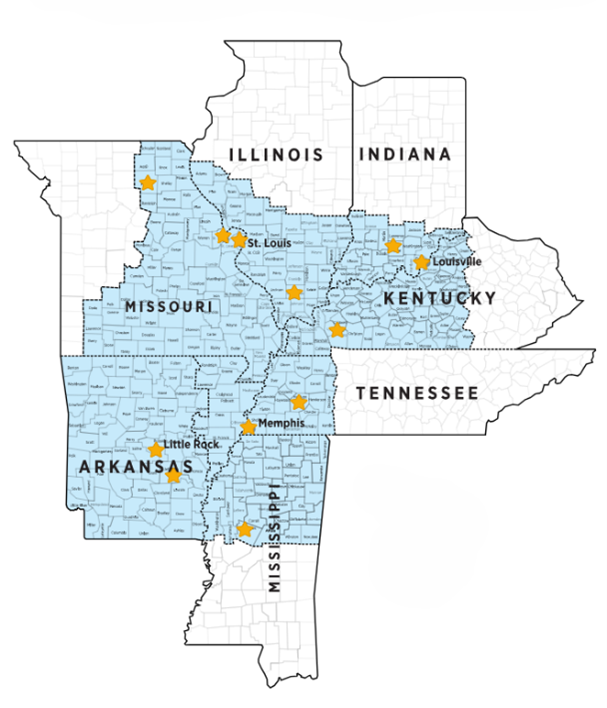

Map of Financial Well-being Roundtable Locations

The second is a qualitative analysis of 12 roundtable discussions about financial well-being held in communities across the Eighth District in 2025. St. Louis Fed Community Development staff convened these roundtables with representatives from banks, community development financial institutions, nonprofits, small-business development centers, community development corporations and chambers of commerce. At each roundtable, staff facilitated a conversation about the state of access to financial services in a community. Participants shared nuanced, on-the-ground insights about how low- and moderate-income individuals interact with institutions to access financial services in Eighth District communities.

The quantitative analysis found that some Eighth District states have less access to credit than the nation. Across income levels, adults in low- and moderate-income Eighth District census tracts had the least access to credit. An estimated 11.3 million (33.9%) adults in Eighth District states either do not have a credit score or have a subprime credit score in 2025. Overall, more adults seem to have limited access to credit because of a subprime credit score rather than no credit score.

The qualitative analysis found that financial literacy drives access to traditional financial services for low- and moderate-income individuals. Trust in banks is closely related to an individual’s financial literacy and similarly drives access. Roundtable participants discussed the largest gaps in financial literacy; their principal recommendation is to expand financial education. They also recommend that traditional financial institutions offer services which meet the needs of low- and moderate-income individuals and that they partner with peers to better connect individuals to resources. A marriage of these solutions could improve access to financial services and, ultimately, financial well-being in Eighth District communities.

- Federal Deposit Insurance Corp. 2023 FDIC National Survey of Unbanked and Underbanked Households (PDF). November 2024.

- Federal Deposit Insurance Corp. 2023 FDIC National Survey of Unbanked and Underbanked Households: Appendix Tables (PDF). November 2024.

- Michael S. Barr. “Financial Inclusion: Past, Present, and Hopes for the Future” (PDF). Financial Inclusion Practices and Innovations Conference, Board of Governors of the Federal Reserve System, Washington, D.C., July 9, 2024.

- 2023 FDIC survey appendix tables (PDF), loc. cit.

- Ibid (PDF).

- Satyajit Chatterjee, Dean Corbae, Kyle P. Dempsey and José-Víctor Ríos-Rull. “Credit Scores and Inequality across the Life Cycle” (PDF). National Bureau of Economic Research, Working Paper 34027, July 2025.

- Sumit Agarwal, Paige Marta Skiba and Jeremy Tobacman. “Payday Loans and Credit Cards: New Liquidity and Credit Scoring Puzzles?” The American Economic Review, May 2009, Vol. 99, No. 2, pp. 412-17.

Brian T. Melzer. “The Real Costs of Credit Access: Evidence from the Payday Lending Market.” The Quarterly Journal of Economics, February 2011, Vol. 126, No. 1, pp. 517-55.

Paige Marta Skiba and Jeremy Tobacman. “Do Payday Loans Cause Bankruptcy?” The Journal of Law and Economics, August 2019, Vol. 62, No. 3, pp. 485-519.

Marco Di Maggio and Vincent Yao. “Fintech Borrowers: Lax Screening or Cream-Skimming?” The Review of Financial Studies, October 2021, Vol. 34, No. 10, pp. 4565-618. - Will Dobbie, Paul Goldsmith-Pinkham, Neale Mahoney and Jae Song. “Bad Credit, No Problem? Credit and Labor Market Consequences of Bad Credit Reports.” The Journal of Finance, October 2020, Vol. 75, No. 5, pp. 2377-419.

- Board of Governors of the Federal Reserve System. Community Reinvestment Act (CRA): Resources. Last updated July 16, 2025.