Where Is the "Peril" of Deflation Striking Back?

By Silvio Contessi, Economist

Almost five years ago—when the U.S. policy rates were close to zero and inflation was subdued—St. Louis Fed President James Bullard discussed the dangers of falling into a Japanese-style deflationary environment and advocated boosting quantitative easing to avoid this scenario.1 Bullard’s analysis2 discussed two steady states in the economy:

- The “targeted” steady state, with positive interest rates and near-target inflation

- The “unintended” steady state, with interest rates close to zero and deflation

In a class of theoretical models, when a particular monetary policy rule combines with the zero lower bound for nominal interest rates, the economy may get locked into the unintended steady state and experience Japanese-style deflation. While these fears did not materialize in the U.S. economy after the U.S. financial crisis and are unlikely to materialize as monetary policy normalizes, several advanced economies are now at or close to the zero lower bound with very low inflation or even deflation, and Bullard’s analysis remains valid for other economies.

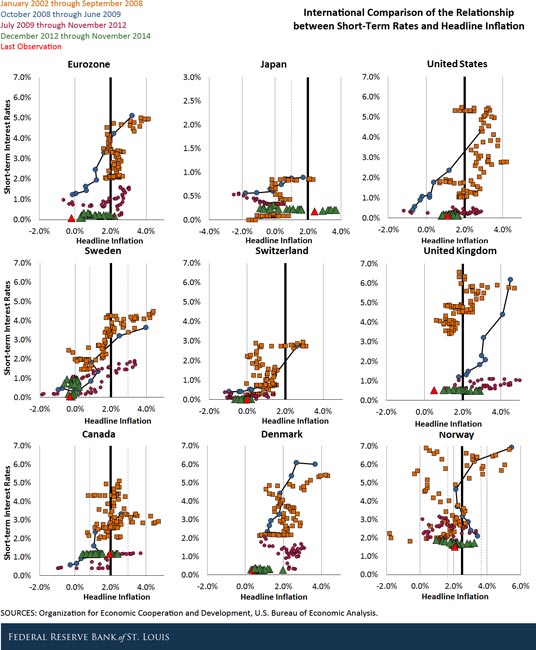

In the figures below, we extend Bullard’s graphical analysis originally done for the U.S. and Japan to nine advanced economies and extend the time series to the most recent data. The vertical axes represent short-term interest rates as reported by the Organization for Economic Cooperation and Development (OECD), and the horizontal axes represent inflation.

We focus on individual-country measures of year-over-year core inflation rates in the first figure and on headline inflation in the second figure. While some countries target headline inflation, core inflation is generally more stable and less affected by volatile commodity prices. The thicker vertical bar identifies the inflation target for all countries (2 percent in all countries except Norway, which is 2.5 percent).3 The figures examine four periods:

January 2002 through September 2008

January 2002 is the initial data point in Bullard’s paper, corresponding to the beginning of the recovery from the 2001 recession through Lehman Brothers’ collapse in September 2008. In the period before the collapse of Lehman Brothers and the beginning of the zero lower bound period in the U.S., all countries except Japan were essentially circling around 2 percent, a rate that was the explicit target inflation for some. (Switzerland’s target is 2 percent or below, and Japan increased the target from 1 percent to 2 percent in early 2013.)

October 2008 through June 2009

In the period between the collapse of Lehman Brothers/beginning of the U.S. zero lower bound and the end of the U.S. recession, all countries experienced falling inflation (sometimes with brief deflation) and quickly falling short-term interest rates.

July 2009 through November 2012

The period corresponding to the U.S. recovery through the beginning of “Abenomics” (the set of new economic policies of Japanese Prime Minister Shinzo Abe) witnessed a return to positive inflation circling around 2 percent for all countries except Switzerland, Japan (both close to zero) and the United Kingdom (close to 3 percent).

December 2012 through November 2014

The months since the beginning of Abenomics were characterized by falling inflation and interest rates near the zero lower bound for the vast majority of countries. Inflation rates were still positive in most countries, but close to zero in others. In all countries except Japan, headline inflation had trended downward in large part due to falling oil prices. Japan, however, successfully managed to move both inflation and inflation expectations well above zero percent.

Relative to a few months ago, the inflation picture for advanced economies appears more heterogeneous with some countries (Canada and Japan) close to target, the United States being below but not very far from target (average headline and core PCE inflation figures were 1.44 percent and 1.48 percent, respectively, in the six months between June and November 2014, the latest figures available for PCE) and several European countries having inflation rates close to zero percent. It is for these European countries that the danger of falling in a policy trap appears more relevant today.

Notes and References

1 Bullard, James. “Seven Faces of ‘The Peril.’ “ Federal Reserve Bank of St. Louis Review, September/October 2010, Vol. 92, No. 5, pp.339-52;

2 This analysis was an application of the model described in the 2001 paper “The Perils of Taylor Rules.” Benhabib, Jess; Schmitt-Grohé, Stephanie and Uribe, Martın. "The Perils of Taylor Rules." Journal of Economic Theory, 2001, 96(1), pp. 40-69.

3 This is an approximation because of the exceptions discussed in the 2014 paper “An International Perspective on the Recent Behavior of Inflation.” Contessi, Silvio; De Pace, Pierangelo; and Li, Li. “An International Perspective on the Recent Behavior of Inflation.” Federal Reserve Bank of St. Louis Review, Third Quarter 2014, Vol. 96, No. 3, pp. 267-94.

Additional Resources

- On the Economy: Three Faces of Inflation: U.S., Japan and the Eurozone

- On the Economy: Lowflation in Advanced Economies

- On the Economy: Oil Prices: Is Supply or Demand behind the Slump?

Citation

ldquoWhere Is the "Peril" of Deflation Striking Back?,rdquo St. Louis Fed On the Economy, Jan. 19, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions