What Drives Long-Run Economic Growth?

There are three main factors that drive economic growth:

- Accumulation of capital stock

- Increases in labor inputs, such as workers or hours worked

- Technological advancement

Growth accounting measures the contribution of each of these three factors to the economy. Thus, a country’s growth can be broken down by accounting for what percentage of economic growth comes from capital, labor and technology.

It has been shown, both theoretically and empirically, that technological progress is the main driver of long-run growth. The explanation is actually quite straightforward. Holding other input factors constant, the additional output obtained when adding one extra unit input of capital or labor will eventually decline, according to the law of diminishing returns. As a result, a country cannot maintain its long-run growth by simply accumulating more capital or labor. Therefore, the driver of long-run growth has to be technological progress.

This post further investigates the relationship between sources of past economic growth and future performances, especially the periods after the Great Recession, among developed countries. We collected data from the Conference Board’s Total Economy Database for nine major advanced economies1 from 1990 to 2013 and performed the following growth accounting exercise:

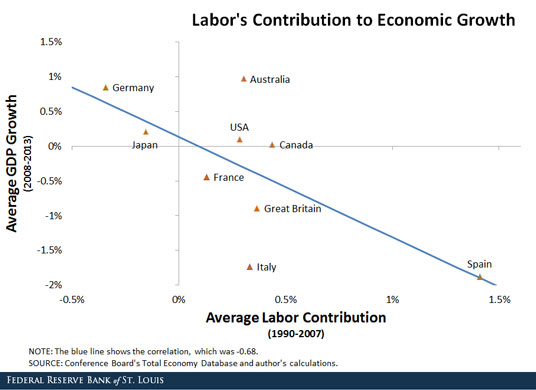

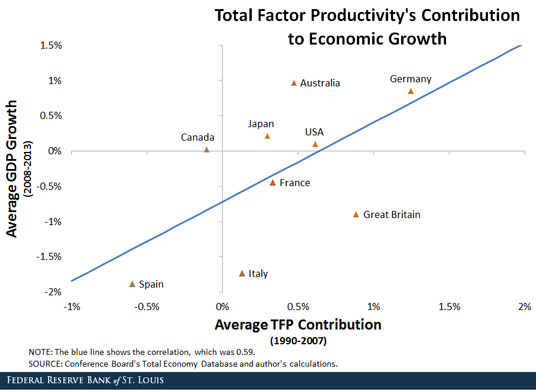

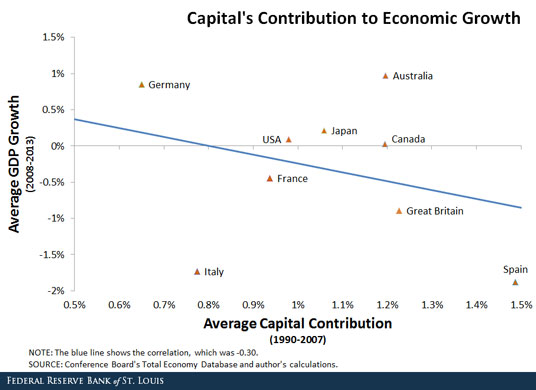

For each country, per capita output growth is first broken down into the respective contributions from capital stock, labor inputs and technological advancements (represented by total factor productivity, or TFP).2 Next, we divide our sample into two periods: before and after the financial crisis. This allows us to check if drivers of growth relate to the economic performance of a country, especially during or after the recession. Finally, we plot average gross domestic product (GDP) growth after the financial crisis against the average contribution to output growth of labor, capital and TFP before 2007, as shown in the figures below.

The result shows a positive correlation between past TFP and future growth among developed economies. The correlation coefficient was close to 0.60. Namely, those countries whose growth was driven by TFP before the crisis tended to have higher output growth afterward. However, the relationships between GDP growth after the crisis and the contribution to GDP from capital or labor were both negative. The correlation between output growth and labor was -0.68 and between output growth and capital was -0.30. The negative correlations suggest that countries with growth driven by capital or labor accumulation are less likely to do well in the future, especially during economic downturns. Our simple exercise also implies that the health of an economy depends on the source of growth instead of the growth itself.

In addition to the role TFP plays in driving long-run growth, this simple exercise shows that a country with robust TFP-driven growth prior to the Great Recession tended to do well relative to other countries following the recession.

Notes and References

1 The countries are Germany, Italy, France, the United States, Japan, Australia, Canada, Great Britain and Spain.

2 The labor inputs are measured by the total labor hours adjusted by quality of labor (human capital).

Additional Resources

- On the Economy: How to Measure the Black Market

- On the Economy: The Effects of Contract Enforcement and Corruption on Trade

- On the Economy: Why Has International Trade Increased So Much?

Citation

YiLi Chien, ldquoWhat Drives Long-Run Economic Growth?,rdquo St. Louis Fed On the Economy, June 1, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions