Internal Devaluation in Eurozone Peripheral Countries

Thinkstock/Maksym Yemelyanov

A few years ago, during the European sovereign debt crisis, there was talk about “internal devaluation” as a way to increase competitiveness in the countries most affected by the crisis.1 The idea was to engineer a depreciation of real exchange rates to increase exports in these countries.

Real exchange rate depreciation can be understood from the definition of real exchange rate (how many units of foreign goods one can buy with one unit of a domestic good):

eR = (eN x P) / P*

In this equation, eR is the real exchange rate, eN is the nominal exchange rate (measured as the units of foreign currency that one can buy with one unit of domestic currency), P is the price of a basket of domestic goods, and P* is the price of a basket of foreign goods.

In growth rates:

% Change in eR = % Change in eN + Domestic Inflation – Foreign Inflation

A decrease in the real exchange rate implies a domestic depreciation and, therefore, an increase in the competitiveness of domestic goods. Competitiveness could increase through a depreciation of the domestic currency with respect to the foreign currency (the nominal exchange rate), a decrease in domestic inflation or an increase in foreign inflation. The idea is that a real depreciation would boost exports and reduce current account deficits or increase current account surpluses.

In a monetary union, countries share a currency, and thus there is no bilateral nominal exchange rate among countries within the union. Therefore, the real exchange rate depreciation or appreciation is given by the difference of inflation rates between the two countries:

% Change in eR = Domestic Inflation – Foreign Inflation

Based on some fundamental economic variables, two groups of countries emerged in the eurozone prior to the crisis:

- Those (such as Germany) with current account surpluses and low inflation

- Those (such as Spain, Ireland, Portugal, Italy and Greece) with current account deficits and high inflation

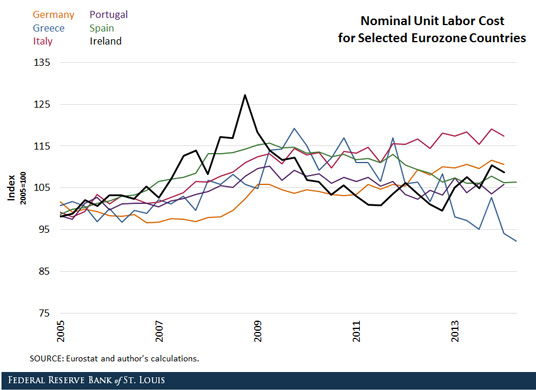

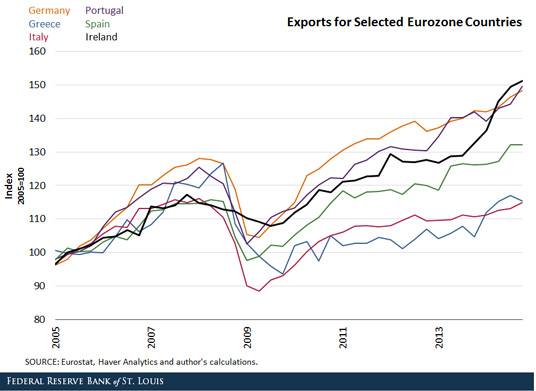

In this case, one way to reduce the current account imbalances between countries with surpluses and countries with deficits would be by either increasing inflation in the first group or decreasing inflation in the second group. This is what people referred to as an “internal devaluation.” Indeed, since 2008, Ireland, Greece, Portugal and Spain have reduced their unit labor cost gaps with Germany (as shown in the first figure above) .2,3 Exports have increased in many of these countries relative to Germany, especially in Spain, Portugal and Ireland (as shown in the second figure above).

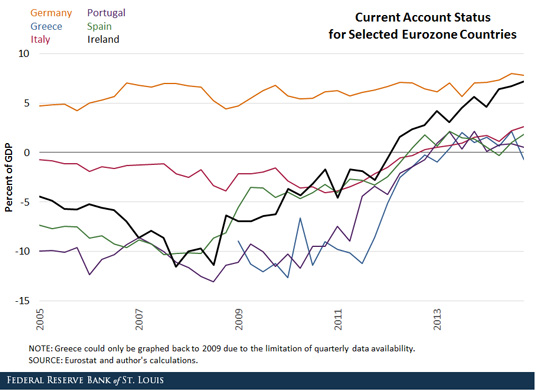

A couple weeks ago, Germany announced an increase in wages.4 This has been considered by some as good news for the eurozone and its peripheral countries.5 Whether this policy will be good news for exports of the peripheral countries and for reducing global imbalances remains to be seen. Imbalances seem to have been reduced around the eurozone following 2011 (as seen in the third figure above), but there are reasons beyond the depreciation of the real exchange rate that could explain the adjustment: structural reforms in the peripheral country, an increase in savings through deleveraging of both households and firms with low access to credit, and a reduction in investment.

Notes and References

1 Krugman, Paul. “The Unbearable Slowness of Internal Devaluation.” New York Times, April 25, 2012.

2 Christopoulou, Rebekka and Monastiriotis, Vassilis. “Two Tales of Wage Adjustment.” London School of Economics, April 29, 2014.

3 Peeters, Marga and den Reijer, Ard. “Apart from the Fiscal Compact – on Competitiveness, Nominal Wages and Labour Productivity.” VOX, Jan. 3, 2012.

4 Vasagar, Jeevan and Jones, Claire. “German Wage Rises Lift Hopes of Eurozone Recovery.” Financial Times, April 19, 2015.

5 Bernanke, Ben S. “German Wage Hikes: A Small Step in the Right Direction.” The Brookings Institution, April 13, 2015.

Additional Resources

- On the Economy: Why Has International Trade Increased So Much?

- On the Economy: How World War I Changed Marriage Patterns in Europe

- On the Economy: Using Exchange Rates as Monetary Policy Instruments

Citation

Ana Maria Santacreu, ldquoInternal Devaluation in Eurozone Peripheral Countries,rdquo St. Louis Fed On the Economy, May 4, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions