Lifetime Education Benefits Have Never Been So High

Most people are familiar with the education premium, which says that people typically experience greater income as their level of education goes up. A new study shows that the lifetime benefits of additional education have never been as high as they are now.

In an article in The Regional Economist, Senior Economist Guillaume Vandenbroucke calculated a “lifetime education premium,” which aimed to accomplish two things:

- It is an attempt to measure the difference between the earnings of people with different educational attainment.

- It measures lifetime earnings, not just earnings at a particular age.1

The second point is particularly key, as the education premium changes from year to year, due to the wages of different workers growing at different rates. Using data from the U.S. Census Bureau, Vandenbroucke calculated the present value of future earnings for three groups:

- No high school

- High school

- College2

These groups were further organized by the year they turned 30 and by decade. Someone who was age 30 in 1940 belonged to the 1940 cohort, someone who was 30 in 1950 belonged to the 1950 cohort and so on.

The lifetime earnings among the education groups can be estimated for each cohort. For example, the present value of future earnings for someone in the 1940 cohort without a high school education was $562,300. It was $719,000 for someone with a high school education, and it was $986,300 for someone with a college education.3 (See The Regional Economist article “Lifetime Benefits of an Education Have Never Been So High” for the lifetime earnings of each group and each cohort studied.)

Vandenbroucke then calculated two education premiums:

- The high school premium, or the difference in lifetime income between those with and without high school diplomas

- The college premium, or the difference in lifetime income between those who graduated college and those who only graduated high school

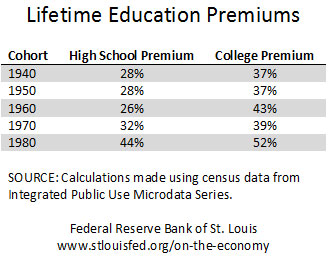

Using the 1940 cohort example, the high school premium would be calculated as $719,000 / $562,300 – 1 = 0.28, for a premium of 28 percent. The table below shows the high school and college premiums for each of the cohorts studied.

Vandenbroucke concluded, “Understanding education choices is important since education determines, to a large extent, a worker’s earnings. But measuring the benefits of an education is not that easy. I presented a simple measure of the benefits of purchasing an education for a sequence of cohorts and showed that these benefits have been on the rise for the last cohort. In fact, the lifetime financial benefits of an education have never been so high.”

Notes and References

1 It should be noted that this premium is calculated without considering the cost of education. Vandenbroucke also only considered white males, as the education and earnings of women and/or nonwhite people may involve issues of discrimination that could not be covered in this particular analysis.

2 “No high school” refers to workers whose highest educational attainment was grade 11. “High school” refers to workers who completed high school and up to three years of college. “College” refers to workers who completed at least four years of college.

3 All figures are expressed in 2010 dollars. Also, Vandenbroucke used an interest rate of 4 percent in calculating the present values of future earnings, as the one-year Treasury rate fluctuated around this rate between the 1950s and 1990s.

Additional Resources

- Regional Economist: Lifetime Benefits of an Education Have Never Been So High

- On the Economy: What Drives People to Work in Risky Occupations?

- On the Economy: The Financial Gaps Widen between Those with Advanced Degrees and Everyone Else

Citation

ldquoLifetime Education Benefits Have Never Been So High,rdquo St. Louis Fed On the Economy, Aug. 4, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions