Do Recessions Mean Even Lower Wages When the Unemployed Rejoin the Workforce?

Are recessions bad for the unemployed?

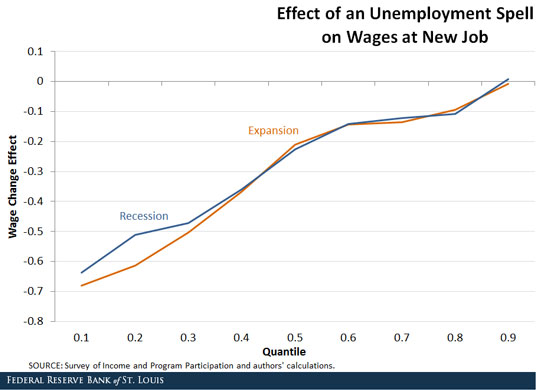

In a sense, yes, and in a sense, no. Of course, there are many ways to quantify the effects of unemployment beyond the direct effect of the loss of income. There is a further loss because, on average, workers who go through an unemployment spell receive lower wages in their next job. This re-employment wage effect of unemployment is no different between recession and expansion. Throughout the distribution of wage changes—whether the worker is gaining or losing wages—the marginal effect of having gone through unemployment is nearly the same and statistically indistinguishable.

Measuring the Effect

To see this effect, we examined job changers via the Survey of Income and Program Participation over the period 1996-2013. Each of these workers had some change in wages from their past job to their next job, and some of them switched jobs with an intervening unemployment spell. We wanted to see how a spell of unemployment brings down wages compared with someone who moved directly from one job to another. This analysis focuses on the short-run effect of a job change, comparing the final month with the previous employer with the first month with the next.

First, we estimated the effect of several variables that might determine the change in wages. (In the parlance, the dependent variable is change in wages. The independent variables include whether there was an unemployment spell and whether the job change involved an occupation change as well.)

Average Effect on Wages for Re-employed

The result of this estimation will be the average effect on wage changes from an unemployment spell. We segmented our sample into months during recessions and months within expansions and estimated the effects separately. The point estimate for the average effect is a loss of 30 percent of wages in expansions and 27 percent in recessions, but these two numbers are not statistically distinct. They are within sampling error of each other.

Effect Different for Wage Gainers or Losers?

What if this effect is different for wage gainers or wage losers? Perhaps workers who are the big wage losers do particularly poorly in recession. To address this idea, we looked at the same marginal effect of unemployment, but rather than estimating the mean, we focused on various ranks, or regions, of the distribution of wage changes. That is, are the very big wage losers in the bottom 10th percentile more affected by an unemployment spell? Is the effect different in a recession or expansion?

The answer is that big wage losers lose more from unemployment, but not any more or less in expansion or recession. To see this, we plotted the estimated short-run effect of unemployment at each interval of the wage change distribution. Indeed, the line for the effect during a recession falls right on top of the line for the effect during an expansion.

Conclusion

What is the important takeaway? The rise in unemployment does affect the distribution of wage changes during a recession, but not because it’s more costly to lose your job in a recession. Rather, it’s because there are simply more people being displaced.

Additional Resources

- On the Economy: Wages Aren’t Keeping Up with Economic Growth

- On the Economy: The Unemployment Rate vs. Other Indicators

- On the Economy: Does Moving for a Job Mean Higher Wages?

Citation

David G Wiczer, ldquoDo Recessions Mean Even Lower Wages When the Unemployed Rejoin the Workforce?,rdquo St. Louis Fed On the Economy, July 20, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions