U.S. Trade Imbalances with China and Others

Since the late 1970s and early 1980s, the U.S.’s large and persistent trade and current account deficits with the rest of the world have received much attention in the press and in academia.Trade balance refers to the difference between exports and imports. The balance in the current account refers to the trade balance of the country plus the net payment of factors. In political debate, much of the attention has been directed toward the actions of foreign countries. Japan was the key concern during the 1980s. Nowadays, much of the concern is on China, especially with the escalation of the “trade war.”

Changes in Trade Involving China and the U.S.

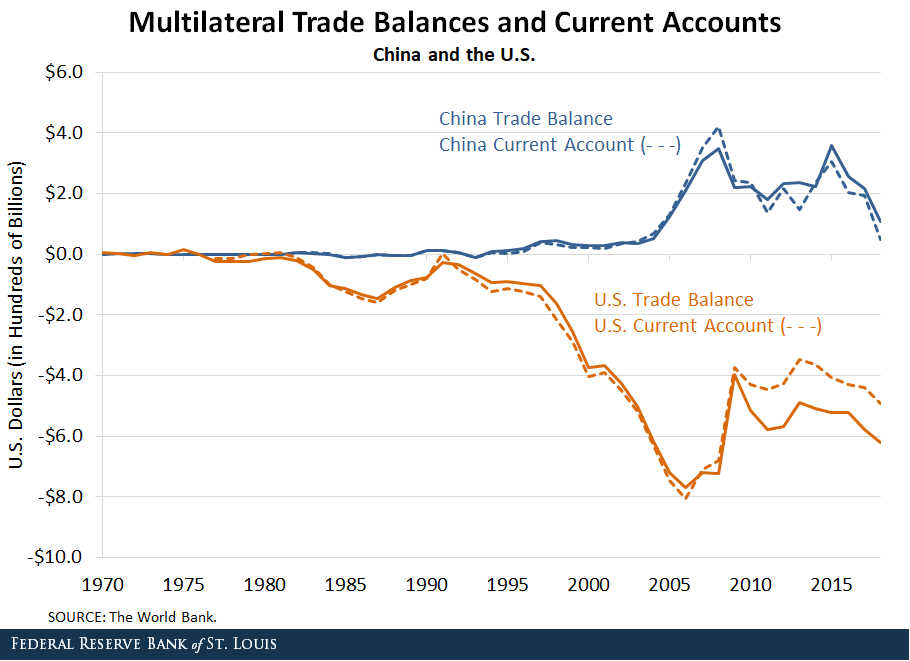

To review these patterns, the figure below shows the trade balance (solid line) and current account (dashed line) for both China and the U.S. with the rest of the world.

Several interesting patterns emerge. First, China was relatively isolated from the rest of the world until 2005. Obviously, it could not largely account for the U.S. deficits prior to that year.

Second, the emergence of China onto the world stage eventually led to a surge in its trade surplus. Interestingly, this surge coincided with a surge in the current account and trade deficits of the U.S. in 2005-07. However, the U.S. deficits were substantially larger than the surpluses of China, so China alone evidently falls short as an explanation of the U.S. deficits.

U.S. Trade with China, All Other Countries

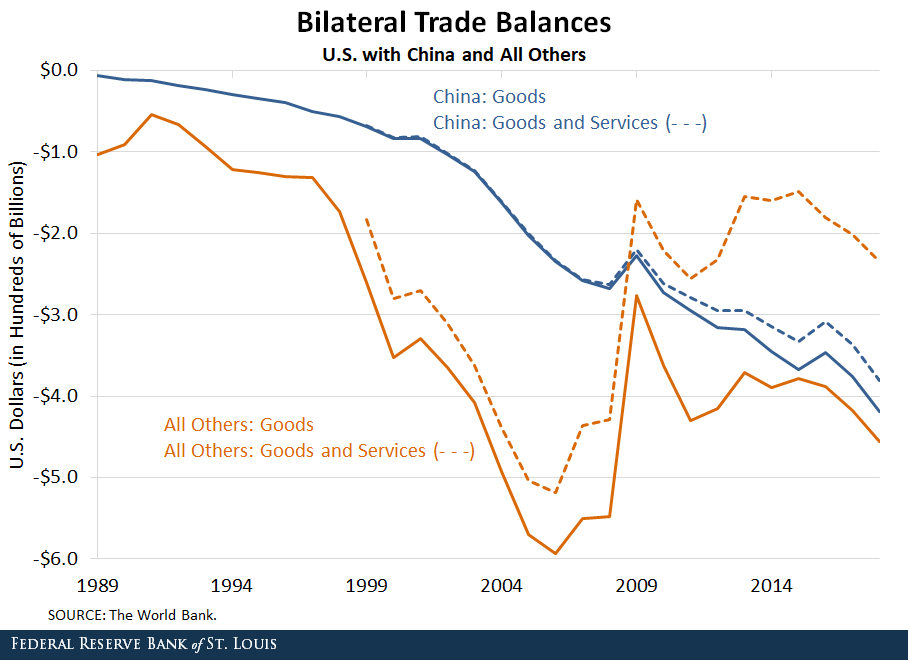

To explore these issues further, the following figure shows the bilateral balances between the U.S. and China and the U.S. and all other countries. The solid lines refer to the trade balances in goods, while the dashed lines refer to the trade balances in goods and services.

As indicated above, it becomes clear that the trade imbalances of the U.S. were large way before China became a substantial trade partner. Interestingly, the big deficits during the years leading up to the financial crisis of 2007-08 were mostly due to trade deficits with other countries.

To be sure, the deficit with China steadily grew from being almost nil in 1989 to being sizeable nowadays. In 2018, the deficit in goods with China alone was comparable to the aggregate deficit with all other countries.

U.S. Goods vs. U.S. Services

Equally interesting, once trade in services is added, the picture changes dramatically. The U.S. is a big net exporter of services, but this is mostly with countries other than China. The U.S. trade surplus in services substantially reduces the overall deficit with all other countries but only modestly reduces the deficit with China.

Additional Considerations

Trying to find foreign explanations ignores two simple but important considerations. First and most fundamentally, it is well known that the counterpart of a deficit in the current account is a positive net capital inflow from the rest of the world, which finances either domestic investments or consumption. Shutting down those inflows would require a reduction in domestic investments, consumption or possibly both.

Second, gross capital inflows from the rest of the world can be used by American investors to finance their investments abroad. Americans can invest in the rest of the world as foreigners invest in the U.S., allowing both sides to diversify their asset holdings. Shutting down these two-way flows would reduce the cross-country diversification of risk and, possibly, the international exchange of productive know-how.

Notes and References

1 Trade balance refers to the difference between exports and imports. The balance in the current account refers to the trade balance of the country plus the net payment of factors.

Additional Resources

- On the Economy: U.S.-China Trade War: Shifting to Importing from Other Nations

- On the Economy: What’s Behind the U.S. Trade Deficit?

Citation

Alexander Monge Naranjo and Qiuhan Sun, ldquoU.S. Trade Imbalances with China and Others,rdquo St. Louis Fed On the Economy, Feb. 3, 2020.

This blog offers commentary, analysis and data from our economists and experts. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Email Us

All other blog-related questions