Delinquent Student Loan Borrowers Are Getting Further Behind

The Great Recession affected households in different ways, including causing people to get behind in debt payments. Student loan payments were no exception. The figures below show student loan delinquencies in the fourth quarters of 2007 (the beginning of the recession), 2010 (after the recession) and 2014 (the most recent data available). We used the fourth quarter of each year to avoid changes that may be related to the time of year.

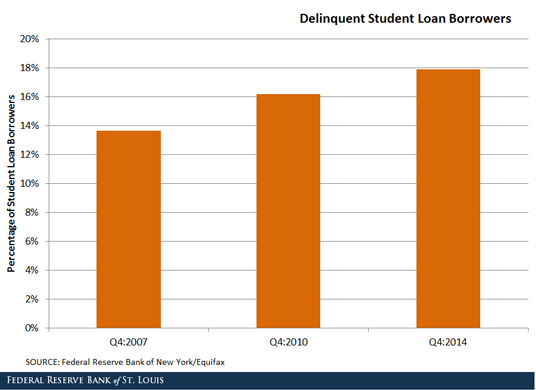

The first figure represents a usually quoted rate of delinquency in student loans: the percent of people with student loans who are behind in their payments.

The figure above clearly shows the effect of the Great Recession, as the delinquency rate increased from 13.6 percent to 16.2 percent. Since then, it has increased at a slower, but still significant, rate to 17.9 percent.

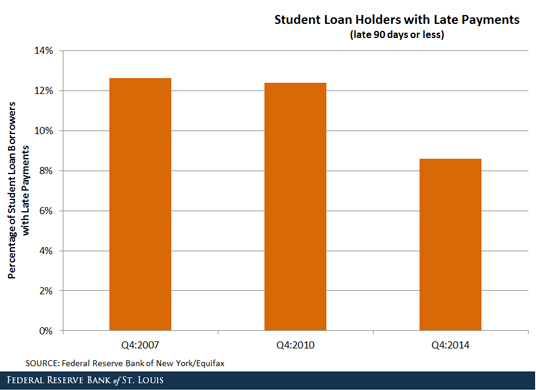

To further study student loan delinquency, the figure below shows student loan borrowers making payments late who are behind by 90 days or less. Thus, this figure represents the percent of delinquent borrowers who are not seriously delinquent.

As the figure shows, that rate remained relatively flat during the crisis, suggesting that households would stop making payments for a couple of months during the recession, then restart. During the past four years, this rate worsened significantly, dropping from 12.4 percent to 8.6 percent.

The two figures taken together suggest that although student loan delinquency has slowed over the past four years, its quality has worsened because more borrowers have become seriously delinquent.

Additional Resources

- Economic Synopses: Student Loan Delinquency: A Big Problem Getting Worse?

- On the Economy: A Look at Household Debt around the Great Recession

- On the Economy: The Share of Borrowers with High Student Loan Balances Is Rising

- On the Economy: The Impact of Financial Education

Citation

Juan M. Sánchez, ldquoDelinquent Student Loan Borrowers Are Getting Further Behind,rdquo St. Louis Fed On the Economy, April 20, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions