How Will the Fed Reduce Its Balance Sheet?

—Fed Chair Jerome Powell, May 4, 2022

Between March 2020 and March 2022, the Fed was purchasing U.S. Treasury securities and agency mortgage-backed securities (MBS) to foster smooth market functioning and support the flow of credit to households and businesses by providing accommodative financial conditions. This action was in response to the COVID-19 shock that hit the global economy very hard. The pandemic and shutdowns initially caused severe volatility in financial markets and induced uncertainty in the economic outlook.For more discussion of the Fed’s objectives and a detailed discussion of the implementation of the asset purchases, see the March 2, 2022, speech, “Federal Reserve Asset Purchases: The Pandemic Response and Considerations Ahead,” by Lorie Logan, a New York Fed executive vice president. (Logan has been named Dallas Fed president and CEO, effective Aug. 22, 2022.)

Over most of this period, the monthly pace of purchases was $80 billion for Treasury securities and $40 billion for agency MBS. Overall, as shown in the Federal Reserve System assets graph, securities holdings more than doubled, from about $3.9 trillion in early March 2020 to $8.5 trillion in May 2022. As a percent of GDP, the holdings rose from 18% to 35%.

Federal Reserve System Assets More than Doubled in Two Years

Redeeming Securities Will Shrink the Balance Sheet

With the economy facing an extremely tight labor market and high inflation, the FOMC has raised its policy target interest rate a couple of times and, at its May meeting, announced it will begin reducing the size of the Fed’s balance sheet in June.

Mechanically, the Fed will reduce its securities holdings by not reinvesting the funds it receives from maturing securities. So, for example, when a Treasury security hits its maturity date, the Fed will not reinvest the proceeds into another Treasury security (as it has been doing over the past two years). Instead, it will redeem the maturing security, which will reduce the amount of the Fed’s securities holdings and the size of its balance sheet.For more details, see the 2017 paper, “How Does the Fed Adjust its Securities Holdings and Who is Affected?” by Jane Ihrig, Lawrence Mize and Gretchen Weinbach.

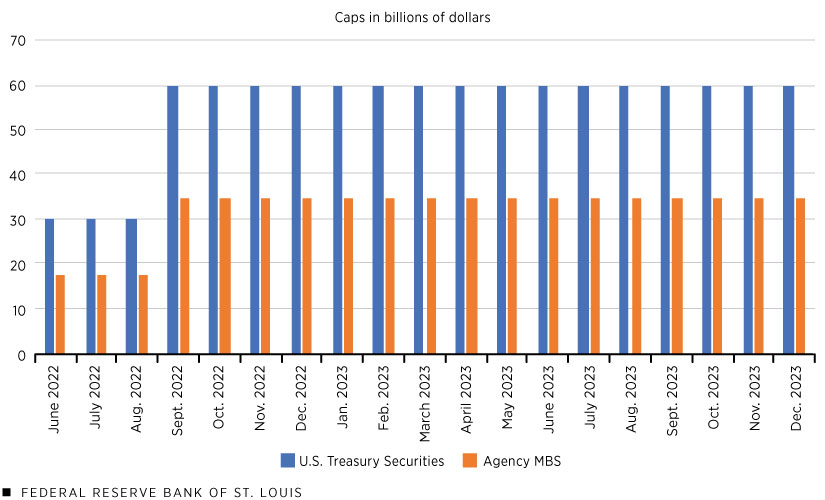

The Fed wants a predictable and smooth reduction in its balance sheet, so it is imposing redemption caps on the dollar amount of securities that will run off the Fed’s portfolio in any given month. For Treasuries, this monthly cap will peak at $60 billion; for agency MBS, the monthly cap will peak at $35 billion.The Fed holds a small amount of agency debt (see the Federal Reserve assets graph) that when matured will be folded into the agency MBS cap. No agency debt matures over the next several years. To ensure a smooth transition to the runoffs, the caps will be phased in, set at half their peak levels in June, and increased to their higher levels in September, as shown in the graph below.

Monthly Redemption Caps Will Be Phased In

NOTES: As described in May 4, 2022, FOMC Implementation Note, the monthly caps for redeeming maturing securities on the Fed’s balance sheet will be phased in. That is, the monthly caps will be $30 billion for Treasuries and $17.5 billion for agency MBS in the first three months, June through August 2022. Then the caps will be increased to $60 billion and $35 billion, respectively, thereafter.

How Far Will Securities Holdings Be Reduced?

In January 2022, the FOMC released a statement on its planned approach for reducing the size of the Federal Reserve’s balance sheet. The statement provided insight into how the FOMC is thinking about the appropriate size of the securities portfolio in the longer run.

“Over time, the Committee intends to maintain securities holdings in amounts needed to implement monetary policy efficiently and effectively in its ample reserves regime,” the statement said.

That means reducing securities holdings and the balance sheet to levels much lower than today’s. Absent other changes in conditions, as securities holdings decrease, reserve balances decrease. The Fed will need to make sure its level of securities holdings keeps reserve balances “ample,” or large enough so that small shocks to the level of reserves in the banking system do not put stress on money market interest rates.For more information on “ample” reserves, see the August 2020 Page One Economics essay, “The Fed’s New Monetary Policy Tools,” by Jane Ihrig and Scott Wolla.

How to Keep Up with Information on Runoff Plans

In May, the FOMC released detailed plans of how it will reduce the balance sheet. Besides mentioning the dollar size of the caps, it provided guidance on how it would end redemptions. In particular, as reserves are declining toward “ample,” the FOMC noted it plans to first slow and then stop the decline in redemptions when it judges reserves are somewhat above their desired ample level.

One can follow information about the Fed’s securities redemption plans by listening for commentary from the FOMC, including through post-meeting statements; minutes of the meetings, which are released three weeks later; and policymakers’ commentary. Another helpful resource is the Federal Reserve Bank of New York’s website, which reports on the policy implementation actions that the Open Market Trading Desk takes on behalf of the FOMC.

Editor's Note: Updated to reflect Lorie Logan’s new position, announced May 11.

Notes

- For more discussion of the Fed’s objectives and a detailed discussion of the implementation of the asset purchases, see the March 2, 2022, speech, “Federal Reserve Asset Purchases: The Pandemic Response and Considerations Ahead,” by Lorie Logan, a New York Fed executive vice president. (Logan has been named Dallas Fed president and CEO, effective Aug. 22, 2022.)

- For more details, see the 2017 paper, “How Does the Fed Adjust its Securities Holdings and Who is Affected?” by Jane Ihrig, Lawrence Mize and Gretchen Weinbach.

- The Fed holds a small amount of agency debt (see the Federal Reserve assets graph) that when matured will be folded into the agency MBS cap. No agency debt matures over the next several years.

- For more information on “ample” reserves, see the August 2020 Page One Economics essay, “The Fed’s New Monetary Policy Tools,” by Jane Ihrig and Scott Wolla.

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us