The Impact of COVID-19 on the Residential Real Estate Market

KEY TAKEAWAYS

- The COVID-19 pandemic significantly affected the U.S. residential real estate market during the spring months.

- Because of health concerns, stay-at-home orders and economic uncertainty, many metro areas experienced a noticeable drop in home sales.

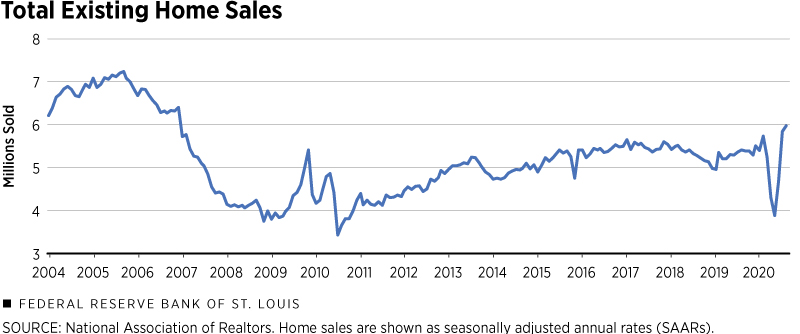

- In April and May, nationwide home sales dropped to their lowest levels since the housing and financial crisis that began in 2007, but improved in the summer.

The COVID-19 crisis significantly impacted the residential real estate market this spring. Health concerns and stay-at-home orders led to fewer buyers looking for homes and fewer sellers willing to list their properties or allow strangers to enter their homes during a pandemic.

Despite the steep downturn during the early spring, home sales rebounded in the summer. At the same time, the health crisis generated an economic toll in the form of job losses and uncertainty.

Fears from the 2007-09 housing crisis linger in the minds of many, as some homeowners have struggled to make mortgage payments and the unemployment rate remains at historic highs. Because of the pandemic, many households are reconsidering their housing needs, as their homes have become substitutes for offices, schools, restaurants and recreation facilities.

What Happened and Why?

Home sales in April and May dropped to their lowest levels since the housing and financial crisis that began in 2007 (Figure 1), with many homeowners hesitant to sell in the wake of the pandemic. The number of delisted homes increased over 25% from one year ago during early March to early April, according to the national real estate brokerage Redfin.Delistings as a percentage of active listings remained low throughout the spring—below 2%.

New listings were also down more than 40% in April compared with the same period last year. Because of a lack of new listings and an already low inventory, the supply of housing dropped to new lows. Inventory of homes for sale decreased 17% in April compared with the same period last year, according to Redfin.

Buyers also reduced their home-buying activity. Home showings per listing in the U.S. were down over 40% in April compared with the same period last year.For home-showing data, see the Showing Index from ShowingTime, a residential real estate showing-management company. Other measures of housing demand—such as online search activity, queries for agents and offers made—were also down sharply in April.See housing demand indexes from Realtor.com and Redfin.com.

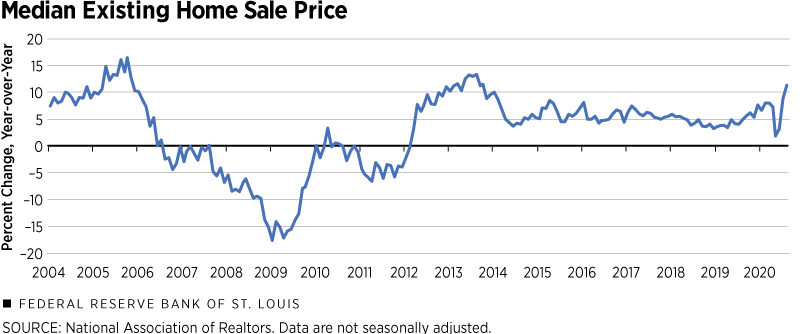

Typically, a large decline in demand for new home sales would be accompanied by a drop in prices. However, the coronavirus turmoil in the spring did not lead to large price declines. The combination of low supply and historically low mortgage rates allowed prices to remain steady throughout April and May. Figure 2 shows prices of homes sold were still up during the pandemic compared with last year, in contrast to the price declines seen during the 2007-09 crisis.

Residential real estate activity depends largely on local conditions, so while virtually every major metro area experienced a significant decline in real estate activity during the spring, some areas that were hit harder by the pandemic saw especially steep drops. New York City, for example, had a 58% decline in pending home sales in April compared with last year. Detroit, where most real estate activity was considered nonessential through early May, saw a 74% decline in pending sales. By comparison, U.S. metro areas faced a 33% decline on average.Pending sales data are according to Redfin’s housing market data, found on its Data Center site.

Home sales in the Federal Reserve’s Eighth District metropolitan statistical areas (MSAs) faced similarly large, but slightly more subdued, declines compared with the national average, as shown in the table below. The slightly less severe declines in real estate activity during early spring are consistent with the lower COVID-19 cases and less-restrictive stay-at-home orders in District MSAs compared with those in other MSAs nationwide.

| Home Sales | Median Sales Price | Inventory | ||||

|---|---|---|---|---|---|---|

| Low | August | Low | August | Low | August | |

| National | -35% | 4% | 0% | 11% | -36% | -36% |

| St. Louis MSA | -26% | 7% | 2% | 12% | -39% | -39% |

| Memphis MSA | -27% | -6% | 4% | 21% | -37% | -37% |

| Louisville MSA | -26% | 4% | 0% | 12% | -41% | -41% |

| Little Rock MSA | -14% | 11% | 3% | 9% | -33% | -33% |

| SOURCE: Redfin | ||||||

| NOTES: Data represent the percentage change over the same period in 2019. Home sales represent growth in total home sales, which lag behind measures of pending sales. The low point in home sales growth occurred in May for all locations. Home price growth was at its lowest in May nationally and in June for the District MSAs. All inventory lows occurred in August. Data are not seasonally adjusted. | ||||||

Demand Recovers, Supply Remains Low

Despite the large drops in home sales due to the pandemic, real estate activity began to improve in the late spring, approaching pre-pandemic levels by the summer. Potential buyers started to increase their housing search and purchase activity by the end of May.

Pending sales in U.S. metro areas, which were down more than 30% in April, were up almost 30% by August over last year’s sales during the same period.Other economic activities that support real estate transactions were also affected by the pandemic. For example, home inspections were delayed or canceled, and new clauses were added to closing contracts. Banks have experienced a surge in pandemic-related loans—while operating in contingency environments with fewer staff—which has delayed mortgage processing. It is likely these disruptions are generating some of the increase in pending sales. Home showings per listing rose from their lows in March and April, and were well above pre-pandemic levels by May, aided by the increase in online and socially distant viewings.

Housing supply did not recover at the same pace. New listings, despite improving from their April lows, were only slightly higher than one year ago through August. As a result, inventory continued to decline: In August 2020, there were less than two-thirds the number of homes on the market as there were in August 2019. While health-related concerns may continue to keep sellers from the market, surveys indicate that the overall economic uncertainty and the inability to purchase another home are also keeping homeowners in place.

District MSA sales activity has generally recovered from its lows: By August sales were near or above levels from last year in all four of the largest District MSAs. Similar to national trends, inventory in each of the four District MSAs dropped more than 30% in August compared with the same period last year. Housing prices increased considerably in July and August, with the Memphis MSA seeing especially high price growth by August.

Despite some improvement in the economy, heightened unemployment and economic uncertainty could continue to affect the housing market through 2020 and beyond. During the 2007-09 financial crisis, foreclosures and tighter lending practices locked many out of homeownership for several years. There are signs of these long-term effects again.

After a modest increase in the first quarter, over two-thirds of senior loan officers reported tightening lending standards during the second quarter, according to a survey by the Federal Reserve Board. Many households reported facing difficult financial conditions and missing rent and mortgage payments. Mortgage forbearance programs and moratoriums on foreclosure proceedings have helped keep foreclosure rates and serious delinquency rates low. However, things could get difficult for homeowners—particularly low-income and minority homeowners—as these programs expire.

Longer-term Housing Outlook

Even though the current recession was not driven by a housing crisis, the housing market outlook is uncertain because of the abrupt economic recession and steep job losses. However, there are some signs of a return to normal. Buying conditions for houses have improved and are back to where they were one year ago, according to the August Michigan Survey of Consumers.

Many households cite “good buys available” and low interest rates as the primary reasons, while one year ago, more households cited “prosperity” and “housing as a good investment.” An August Conference Board survey reported the percentage of consumers planning to buy a home within the next six months was the same as it was one year ago.

Much commentary continues about how the pandemic will reshape the nature of work and home. Workers able to work from home may place less value on a shorter commute and move farther from the office. Moreover, families are substituting home amenities (swimming pools or swing sets) for community amenities (parks or stadiums). This shift also places a greater value on the specific characteristics of a house and less on its location.

It is not yet clear to what degree these shifts will be permanent or will reverse. For example, working from home during a pandemic may be efficient when leisure and in-person networking opportunities are scarce. Housing is a long-term investment and the largest asset for many households, so even if preferences do permanently change, the immediate economic uncertainty may keep prospective buyers on the sidelines for some time. With a limited supply of inventory, a sustained growth in home prices may make it difficult to act on these potential moves.

Endnotes

- Delistings as a percentage of active listings remained low throughout the spring—below 2%.

- For home-showing data, see the Showing Index from ShowingTime, a residential real estate showing-management company.

- See housing demand indexes from Realtor.com and Redfin.com.

- Pending sales data are according to Redfin’s housing market data, found on its Data Center site.

- Other economic activities that support real estate transactions were also affected by the pandemic. For example, home inspections were delayed or canceled, and new clauses were added to closing contracts. Banks have experienced a surge in pandemic-related loans—while operating in contingency environments with fewer staff—which has delayed mortgage processing. It is likely these disruptions are generating some of the increase in pending sales.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us