Can Countries Escape the Low- or Middle-Income Trap?

By Yi Wen, Assistant Vice President and Economist, and Maria A. Arias, Research Associate

Since 1960, economic growth in the developing world has lifted many low-income economies from poverty to a middle-income level and other economies to even higher levels of income. However, only a few countries have been able to catch up with the high per capita income levels of the developed world and stay there. By American living standards (as representative of the developed world), most developing countries since 1960 have remained or been “trapped” at a constant low-income level relative to the U.S.

This “low- or middle-income trap” phenomenon raises concern about the validity of the neoclassical growth theory, which predicts global economic convergence. Specifically, the Solow growth model suggests that income levels in poor economies will grow relatively faster than developed nations and eventually converge or catch up to these economies through capital accumulation, assuming that all countries have the same access (due to spillover effects) to the world frontier of new technologies. But, with just a few exceptions, that is not happening.

Measuring the Traps

Up to now, the growing literature about the low-income trap and the middle-income trap has focused on income divergence between the developed and developing worlds, but ignored the more pervasive phenomenon of the lack of convergence. This perspective can be important because even the poorest economies continue to grow at some positive rate every year.

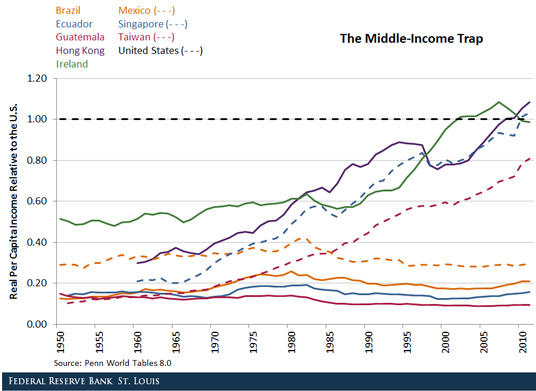

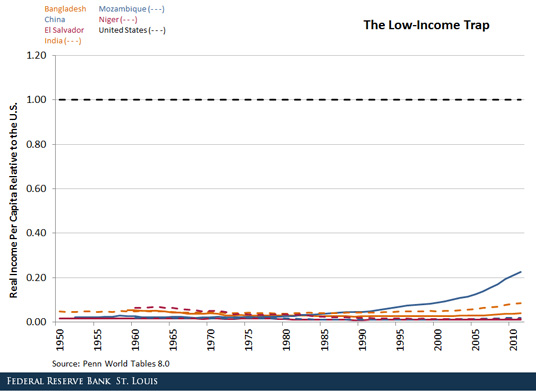

Redefining the low- and middle-income traps as situations where income levels relative to the U.S. remain constantly low and without a sign of convergence allows us to study the issue of economic convergence (or the lack of it) directly. The figures below highlight our new concept of the middle-income trap and the low-income trap. Several examples of countries that have escaped the middle-income trap to reach a high-income level and countries that have escaped the low-income trap are depicted along with those trapped countries with constant income levels relative to the U.S.

The figure above shows the rapid and persistent relative income growth (convergence) seen in Hong Kong, Singapore, Taiwan and Ireland beginning in the late 1960s all through the early 2000s to catch up or converge to the higher level of per capita income in the U.S.

Convergence implies that income growth in these economies was significantly faster than in the U.S. In sharp contrast, per capita income relative to the U.S. remained constant and stagnant at 10 percent to 30 percent of U.S. income in the group of Latin American countries, which remained stuck in the middle-income trap and showed no sign of convergence to higher income levels, despite experiencing moderate absolute growth during the same period.

The lack of convergence is even more striking among low-income countries. Countries such as Bangladesh, El Salvador, Mozambique and Niger are stuck in a poverty trap, where their relative per capita income is constant and stagnant at or below 5 percent of the U.S. level. Even though their economies might have grown moderately in absolute terms, they have not grown at a rate faster than the U.S. growth rate; thus, their relative income levels have not increased.

China has been able to grow relatively faster than the U.S. since about the early 1980s, breaking away from the low-income trap and reaching middle per capita income levels. India has also shown signs of escaping the low-income trap since the early 1990s. However, both countries still have a long way to go to catch up and converge to the levels seen in developed economies, and both have to cross (overcome) the middle-income trap on their way toward ultimate prosperity.

Why do some countries remain stagnant in relative income levels while some others are able to continue growing faster than the frontier nations to achieve convergence? Is it caused by institutions, geographic locations or smart industrial policies? Examining the phenomenon of low- and middle-income traps based on relative income will help shed new light on the study of the prevalent factors behind economic convergence (or lack thereof).

Additional Resources

- On the Economy: Where Is the “Peril” of Deflation Striking Back?

- On the Economy: How Have Households Deleveraged Since the Great Recession?

- On the Economy: Oil Prices: Is Supply or Demand behind the Slump?

Citation

ldquoCan Countries Escape the Low- or Middle-Income Trap?,rdquo St. Louis Fed On the Economy, Feb. 2, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions