What the Markets Are Signaling about Inflation Expectations and Fed Credibility

Credibility is the quality of being believed. Central banks struggled for years to regain credibility after the high inflation of the 1970s. Disturbingly, it would appear that markets are again doubting central banks’ willingness or ability to achieve their stated goals.

Price stability is one of the Fed’s two congressional mandates.1 While Congress never explicitly defined price stability, the Federal Open Market Committee (FOMC) has long interpreted price stability to mean 2 percent personal consumption expenditures price index (PCE) inflation, and this interpretation has been explicit since January 2012.2

In setting policies, the FOMC considers public or financial market expectations of many variables, including inflation. Inflation expectations are particularly important because they can help the FOMC directly gauge whether policy is too tight or too accommodative to achieve price stability. If expected inflation is higher (lower) than the FOMC's target, then this might indicate that expected monetary policy is too accommodative (tight).

One can measure expected inflation in several ways. One way is through “breakeven” inflation—a market consumer price index (CPI) inflation forecast—from the spread between yields of bonds with CPI inflation-adjusted payouts (Treasury inflation-protected securities, or TIPS) and yields of bonds with payouts that do not depend on inflation.

As of July 1, breakeven CPI inflation over five- and 10-year horizons were 1.60 percent and 1.89 percent, respectively. Those figures had dipped as low as 1.05 percent and 1.54 percent, respectively, on Jan. 13—just prior to the European Central Bank’s announcement of a quantitative easing program.

In addition, the FOMC’s target of PCE inflation has averaged 0.3 percentage points less than CPI inflation per year over the past 10 years.3 Subtracting 0.3 percentage points from CPI breakeven inflation rates suggests that breakeven PCE inflation rates were 1.30 percent and 1.59 percent for five and 10 years, respectively, as of July 1.

The fact that market-implied PCE inflation forecasts are well below the official 2 percent target suggests that markets doubt the Fed will hit its inflation target. This is a problem because economists generally think that central banks should be able to control average inflation over such long horizons. It indicates lack of credibility.

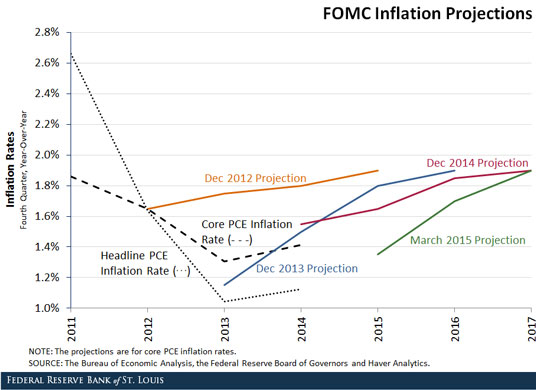

Why do markets think that the Fed can’t control inflation over such a long horizon? There are at least two possible explanations. First, markets might believe that the Fed will systematically overpredict inflation, which would mean less accommodative policy than necessary to hit the inflation target. The fact that the Fed and private forecasters have repeatedly overpredicted inflation since 2012 is consistent with this explanation.

Second, markets might believe that economic conditions will be so weak—the equilibrium real interest rate will be so low—that the Fed will be unable to hit a 2 percent inflation target. This is a much more disturbing possibility.

Notes and References

1 The other is maximum employment. Most central banks have price stability as one of their mandates.

2 See the FOMC press release from Jan. 25, 2012.

3 The difference over the past 50 years is larger, with PCE inflation trailing CPI inflation by an average of 0.53 percentage points per year.

Additional Resources

- On the Economy: Liftoff and the Natural Rate of Interest

- On the Economy: How Accurate Are Measures of Inflation Expectations?

- Regional Economist: The Ups and Downs of Inflation and the Role of Fed Credibility

Citation

Christopher J. Neely, ldquoWhat the Markets Are Signaling about Inflation Expectations and Fed Credibility,rdquo St. Louis Fed On the Economy, July 13, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions