A Look at Household Debt around the Great Recession

As we saw yesterday, mortgage debt has been the largest component of household debt and deleveraging over the past few years. However, there are several other drivers of household debt. Today, we’ll look at unsecured (including credit card) debt, auto loans and student loans.1 We will start by examining inflation adjusted unsecured debt for individuals in 1999.2

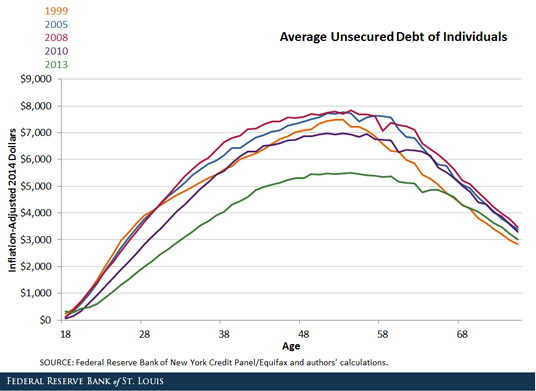

Unsecured debt can be characterized by a hump-shaped pattern over the life cycle with the peak occurring around age 53. Unsecured debt holdings increased between 1999 and 2008. The increase in this type of debt tended to occur for individuals over age 30.

The Great Recession greatly impacted holdings of unsecured debt. Between 2008 and 2010, the curve shifted downward for all ages, and an even bigger shift occurred between 2010 and 2013:

- In 2008, the average unsecured debt of a 50-year-old individual was more than $7,600.

- In 2010, it was about $6,900.

- In 2013, it was approximately $5,400.

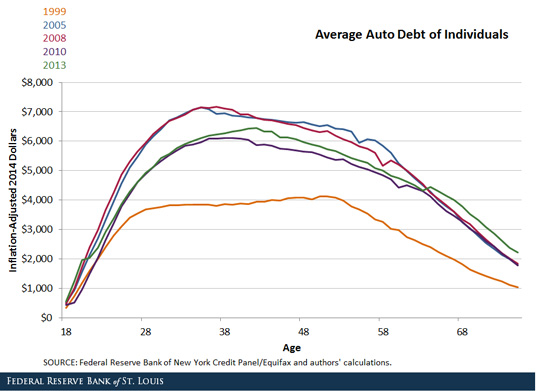

Another important household debt category is automobile debt. In 1999, the life cycle distribution of auto debt meant balances increased rapidly between age 20 and 30 and somewhat more slowly between 30 and 55. After age 55, auto debt declined with age. Peak auto debt did not exceed $4,200.

Between 1999 and 2008, households increased their auto debt, and the age pattern of this type of debt changed. In 2008, auto debt had a more pronounced hump pattern with the peak occurring in people’s 30s. More importantly, peak auto debt had increased to about $7,100.

As with unsecured and mortgage debt, auto debt levels declined by 2010. However, between 2010 and 2013, auto debt patterns deviated from the aforementioned debt categories. After age 35, auto debt increased once again.

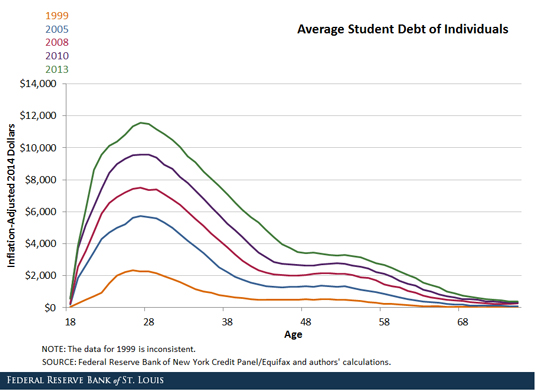

The final important type of household debt is educational or student debt. There are some data inconsistencies prior to 2003, but by current standards, student debt levels in 1999 were low. Student debt tends to peak in the late 20s, with minimal debt levels by age 40. As with other forms of household debt, average student debt increased between 1999 and 2008.

In contrast to the other types of household debt, student debt grew throughout the recession. By 2013, peak average student debt increased to around $11,600. As a result, significant student debt existed longer in individuals’ lives. In addition to this change in the student debt age profile, we found that individuals in the 50-60 age cohort were taking on debt. This was likely a result of parents or grandparents either paying or co-signing for the student debt of their relatives, and potentially an increase in the number of nontraditional students.

Conclusion

The changes in debt composition have occurred in several ways, and fully discussing these patterns might be a blog post for another day. Still, a few quick observations emerge.

Along the intensive margin—the average amount per borrower—borrowers have been altering level of debts they hold. For example, prior to the crisis, there were large run-ups in the average debt per borrower for both student debt and mortgage debt. While debt per borrower continues to grow for student debt, the debt per mortgage borrower has decreased in the wake of the downturn.

Along the extensive margin—the number of borrowers—there are many patterns in the choice of debt types that individuals are holding. For example, many more individuals hold student debt than in prior years.

Notes and References

1 The figures in this post report unconditional average debt holdings by age adjusted for inflation. By unconditional debt holding, we mean the average over all individuals whether or not they hold that category or other forms of debt.

2 Unsecured debt includes credit card debt, consumer finance loans and retail loans.

Additional Resources

- Dialogue with the Fed: Household Debt in America: A Look across Generations over Time

- On the Economy: Mortgage Debt and the Great Recession

- On the Economy: How Have Households Deleveraged Since the Great Recession?

Citation

ldquoA Look at Household Debt around the Great Recession,rdquo St. Louis Fed On the Economy, March 17, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions