Unemployment Insurance Fraud and the Great Recession

In the wake of the Great Recession, unemployment benefits doubled over a three-year period. The increase in benefits triggered an increase in attention to the unemployment insurance system, including to cases of fraud. However, the cases that seem to draw the most attention from media appeared to make up only a small fraction of the overpayments due to fraud.

Unemployment insurance fraud occurs whenever an ineligible individual collects benefits after intentionally misreporting his or her eligibility. As an example, prisoners aren’t eligible to receive unemployment benefits, as they aren’t able and available to work. Yet in July 2012, cases of prisoners receiving benefits were reported in Arizona and Indiana.1

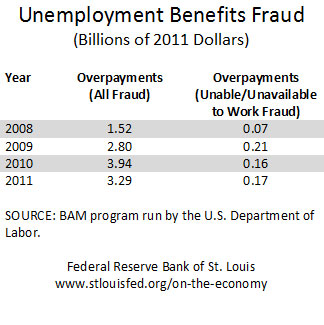

In a 2012 Economic Synopses essay, Deputy Director of Research B. Ravikumar, along with co-authors David Fuller of Concordia University and Yuzhe Zhang of Texas A&M University, compared the unemployment insurance overpayments due to people being unable and unavailable to work to the total amounts of overpayments due to fraud. The results are in the table below.

To help put this into perspective, total benefits paid out averaged $110.8 billion per year over this period. Thus, overpayments due to all fraud were less than 3 percent of total payments, and overpayments due to “Unable and Unavailable to Work” fraud amounted to about one-tenth of 1 percent of total payments.

So what type is most prevalent? The authors also examined different types of unemployment insurance fraud. They found that the majority of fraud cases (almost two-thirds of total overpayments due to fraud) were due to “concealed earnings,” or collecting benefits despite being employed and receiving wages.

Notes and References

1 Mejdrich, Kellie. “DES Targets Ill-Gotten Arizona Benefits,” The Arizona Republic, July 18, 2012. Censky, Annalyn. “Overpaid Unemployment Benefits Top $14 Billion,” CNN, July 9, 2012.

Additional Resources

- Economic Synopses: Unemployment Insurance Fraud

- On the Economy: Do Recessions Mean Even Lower Wages When the Unemployed Rejoin the Workforce?

- On the Economy: Does a Falling Unemployment Rate Imply Rising Wages?

Citation

ldquoUnemployment Insurance Fraud and the Great Recession,rdquo St. Louis Fed On the Economy, July 28, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions