What Drives People to Work in Risky Occupations?

About one-third of the workforce has twice the risk of disability as the other two-thirds. So what drives these people to work in such risky occupations? And how does this affect the Social Security Disability Insurance (SSDI) program?

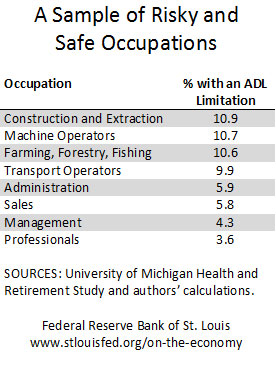

Economist David Wiczer of the St. Louis Fed and Assistant Professor Amanda Michaud of Indiana University in Bloomington examined these questions in an article in The Regional Economist. Using the University of Michigan Health and Retirement Study, they grouped workers by their primary lifetime occupations, then computed the fraction who reported some difficulty with one of the Activities of Daily Living (ADLs) during their working life before age 65.1

Risky vs. Safe Occupations

Wiczer and Michaud found that most workers belonged to a group that had low disability rates. However, another group of occupations had workers who were twice as likely to have had some disability. The table below shows samples of risky and safe occupations.

Wiczer and Michaud noted that those in high-risk occupations were more likely to apply for and receive SSDI. In fact, 21 percent of the workers in riskier occupations received SSDI benefits versus 12 percent from other occupations.

Why Work Risky Jobs?

The authors found that workers in riskier occupations, while less educated than those in safe occupations, were paid relatively well. After controlling for education and other demographics, workers in risky occupations made $5,000 more per year compared with workers with similar education and demographic characteristics.

However, these workers also had lower savings than those in safer occupations. Wiczer and Michaud noted, “From the perspective of a simple theory of precautionary savings, this was puzzling: If workers in certain occupations faced a much higher risk of disability, with its corresponding loss of income and increased expenses, we would expect them to save a larger fraction of their income.”

They offered one potential explanation that people in risky occupations may simply put a higher value on their current welfare, which would explain two aspects of this puzzle if true:

- People would save less than those who have more interest in future rewards.

- People would trade higher pay today for potentially greater problems later in life.

Impact on the SSDI Program

The authors noted that understanding the reasons that people work risky jobs is important for the design and assessment of the SSDI program:

- The work produced by those in risky occupations is needed.

- SSDI transfers money to riskier occupations.

Ultimately, Wiczer and Michaud concluded that more research is needed: “Although the rolls of those receiving disability benefits have been rising quickly, we do not have a good benchmark for what should be their optimal size, nor do we know the effects of the availability of disability insurance on individuals in the job market.”

Notes and References

1 ADLs are basic self-care activities such as eating, bathing, dressing and walking across a room.

Additional Resources

- Regional Economist: Understanding the Motives and Constraints That Lead People to Risky Occupations

- On the Economy: Do Recessions Mean Even Lower Wages When the Unemployed Rejoin the Workforce?

- On the Economy: Wages Aren’t Keeping Up with Economic Growth

Citation

ldquoWhat Drives People to Work in Risky Occupations?,rdquo St. Louis Fed On the Economy, July 23, 2015.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions