Does a Falling Unemployment Rate Imply Rising Wages?

Unemployment has dropped significantly since the end of 2009, when it reached 10 percent, but does such a drop lead to higher wages? A recent Economic Synopses essay by Economist Maximiliano Dvorkin and Research Associate Hannah Shell examined the relationship between wage growth and unemployment.

Typically, this relationship is studied at a national level. However, not all areas of the country experienced the same labor market fluctuations. For example, the unemployment rate reached almost 15 percent in some states while remaining around 4 percent in others.

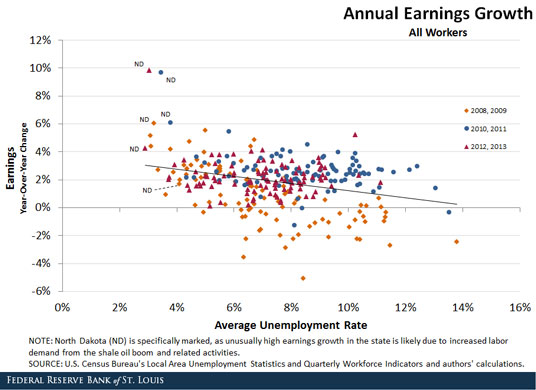

Because not all regions experienced the recent recession and subsequent expansion the same way, Dvorkin and Shell plotted year-over-year growth in nominal earnings against the unemployment rate for all 50 states over the period 2008-2013. The figure below shows the relationship between the two variables for all workers.

Dvorkin and Shell noted, “As that data show, the negative relationship between unemployment and earnings growth seems to hold across states.”

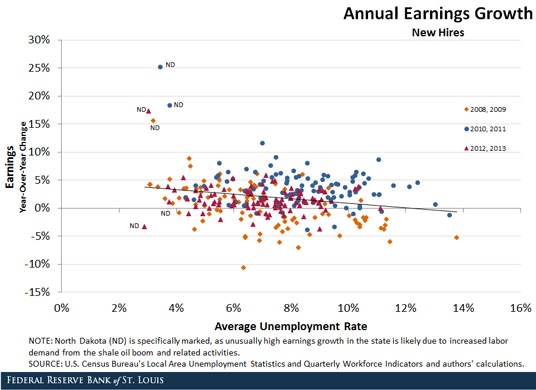

However, not all wages react the same way to economic conditions, and the authors noted that the wages of new hires may be more sensitive to the state of the labor market. The figure below shows the relationship between earnings growth and the unemployment rate for new hires only.

Dvorkin and Shell noted, “Although the negative relationship between unemployment and earnings growth does not seem as strong, in part because of higher volatility in the year-over-year earnings of new hires, it holds nonetheless.”

The authors concluded, “Since labor markets in the United States have substantially improved and are expected to improve even more, it is likely that nominal wages will increase at a faster pace.”

Additional Resources

- Economic Synopses: The Relationship between Labor Market Conditions and Wage Growth

- On the Economy: Labor Force Participation: The U.S. and Its Peers

- On the Economy: The Financial Gaps Widen between Those with Advanced Degrees and Everyone Else

Citation

ldquoDoes a Falling Unemployment Rate Imply Rising Wages?,rdquo St. Louis Fed On the Economy, June 23, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions